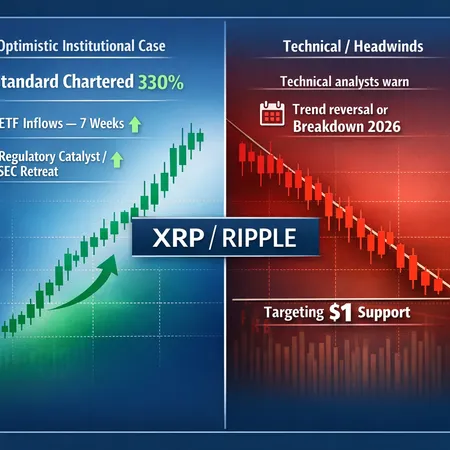

XRP’s Crossroads: Standard Chartered’s 330% Upside vs. Technical Risks and ETF Flow Headwinds

Summary

A bifurcated market: why XRP feels like two different assets

XRP’s story over the past few years has become a case study in asymmetric outcomes. On one hand you have institutional research notes and bullish flows that argue for large upside if the regulatory environment improves. On the other, technical analysts and conservative allocators point to messy price action and concentration of downside risk if the market’s confidence in ETF inflows or a favorable SEC outcome fades.

The debate is not academic: for market strategists and crypto investors weighing allocations, this is a classic asymmetric bet — a relatively small regulatory win could unlock outsized returns, while a prolonged period of uncertainty or technical failure could erode capital. For many traders, XRP now behaves less like a pure market beta and more like a regulatory playbook with tradable technical levels.

The institutional bull case: Standard Chartered and the ETF narrative

One of the loudest bullish themes this cycle comes from large financial institutions. As reported by CoinPaper, analysts at Standard Chartered outlined a scenario in which XRP could rally as much as 330%, largely contingent on the SEC retreating from its current legal posture toward Ripple. That is an explicitly conditional thesis: the magnitude of upside hinges on a regulatory catalyst rather than pure on-chain adoption or macro tailwinds (CoinPaper — Standard Chartered’s forecast).

Compounding institutional interest are steady inflows tied to broader crypto ETF activity. Several publications, including Coingape, have documented that ETF inflows extended to a seventh straight week, and XRP’s consolidation has been viewed through that lens: if ETF liquidity keeps chasing broader crypto exposure, XRP stands to benefit indirectly from improved market structure and greater institutional participation (Coingape — seven straight weeks).

Why this matters: ETFs provide a predictable source of demand that can support higher valuations and compress volatility as new buyer bases form. If the SEC softens its approach — or signals a pathway to regulatory certainty — the combination of flows plus positive headlines could swiftly repriced XRP relative to peers.

The skeptics’ view: technical fragility and the $1 risk

Not every chart supports an immediate breakout. Technical analysts point to elongated consolidation, repeated failures to sustain higher highs, and critical support bands that, if broken, suggest deeper downside. Coinpedia’s analysis warns that XRP could still slip toward $1 despite positive ETF flows, highlighting the risk that flows alone cannot overcome poor price structure or an adverse regulatory ruling (Coinpedia — possibility of slip toward $1).

Another framing from CoinPaper describes XRP at a “high-stakes crossroad” — the asset faces a binary-looking path where a breakout could cascade into broad short-covering, while a breakdown might trigger capitulation among leveraged longs and growth-focused holders (CoinPaper — breakout or bloodbath).

Technically oriented traders will be watching moving-average alignment, volume confirmation on any breakout, and the slope of on-chain metrics like active addresses and ledger flows; without structural improvement, ETF inflows may only prop a sideways market rather than force a sustained trend reversal.

Three 2026 scenarios: timing, catalysts, and probabilities

Below I map three practical scenarios that combine regulatory events, ETF dynamics, and technical triggers. These are not predictions but scenario templates to inform position sizing and risk management.

Optimistic: SEC retreat leads to quick re-rating (Probability: 15–25%)

- Timing: early to mid-2026.

- Catalyst set: a favorable legal development or regulatory guidance that materially reduces enforcement risk for Ripple-related activity; continued ETF inflows and renewed institutional coverage such as the Standard Chartered thesis gaining traction.

- Market reaction: rapid re-rating as investors reassess risk premia; technical breakout above major resistance, heavy volume, and a multi-month trend reversal.

- Strategy implication: asymmetric long exposure (small core position with optionality via long-dated calls) could capture outsized upside while limiting capital at risk.

Baseline: gradual progress, choppy consolidation (Probability: 45–60%)

- Timing: mid to late 2026.

- Catalyst set: partial regulatory clarity or a slow-moving legal settlement that reduces tail risk but doesn’t fully eliminate it; ETF flows remain modestly positive but not explosive.

- Market reaction: volatile, range-bound price action with occasional spikes on headlines; trend reversal becomes viable only after consistent higher lows and stronger volume.

- Strategy implication: laddered entries, equal-weighted allocations, and monitoring weekly ETF inflow prints can help manage exposure while avoiding being early into a false breakout.

Bearish: regulatory setback or flow reversal pushes XRP toward $1 (Probability: 20–35%)

- Timing: late 2026 if headlines sour or ETF momentum stalls.

- Catalyst set: adverse SEC rulings, renewed enforcement, or macro-driven risk-off that triggers ETF outflows and deleveraging in crypto markets.

- Market reaction: breakdown through key supports, accelerating sell pressure, and possible capitulation toward lower technical bands like the $1 area flagged by technical analysts.

- Strategy implication: active risk reduction, use of protective puts, and tight stop disciplines are prudent; contrarians might watch for on-chain accumulation at lower prices.

Practical signals to watch now

For strategists who need actionable trackers rather than abstract theory, focus on:

- The regulatory calendar: court filings, SEC motions, and any formal guidance on token classifications. A single favorable filing can flip market sentiment.

- Weekly ETF inflows and institutional custody announcements — persistent inflows sustain bid, while outflows can remove it. Weekly reports like those cited earlier are useful leading indicators (Coingape ETF inflows).

- Technical confirmation: a sustained close above major resistance with volume confirmation or, on the downside, clean breaks of support accompanied by rising realized volatility.

- On-chain metrics and Ripple developments: payment corridors, partnerships, and compliance progress can be early signals of fundamental improvement.

Platforms such as Bitlet.app can make tracking recurring buys and P2P liquidity easier for retail and semi-institutional traders who want to dollar-cost-average into asymmetric themes without overexposing to headline risk.

Verdict: hedge the narrative, trade the structure

XRP’s outlook is a microcosm of modern crypto risk: narratives and regulation can produce outsized outcomes, but price structure and liquidity determine how that narrative translates into realized returns. Standard Chartered’s 330% scenario is plausible only under a clear regulatory retreat — a high-impact, lower-probability event that creates asymmetric upside. Conversely, technical fragility and the possibility of ETF flow reversals make a slip toward $1 a realistic scenario if the market loses faith.

For market strategists, the right approach is not to choose a single narrative but to bridge them: size positions to reflect the asymmetric payoff, hedge exposure around critical legal dates, and trade confirmations rather than hopes. Whether you lean bullish or cautious, make the SEC’s actions and weekly ETF inflow data your primary rate-of-change inputs for 2026.