Crypto

Hyperliquid’s new D.C. Policy Center and lobbying arm mark a shift from grassroots decentralization rhetoric toward professional, targeted advocacy — with important consequences for perpetual derivatives, custody rules, and infrastructure policy. This analysis breaks down regulatory targets, token-market reactions for HYPE, comparisons to earlier advocacy, and practical next steps for DeFi teams and investors.

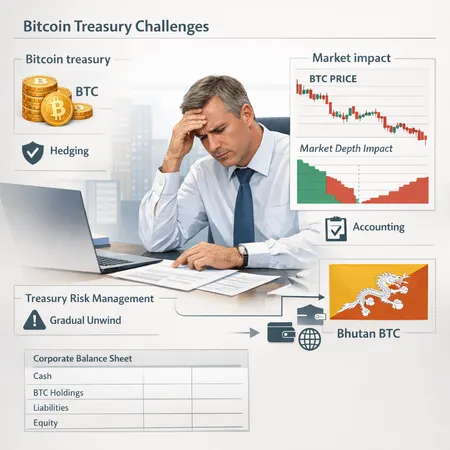

As BTC drifts lower, the once‑comfortable strategy of holding Bitcoin on corporate or sovereign balance sheets is under stress. This article breaks down market‑impact channels, recent sovereign transfers such as Bhutan’s, and a practical CFO playbook for accounting, hedging and staged unwinds.

A practical, repeatable framework for modeling short-term supply risk from scheduled token unlocks and defending NAV in stressed markets. Includes a quantitative checklist, scenario math, and tactical hedges for tokens like HYPE and RAIN during this week's $638M+ unlock window.

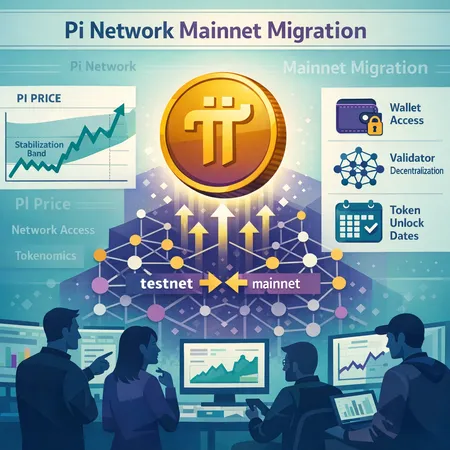

A deep-dive case study of Pi Network’s recent mainnet migration, the drivers behind the PI price rebound and early stabilization signs, and practical guidance for projects communicating migrations to avoid sell-the-news dynamics.

A practical playbook for trading XRP around Ripple’s XRP Community Day, where Brad Garlinghouse may unveil major news. Covers event themes, technical risk, position sizing and hedges tailored to swing traders and community investors.

Traders face a split signal: technicals point to a potential weekly falling wedge breakout for DOGE while early TDOG flows are weak. This piece lays out how to combine ETF flow data with chart setups and practical risk rules.

An investigative primer on recent stablecoin minting, cross‑border risk, and the debate over yield‑bearing stablecoins. Practical policy recommendations for compliance officers, stablecoin teams and regulators.

K33’s new USDC loans collateralized by Bitcoin mark a step toward more institutionalized, balance-sheet-friendly borrowing in crypto. This analysis examines product mechanics, comparisons with incumbents like NEXO, effects on BTC exchange supply and spot liquidity, and the regulatory and counterparty risks investors should weigh.

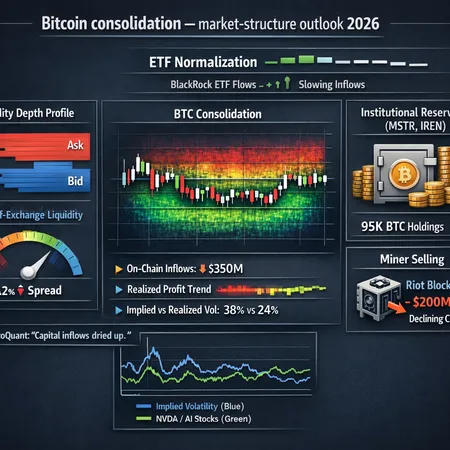

A data-driven market-structure analysis of Bitcoin’s 2026 consolidation phase, synthesizing ETF normalization, institutional treasury behavior, miner selling, dried-up capital inflows, and macro tail risks. Practical portfolio rules for HODLers and active traders follow.

As 2026 opens, spot XRP ETFs and Ripple’s scheduled monthly unlocks are colliding to redefine supply dynamics and adoption signals. This article breaks down ETF inflows (led by XRPZ), supply unlock mechanics, legal narratives, on-chain uptake, and tradeable scenarios for Q1 2026.