Dogecoin

DOGE fell ~10% in a one‑day selloff, testing the psychological $0.10 support even as social chatter spiked in mid‑February. This piece weighs technical stress against renewed narrative momentum and offers a practical trading framework for speculative retail positions.

A data-driven breakdown of the recent weekend memecoin surge and why PEPE, PI and DOGE outperformed. Learn how whale accumulation, tokenomics and CPI-driven rotation created momentum — and how active traders should size positions and hedge risk.

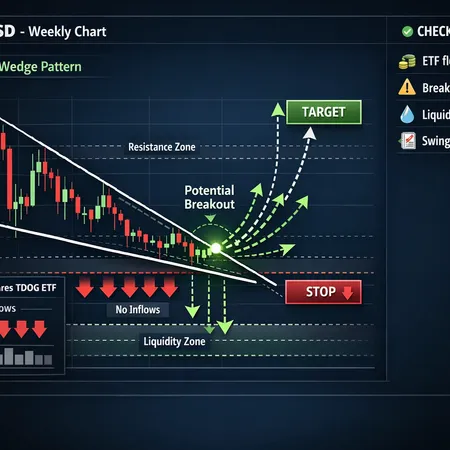

Traders face a split signal: technicals point to a potential weekly falling wedge breakout for DOGE while early TDOG flows are weak. This piece lays out how to combine ETF flow data with chart setups and practical risk rules.

21Shares' Nasdaq‑listed, Dogecoin Foundation‑backed spot Dogecoin ETF changes institutional access and custody for DOGE, but a true memecoin rally will depend on liquidity, narratives, and on‑chain dynamics. This article evaluates ETF mechanics, historical precedents, Shiba Inu technical targets, and practical portfolio rules for speculative exposure.

A proposed Senate Banking Committee vote could carve out Dogecoin from SEC securities law — a change that would reshape listing risk, ETF issuance feasibility, and compliance playbooks for exchanges and ETF issuers. This piece parses the bill text, market reaction, and practical steps for legal and compliance teams.

21Shares filing for a spot Dogecoin ETF (SEC 424B3) marks a turning point: it can widen DOGE liquidity, shift retail vs institutional flows, and alter price discovery and options market structure. Traders should weigh ETF mechanics, likely allocation scenarios and key technical levels such as the $0.28 breakout when deciding whether to use the ETF as a proxy or liquidity play.

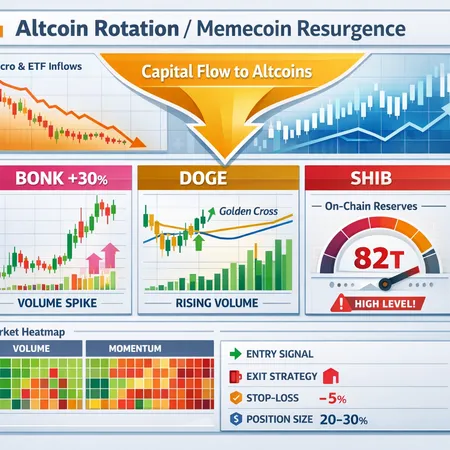

A practical analysis of why BTC dominance is slipping into high‑beta altcoins and memecoins, which names are leading the move (BONK, DOGE, SHIB), and concrete rules for entry, exit, and position sizing for active traders.

Early 2026 saw a sharp memecoin comeback led by DOGE and PEPE as risk appetite returned and retail flows re-entered crypto. This guide explains the drivers, on-chain signals, historical patterns, and practical rules for sizing speculative meme positions without blowing up.

Dogecoin's early‑2026 low exposed cracks in the memecoin market: fading 'reserve-asset' narratives, thin order books and collapsing altcoin liquidity. This piece uses DOGE as a case study and delivers a checklist for disciplined exposure to speculative tokens like SHIB.

Dogecoin’s intraday moves are increasingly driven by derivatives flows and retail events rather than ETF bids. This feature explains how open-interest spikes, a lack of ETF demand, and retail promotions like the Robinhood giveaway create squeezes and what traders should watch to size event-driven DOGE trades responsibly.