Chainlink

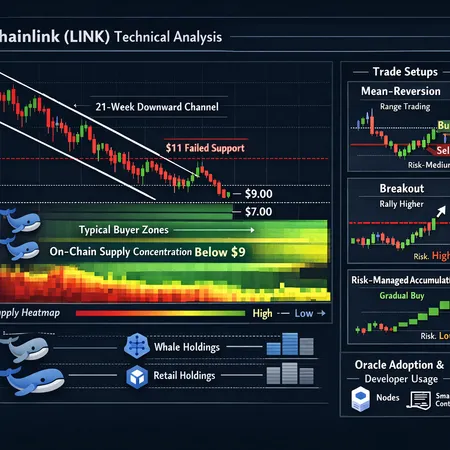

A technical and on‑chain dive into LINK’s sustained sell-off, where supply is clustering, and practical trade plans for different timeframes. Includes support levels, whale behaviour, oracle adoption implications and three disciplined setups to trade or accumulate LINK.

Chainlink Labs joining a Korean KRW stablecoin alliance underscores growing enterprise demand for robust oracles. This piece explains what institutional stablecoin standards need, how on‑chain signals point to LINK’s potential rebound, and which catalysts matter for token demand.

CME Group will list Cardano (ADA), Chainlink (LINK) and Stellar (XLM) futures beginning Feb. 9, expanding regulated altcoin access for institutions. This explainer reviews why CME is making the bet, contract design (micro vs standard), market‑maker and liquidity implications, and concrete hedging and exposure strategies for professional allocators.

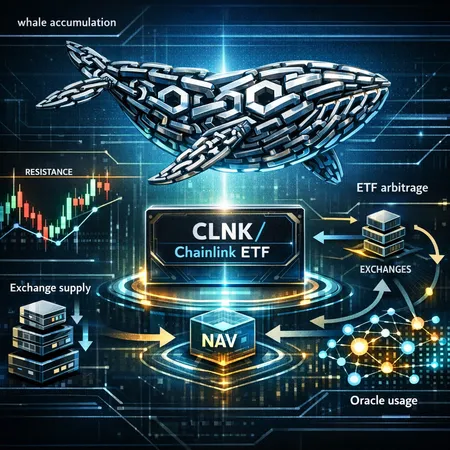

The Bitwise Chainlink ETF (CLNK) opened a new chapter for LINK markets — but whales, on-chain flows and ETF arbitrage mechanics are doing the heavy lifting behind price moves. This guide breaks down what on-chain analysts should track before following whale activity into LINK.

Two recent on‑chain reports show 414,935 LINK ($5.48M) moved into whales and two wallets adding ~409,935 LINK—what does this mean for price mechanics, oracle adoption narratives, and quant trading signals? This piece breaks down on‑chain evidence, wallet clustering, exchange flows, and practical trade hypotheses for LINK.

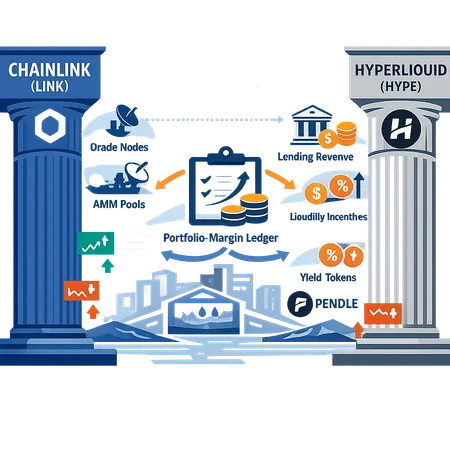

A comparative analysis of LINK and HYPE that focuses on product momentum, new revenue models like portfolio margin, and how yield-token subsidy designs such as PENDLE’s are reshaping liquidity economics. Practical metrics for product managers and traders to monitor protocol sustainability and competitive moat.

PYTH Network’s pivot to a revenue‑backed reserve and Cardano’s first PYTH oracle integration sharpen the debate over oracle value capture. This explainer breaks down the technical and economic shifts, governance wrinkles, and the realistic price catalysts and risks for PYTH token investors and DeFi developers.

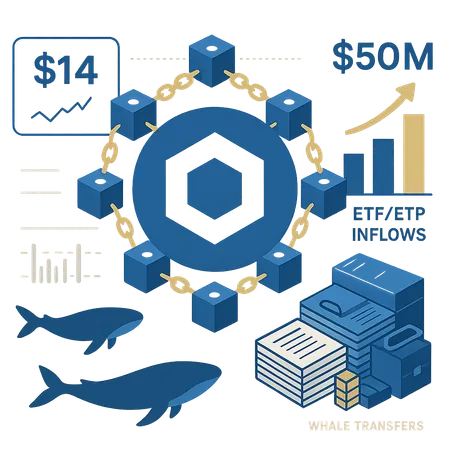

LINK has steadied around $14 as institutional ETP inflows approach $50M. This piece parses the mechanics behind ETP conversions, on-chain signals, cross‑chain demand drivers and what allocators should watch next.

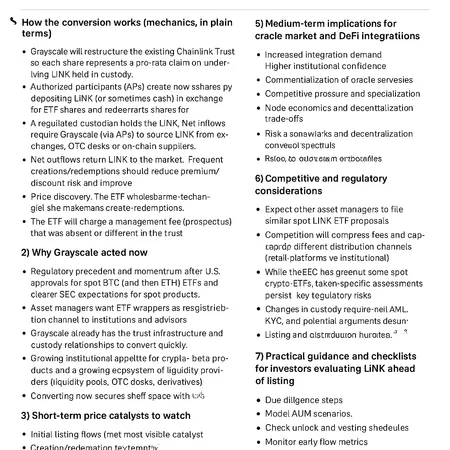

Grayscale’s move to convert its Chainlink Trust into the first U.S. spot LINK ETF is a structural event that could reshape liquidity, institutional access, and oracle economics. This feature explains the mechanics, near-term price drivers, and how allocators should evaluate LINK ahead of the listing.

LINK has slipped for several sessions even as ETF hopes rise — a mix of technical sell signals and a curious decline in exchange reserves demands careful reading. This post blends on‑chain context and TA to outline scenarios and trade management ideas for holders.