Crypto Market

Binance’s roughly $9B drop in exchange-backed stablecoin reserves over three months tightens market liquidity and increases margin and systemic risk across derivatives and spot markets. Professional traders and risk officers should treat shrinking exchange stablecoin balances as an early-warning signal and update collateral, stress-testing, and counterparty policies accordingly.

Shiba Inu sits between two narratives: a technical crash to 2023 lows and a bullish roadmap tied to Shibarium upgrades. This piece compares both views, examines market drivers, and gives practical risk-sizing frameworks for retail traders and community managers.

Ethereum is seeing a sustained jump in active addresses even as ETH trades down. This article unpacks whether rising on-chain activity supports a near-term bull case or instead flags risk amid the layer-2 scaling debate.

Tether’s large-scale accumulation of physical gold and the launch of USAT change the balance of reserve composition and competitive dynamics between stablecoins. This analysis examines custody, market impact, credibility implications for USDT/XAUT, and how USAT pressures USDC in U.S. corridors.

The validator exit queue dropping to zero is more than a technical milestone — it signals stronger staking demand and tighter liquid supply for ETH. This article explains the mechanics behind validator flows, how staking inflows tighten available ETH, and three price scenarios investors should consider.

Solana’s combination of high throughput, sub‑cent fees, and recent upticks in on‑chain activity make it a strong candidate for USD stablecoin issuance and tokenization rails in 2026. Product and treasury teams should weigh technical advantages against regulatory, custody, and market risks before choosing Solana for high‑volume payment rails.

Privacy tokens (DASH, XMR, ZEC) led the 2026 rally as investors revisited anonymity-focused protocols. Regulatory outcomes — notably the SEC closing its probe into the Zcash Foundation — are reshaping fundraising, listings, and institutional appetite.

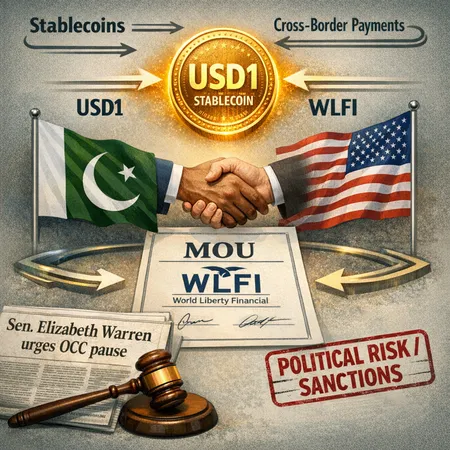

Pakistan's memorandum with World Liberty Financial to explore a USD1 stablecoin raises tangible payments benefits but also acute political, regulatory, and sanctions risks. This explainer breaks down economics, technical feasibility, the MOU terms, Senator Warren's request to the OCC, and practical risk mitigations.

A tactical narrative on the 2026 memecoin revival: why SHIB, BONK and PEPE have run, what on-chain and social signals matter, and a practical framework for sizing, entries and exits.

This feature evaluates conflicting 2026 Ethereum price projections by weighing analyst assumptions against real-world onchain adoption, institutional custody moves like Sharplink’s Linea deployment, and long-term staking dynamics.