Hedging

A $543M whale dump has tightened ETH price structure into a bear pennant with $1,950 watching as critical support and a measured downside near $1,200. This article unpacks on-chain liquidity risks, the technical setup, scenario-based trade and hedge plans, and how hedging markets interact with Ethereum's longer-term fundamentals.

A detailed explainer of the record‑sized $27B+ Bitcoin and Ethereum options expiry, why it amplified short‑term volatility, and practical hedging tactics for traders and desks before and after expiry.

As exchanges open options-writing to more users, ETH markets are shifting — more premium supply, shifting implied volatility, and new risks from concentrated holders. This explainer breaks down mechanics, whale activity, and actionable hedging and income strategies for semi-professional traders and portfolio managers.

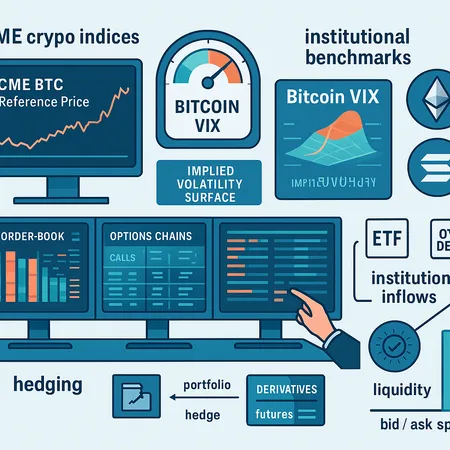

CME’s new pricing indices and a VIX‑style Bitcoin volatility measure are creating standardized reference points that change hedging, derivatives pricing and liquidity provision for BTC, ETH, SOL and XRP. Institutional benchmarks reduce fragmentation, force re‑calibration of models, and reshape how ETF, OTC and market‑making desks operate.

A focused risk primer for traders and allocators: why the imminent BTC/ETH options expiry, a $7.5B spike in whale deposits to Binance, and deteriorating sentiment raise downside scenarios — and how to hedge them.