Tether vs Circle: What 2023–2025 Freezes Reveal About Stablecoin Trust and Regulation

Summary

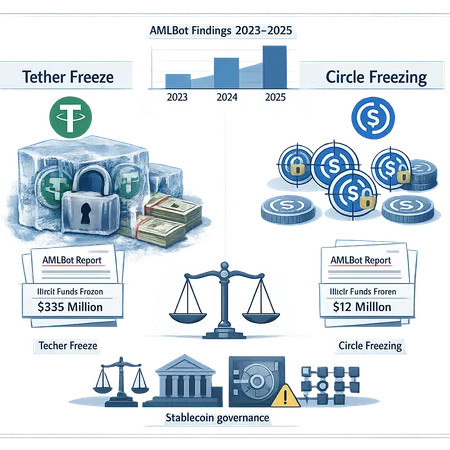

Overview: AMLBot findings and why the gap matters

Between 2023 and 2025 AMLBot-style analytics and reporting surfaced a striking difference in issuer behavior: public summaries put the value Tether froze at roughly $3.3 billion, while Circle’s freezes totaled about $109 million in the same period. Crypto.news describes the scale of Tether’s blacklists compared with Circle’s activity, and Coinpedia restates the same AMLBot-derived figures, which together press this from an isolated incident into a systemic question about stablecoin governance (Crypto.news and Coinpedia).

Why does this matter? Stablecoins like USDT and USDC are not just trading instruments — they are plumbing for the broader crypto market, used by custodians, exchanges, and DeFi protocols. For compliance officers, institutional investors, and policy writers, the scale and style of freezing behavior affect counterparty risk assessments, integration choices, and the regulatory responses that will follow. Platforms offering payments and custody services, including those focused on installments and P2P like Bitlet.app, depend on predictable rails; unpredictable or opaque freezes increase operational risk.

Why Tether and Circle diverged: operational, legal, and technical drivers

The raw numbers alone are not a verdict; they are a signal. The disparity between Tether freeze activity and Circle freezing is best explained by a combination of factors — some technical, some legal, some commercial.

Custody model and reserve architecture

One practical driver is how each issuer holds and manages reserve assets and the custodial relationships that underpin redemption. Circle has positioned USDC with explicit banking relationships and public attestations tied to U.S.-regulated counterparties; their architecture emphasizes on- and off-ramps that require KYC/AML screening. That improves traceability and narrows the pool of addresses from which illicit funds can enter the system, but it also creates paper trails that can be acted on through legal processes.

Tether’s operational footprint historically has been broader and more fragmented across exchanges, custodians, and market niches. A broader distribution of liquidity — and higher usage in non-U.S. markets and on centralized exchanges — can make the token a larger target for blacklisting actions when issuers choose to intervene.

Legal posture, jurisdiction, and enforcement relationships

Circle has repeatedly asserted cooperation with U.S. regulators and has chosen to implement freezes usually coupled with formal legal processes. Tether, while also complying with subpoenas and law enforcement requests, has at times taken a different posture on what counts as actionable intelligence and when to hard-freeze an address. Differences in legal exposure, corporate structure, and the jurisdictions where teams and counterparties operate translate into different thresholds for intervention.

Freezing mechanisms and on-chain technical choices

On-chain, the capacity to freeze balances is a product feature: both USDC and USDT issuer contracts can blacklist addresses. But issuers differ in how they operationalize blacklists: automated whitelists, manual adjudication teams, integration with sanctions lists, and how quickly freezes are enforced. The result: the same technical tool, used under different operational rules, can produce dramatically different outcomes.

Business incentives and market positioning

Market positioning also matters. Circle has cultivated a strategy of appealing to regulated financial customers — banks, custodians, and institutions — where predictability and documented compliance are selling points. Tether has focused on market liquidity and cross-border flow; that business model can create more touchpoints with gray markets and counterparty complexities that increase the likelihood of freeze actions.

Market and legal consequences of mass freezes

Freezes are a blunt instrument. They address criminal finance and sanctions evasion — and they also generate costs.

Liquidity fragmentation and flight: Large or public freezes can spur rapid liquidity migration into alternatives (other stablecoins, fiat rails, or self-custody). When counterparties fear inability to redeem, runs and fragmented liquidity pools are likely.

Counterparty risk reassessment: Institutional treasurers and compliance officers must re-score stablecoin exposures. A history of numerous freezes raises the probability of sudden illiquidity and complicates custody selection.

Legal risk and precedent: Aggressive freezing sets precedents that can be leveraged by regulators demanding similar behavior. It also invites litigation from affected counterparties and may trigger cross-border legal disputes about jurisdiction and asset control.

DeFi and composability frictions: In DeFi, frozen tokens break composability. Smart contracts cannot distinguish a frozen token balance from liquid supply; lending platforms, AMMs, and oracles can be disrupted when a significant counterparty’s assets are suddenly immobilized. That undermines trust in on-chain collateralization models and may raise the cost of capital.

Institutional counterparties and DeFi integrations: practical implications

For institutional players, the freeze behavior of an issuer affects three decisions: which stablecoins to hold, where to custody them, and how to integrate on-chain liquidity.

Custodians will demand clearer incident response policies from issuers before accepting large USDT or USDC positions. They will want SLAs for freeze/unfreeze actions, transparent legal pathways for contesting freezes, and proofs that freezes are tied to credible legal orders.

Treasuries assessing counterparty exposure will factor freeze history into asset allocation. Where a stablecoin is more likely to be blacklisted, institutions may prefer bank deposits, regulated tokenized deposits, or multi-stablecoin strategies.

DeFi integrators face a choice: keep direct exposure to native USDT/USDC (risking frozen collateral) or rely on permissioned wrapped versions or on-chain attestations that convey freeze metadata. Some protocols already implement time-weighted or multi-stablecoin collateral rules to mitigate single-issuer shocks.

For compliance and risk teams, this means building operational playbooks that account for sudden freezes: liquidity contingencies, multi-rail settlement, and legal escalation procedures. For DeFi engineers, it means building mechanisms to recognize and handle frozen balances — and arguably pushing for standardized, machine-readable freeze metadata.

Policy and governance recommendations: balancing AML with market integrity

Freezes are a public policy tool as much as a corporate discretion. To reduce systemic costs while preserving AML goals, issuers, custodians, and regulators should adopt structural reforms.

1) Standardized freeze reporting and public transparency

Issuers should publish machine-readable freeze logs with timestamps, address identifiers, reason codes (e.g., court order, sanctions list hit, suspicious activity), and whether a legal order accompanied the action. Public logs reduce ambiguity and help counterparties triage exposure. Third-party monitoring firms could aggregate and certify these logs.

2) Clear legal thresholds and contestability

Regulators should push for frameworks that distinguish between freezes backed by court orders and issuer-initiated administrative freezes. A streamlined, time-boxed contestability process (with a neutral arbiter or expedited court review) would protect innocent counterparties while allowing rapid AML response.

3) Multi-stakeholder governance for major issuers

For systemically important stablecoins, issuers should consider multi-stakeholder governance for freeze decisions: an internal compliance team, an external advisory panel of legal experts, and a certified auditor or ombuds. This reduces single-party discretion while retaining operational speed.

4) Technical transparency and standard metadata

Adopt a cross-industry standard for on-chain freeze metadata (a JSON schema for reason codes, legal citations, and durations). DeFi protocols and custodians can parse this data to automate risk controls: e.g., excluding frozen addresses from collateral evaluation.

5) Audits, attestations, and escrow mechanics

Regular third-party audits of freeze policies and quarterly attestations of reserve-management practices increase trust. Consider escrow mechanisms for contested funds (trust accounts holding reserves while legal disputes are resolved) rather than indefinite blacklisting.

6) Regulator-issued guidance and safe harbors

Regulators should issue safe-harbor guidance for issuers who act in good faith on credible law-enforcement requests, alongside minimal due-process requirements. That lowers legal risk for issuers but preserves rights for affected users to dispute actions.

Practical steps for issuers, custodians, and regulators

- Issuers: publish a freeze CLR (compliance log record) and adopt a three-person approval policy for emergency freezes. Maintain a public FAQ and a dispute portal.

- Custodians: require issuers to supply SLAs, freeze logs, and legal contacts; simulate freeze scenarios as part of operational drills.

- Regulators: define narrow statutory thresholds for extrajudicial freezes and fund an independent ombuds to hear freeze disputes quickly.

Conclusion: a path to durable trust

The 2023–2025 freeze disparity — roughly $3.3B for Tether vs $109M for Circle per AMLBot-derived reporting — is a wake-up call. It shows that identical on-chain tools can produce very different market outcomes depending on organizational design, jurisdictional posture, and business incentives. Rather than a single fix, the solution is layered: better transparency, clearer legal rules, shared governance, and technical standards that preserve both AML effectiveness and market utility.

Stablecoins will remain core to the crypto market, and their long-term legitimacy depends on predictable governance. Policymakers and market participants should treat freezes not as isolated compliance actions but as systemic events that require standardized, auditable, and contestable processes to protect both financial integrity and user rights.

Sources

- AMLBot summary as reported by Crypto.news: https://crypto.news/tether-freezes-30x-more-value-than-circle-as-stablecoin-blacklists-surge/

- Coinpedia report restating AMLBot figures: https://coinpedia.org/news/new-report-reveals-how-tether-froze-3-3b-while-circle-froze-109m/

For more on how DeFi integrations respond to freezing risk, see discussions around protocol design for composability and risk controls in the broader DeFi conversation; and for macro market context, watch how major rails like Bitcoin and stablecoin liquidity interact during stress events.