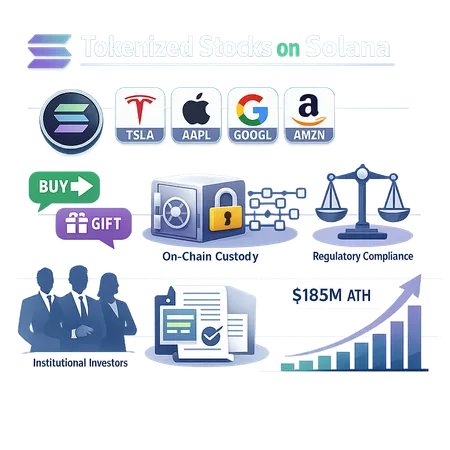

What the $185M Surge in Tokenized Stocks on Solana Means for Adoption, Risk, and SOL

Summary

Executive snapshot

Tokenized equities on Solana recently climbed to a reported $185M in outstanding exposure — a milestone that tells us adoption is no longer just a niche experiment but a consumer-facing product with real liquidity. That figure, while small relative to global equities, matters because it combines three forces: the raw throughput and fee profile of Solana, low‑friction UX such as instant buy/gift via Telegram, and venues willing to list or facilitate secondary markets that skirt traditional exchange infrastructure. For product leads and crypto asset managers, the key questions are practical: how do these tokens work on‑chain, where are the custody and settlement seams, what regulatory pathways are being tested, and what happens to SOL and ecosystem health if tokenized equities scale over the next 12–24 months?

What the $185M all‑time high actually indicates

The $185M figure is meaningful as an adoption pulse rather than a valuation thesis. As reported, tokenized equities on Solana reached a new all‑time high around that number, signaling increased minting and secondary market activity tied to both retail demand and experimental institutional flows. This suggests two things at once: liquidity pools and market‑making are adequate to support some degree of trading, and UX improvements are lowering onboarding friction so more retail users can hold and transfer tokenized shares.

This growth is consistent with on‑chain distribution innovations — for example, Telegram integrations that let users buy and gift tokens instantly — which reduce the behavioral barrier to trying tokenized equities. These UX channels convert curiosity into on‑chain activity faster than traditional broker onboarding.

How tokenized stocks work on Solana: on‑chain mechanics

At a technical level, tokenized equities on Solana are SPL tokens that represent an off‑chain economic claim (or a synthetic claim) on underlying shares. Implementation patterns vary, but common elements include:

- Custody and mint/burn model: An issuer or custodian holds the underlying shares in a brokerage or trust account. When a buyer purchases a tokenized share, the issuer mints the corresponding SPL token; when a holder redeems, the token is burned and the underlying share is released (or cash‑settled).

- Oracle and price feeds: Many markets use off‑chain price references and oracles for indicative pricing and to enable certain automated market making strategies, though the token itself is a transfer of claim rather than a derivative contract on‑chain.

- Bridge and wrapping mechanics: Some ecosystems use wrapped representations where another chain or protocol issues a wrapped SPL token backed 1:1 by custodial holdings elsewhere; Solana’s fast finality and low fees make frequent micro‑transfers and gifting practical.

- Trading infrastructure: Tokenized stocks trade on DEXs, centralized exchanges operating on Solana, and peer‑to‑peer channels. Liquidity can be provided via concentrated liquidity pools, AMMs, or order book models adapted to SPL tokens.

These mechanics emphasize off‑chain custody as the real fulcrum: the smart contract and token are simple relative to the legal and operational complexity of holding and reconciling the underlying securities.

Why on‑chain custody is still limited

Although transfers and ownership registers on Solana are transparent and fast, legal custody typically remains off‑chain. A token ledger proves who holds the token on Solana, but it does not replace share registry entries at an issuer’s transfer agent or a regulated depository unless a legal framework explicitly recognizes the token as the share. That gap is where custodial risk concentrates: if the custodian that claims to back the SPL tokens fails or misreports holdings, token holders may have no direct claim in traditional securities law.

Liquidity and UX: Telegram adoption as a distribution accelerant

Liquidity and user experience are tightly linked. Solana’s low fees and sub‑second confirmations allow platforms to design micro UX flows that are impractical on higher‑fee chains. A notable example is the ability to buy, send, or gift tokenized stocks directly inside messaging apps like Telegram. Integrations that enable instant purchase or gifting turn tokenized equities into social and remittance primitives.

AltcoinBuzz documented how Telegram integrations enable instantaneous buy/gift flows for Solana tokens, highlighting a rapid consumer distribution channel that bypasses traditional broker interfaces. This is significant: friction‑free flows increase frequency of transfers, widen distribution to non‑traditional investor cohorts, and create viral loops (gifting, sharing, staking experiences) that are hard to achieve with standard brokerage UX.

From a liquidity perspective, easy onboarding increases the marginal buyer/seller pool and supports tighter spreads in AMMs or intra‑app order books. For product teams, the lesson is straightforward: UX features that convert intent into an on‑chain transfer are a primary driver of volume growth for tokenized equities today.

Custody, settlement and legal/regulatory fault lines

Tokenized equities expose a trio of acute risks: custodial counterparty risk, settlement ambiguity, and regulatory enforcement. Each has operational and legal consequences.

- Custodial counterparty risk: If an issuer or custodian misstates holdings or becomes insolvent, token holders may have limited recourse. Traditional custodians operate under regulated frameworks (insurance, capital requirements); many token issuers rely on less‑regulated trusts or brokerages in permissive jurisdictions.

- Settlement ambiguity: On‑chain transfers settle instantly between wallet addresses, but reconciliation with traditional registries (transfer agents, clearinghouses) is asynchronous or non‑existent. This creates a persistent mismatch between record‑keeping systems and legal ownership.

- Regulatory arbitrage and enforcement: Issuers and platforms may choose jurisdictions with lighter securities enforcement to issue tokenized equities or to host secondary markets. That strategy delivers speed initially but increases the chance of future enforcement actions, market freezes, or delistings when regulators view tokens as unregistered securities or unauthorized offerings.

Legal structuring matters: some operators attempt to mitigate risk with contractual undertakings (custodial trust agreements, insurance wrappers, or redemption promises). But these are only as strong as the enforceability of contracts across jurisdictions and the solvency of counterparties.

Questions for product teams to model

- Who holds the underlying shares, under what legal title, and where (jurisdiction)?

- What are the redemption mechanics and latency? Is there a guaranteed route to convert tokens to tradable off‑chain shares or cash?

- What insurance or capital buffer exists to protect token holders in custody failure scenarios?

- How will exchanges and liquidity providers respond to regulatory subpoenas or freeze orders?

Addressing these questions requires both legal counsel in securities law and robust operational due diligence.

Capital corridor use cases: gifting, cross‑border access, and retail distribution

Tokenized equities are already being used as lightweight capital corridor tools:

- Retail gifting and social transfer: Instant gifting through messaging apps turns equities into social instruments — a Christmas gift of a fraction of a share becomes a real use case. These flows increase retail penetration and create on‑chain provenance for promotional campaigns.

- Cross‑border access: Residents in jurisdictions that lack local brokerage access can receive and trade tokenized equities on Solana, providing economic exposure without local custodial infrastructure. This raises compliance and tax questions but expands market participation.

- Fractionalization and micro‑investing: By combining fractional tokens and low fees, platforms can deliver micro‑savings products that allocate exposure to many names cheaply and flexibly.

These corridor flows are practically attractive for emerging‑market remittances and gifting use cases, but they also intersect with AML/KYC and local securities regimes.

Scenario analysis: if tokenized stocks scale, what happens to SOL and ecosystem health?

Scenario analysis should consider three broad outcomes over the next 12–24 months: benign scaling, regulatory tightening, and custody failure.

Benign scaling (base case): Tokenized stocks grow steadily, driven by UX channels and DEX liquidity. SOL benefits from higher transaction throughput and developer interest; fees stay low but overall revenue increases. More tooling (wallets, custody solutions, compliant issuance platforms) matures, reducing counterparty risk. This outcome boosts network activity and developer ecosystem health.

Regulatory tightening (risk case): Regulators in major markets take action against issuance platforms or custodians, leading to delistings or forced redemptions. Trading volumes fall, spreads widen, and some liquidity migrates to underground venues or other chains. SOL price may experience volatility tied to risk‑off flows and reduced activity; developer focus may shift to compliance‑friendly layers.

Custody failure (tail risk): A major custodian misstates holdings or collapses, triggering a crisis of confidence. On‑chain balances remain, but off‑chain backing is impaired, forcing freezes, litigation, or coordinated redemptions. Liquidity evaporates, many tokenized positions are contested, and SOL suffers reputational damage and a material drop in on‑chain activity.

Quantitatively, the $185M notch is small relative to SOL’s market cap, so a benign scaling scenario is unlikely to single‑handedly drive a multi‑x price move for SOL. However, the directional impact is positive for activity metrics: more accounts, more micro‑transactions, more demand for tooling and custodial services — all of which are constructive for long‑term ecosystem utility even if not immediately price‑material.

Practical recommendations for asset managers and product leads

- Prioritize counterparty due diligence: demand transparency on where underlying shares are held, legal opinions on enforceability, and proof of reserves for tokenized issuance.

- Build redemption and dispute playbooks: ensure clear, tested processes for redemptions and for handling regulatory inquiries or freezes.

- Design UX with compliance guardrails: Telegram adoption and similar flows are powerful, but they must be paired with KYC/AML screening, transaction monitoring, and region‑aware blocking controls.

- Engage regulators early: seek no‑action letters where feasible, or structure offerings as synthetic products with clear disclosure to reduce ambiguity.

- Monitor liquidity providers closely: the health of AMMs and market makers will dictate spreads and slippage for larger tokenized positions.

These measures balance growth and prudence and help institutions capture UX‑driven adoption without overexposing to counterparty or legal risk.

Conclusion

The $185M all‑time high for tokenized equities on Solana is an early signal: distribution innovations and low‑friction UX — exemplified by Telegram purchase/gift flows — are converting latent demand into real on‑chain liquidity. But that liquidity sits atop an operational stack where custody and legal enforceability remain the main vectors of risk. For product teams and asset managers, the near term will be defined by how well issuers and custodians operationalize legal protections, and how regulators choose to treat these instruments. If handled carefully, tokenized stocks can broaden market access and increase activity on Solana, benefiting SOL and the ecosystem. If mishandled, they could trigger regulatory or counterparty shocks that reduce participation.

Bitlet.app and other custodial platforms will be watching these dynamics closely as the next 12–24 months unfold.

Sources

- AltcoinBuzz — Solana tokenized equities reached an all‑time high: https://www.altcoinbuzz.io/cryptocurrency-news/tokenized-stocks-on-solana-hit-new-all-time-high/

- AltcoinBuzz — Buying and gifting Solana tokens via Telegram: https://www.altcoinbuzz.io/cryptocurrency-news/how-to-buy-and-gift-solana-tokens-instantly-on-telegram/

For broader context on market narratives, see DeFi adoption trends and how on‑chain liquidity feeds wider crypto market behavior; for cross‑market comparisons, consider how Bitcoin ETF flows altered institutional demand dynamics.