ETF Flows

U.S. spot Bitcoin ETFs show roughly $53B in cumulative net inflows even as funds experienced meaningful short‑term outflows. This article explains the chronology, ETF mechanics, and practical sizing rules for portfolio managers and swing traders navigating ETF‑driven liquidity events.

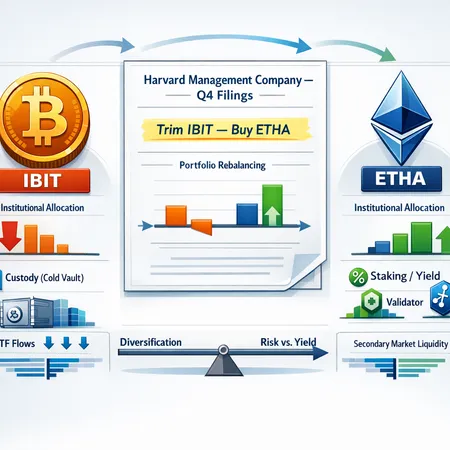

Harvard Management Company’s Q4 filings show a notable trim in IBIT and a fresh position in ETHA, highlighting an institutional shift toward Ethereum ETFs. This article parses the motivations, ETF mechanics, market impact, and portfolio-level takeaways for allocators.

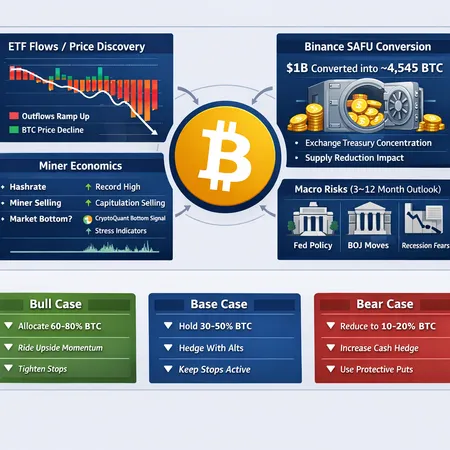

A synthesis of ETF flow data, exchange treasury behavior, miner economics and macro signals to assess whether BTC is close to a cycle bottom and what allocators should do over the next 3–12 months.

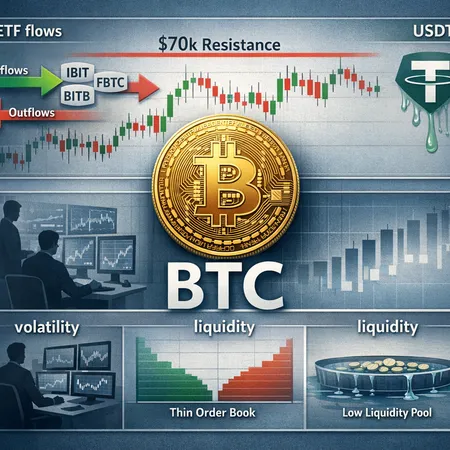

Despite steady spot-BTC ETF demand that almost erased last week’s outflows, Bitcoin remains unusually volatile. This piece parses ETF flow data, technical pressure around $69k–$70k, institutional narratives, and how stablecoin and exchange liquidity amplify swings.

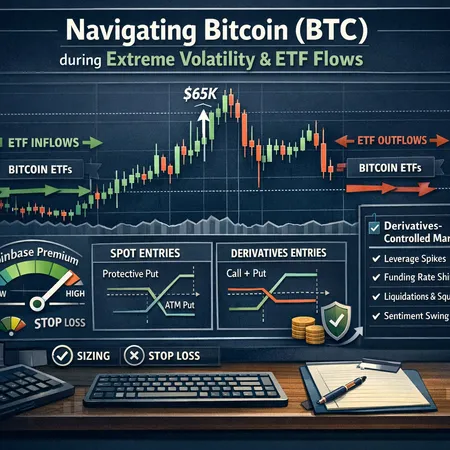

Practical rules, setups and risk controls for trading BTC when ETF flows and derivatives dominate price action. Learn how to read ETF and Coinbase premium signals, size trades in high volatility, use options hedges, and trade whipsaws effectively.

AUM for US spot Bitcoin ETFs slipping below $100B changes the math for liquidity and price sensitivity — especially when flows are dispersed across IBIT, FBTC and ARKB. Traders should read fund-level flow dispersion, not just aggregate totals, to time entries and assess execution risk.

Strategy (formerly MicroStrategy) continued to add Bitcoin even as its corporate holdings moved underwater — a move that raises concrete balance-sheet, covenant and dilution questions for corporate treasuries. This article breaks down the disclosed buys, compares cost basis to the market, and offers a practical risk/return framework for CFOs and institutional allocators.

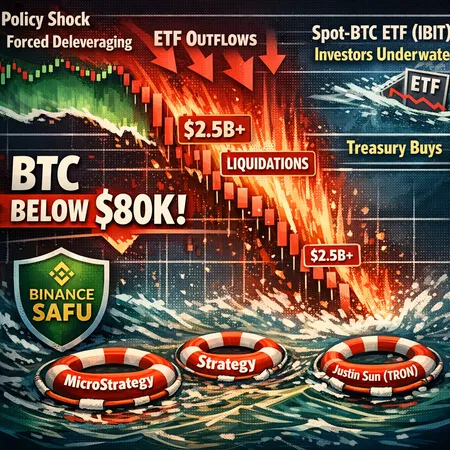

A macro pivot around the Fed and a wave of forced deleveraging pushed BTC under $80k; ETF flow dynamics and large treasury buys will determine whether this is a capitulation or buying opportunity.

A trader-focused roadmap for Bitcoin heading into the FOMC: what the bearish weekly EMA crossover means, how ETF flows and on-chain supply-in-loss influence downside risk, and tactical 7–30 day plays with strict risk rules.

A cluster of $677M+ BTC liquidations, $1.72B in spot ETF outflows and key technical breaks have traders asking whether a larger correction is starting. This article dissects the on‑chain and order‑book signals that preceded the crash, the liquidity impact of ETF withdrawals, critical supports to watch, and a practical risk‑management playbook for spot and derivatives traders.