Zcash

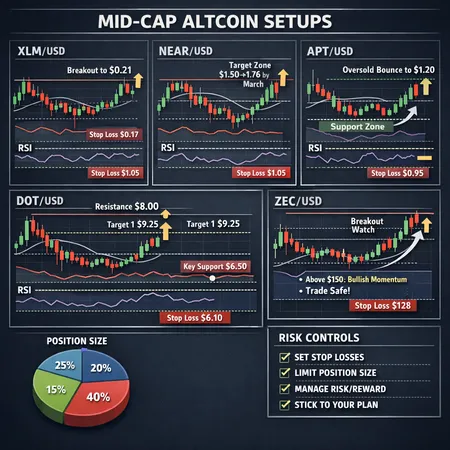

A tactical guide for intermediate traders: five mid‑cap altcoins showing clean technical setups, with price triggers, timeframes and practical risk rules. Includes trade management, position sizing and a portfolio construction framework.

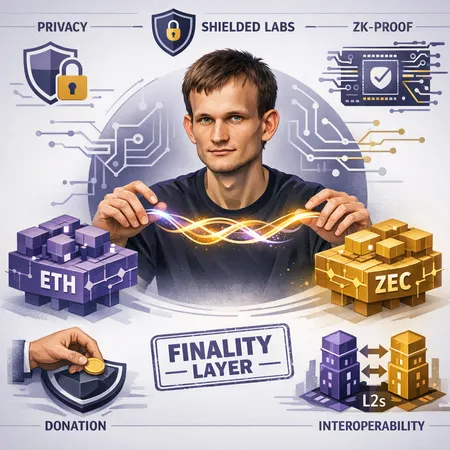

Vitalik Buterin’s recent donation to Shielded Labs for a Zcash crosslink finality upgrade and his clarified views on Layer-2s signal a subtle but important shift in how leading architects think about privacy, scaling, and cross-protocol cooperation.

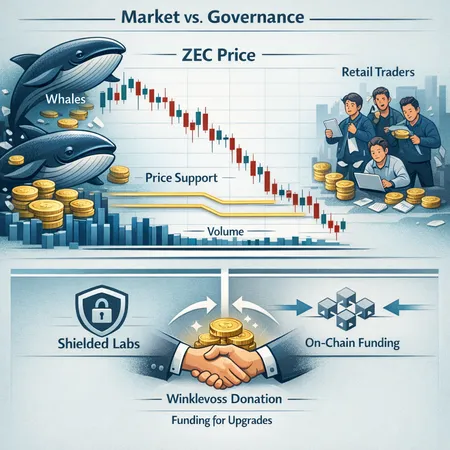

Zcash shows short-term price weakness while on-chain flows and governance moves diverge — notably a Winklevoss donation to Shielded Labs. This article breaks down technical support, whale accumulation, the governance rift, and tradeable scenarios for intermediate traders.

A renewed investor appetite for on-chain privacy has shifted narratives from absolute anonymity to practical ‘selective disclosure’. This article explains audit/view keys, compliance rails, and what the trend means for DeFi, institutions, and builders.

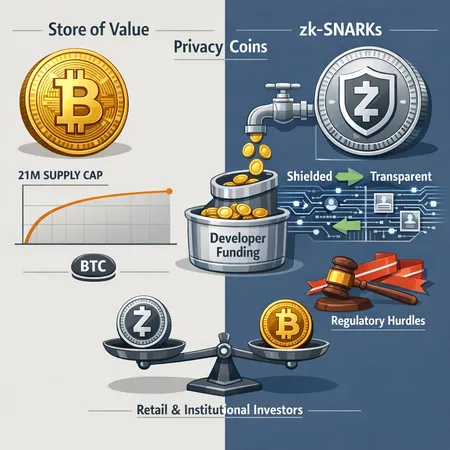

Zcash combines Bitcoin‑like monetary design with zk‑SNARK privacy and an on‑chain funding model—raising the question whether ZEC can ever serve as a broad store of value. This article dissects supply mechanics, shielded vs transparent transactions, developer funding, regulatory hurdles, and how investors might size exposure versus BTC.

Privacy tokens (DASH, XMR, ZEC) led the 2026 rally as investors revisited anonymity-focused protocols. Regulatory outcomes — notably the SEC closing its probe into the Zcash Foundation — are reshaping fundraising, listings, and institutional appetite.

Arthur Hayes argues that weak 2025 for crypto was a dollar-credit story, not a rejection of crypto narratives. This article unpacks his thesis, the channels that turn U.S. dollar liquidity into crypto returns, and actionable portfolio frameworks for allocators.

Monero (XMR) recently surpassed Zcash (ZEC) as the leading privacy coin amid developer departures and governance turmoil at Zcash. The emergence of the CashZ wallet and shifting developer activity have implications for exchanges, regulators, and privacy adoption.

The Electric Coin Company’s full development-team departure triggered a governance showdown with Bootstrap, a double‑digit ZEC selloff, and a larger warning about foundation‑dependent privacy projects. This explainer maps the timeline, technical and trust risks, market fallout, and a practical risk checklist for asset managers and custodians.

ZEC’s recent 15% pop and a near‑record rise in futures open interest have reignited debate about structural demand for privacy coins. This note dissects drivers, technical odds of a 45% follow‑through, regulatory headwinds, and practical trading/holding rules for tactical allocations.