Stablecoin

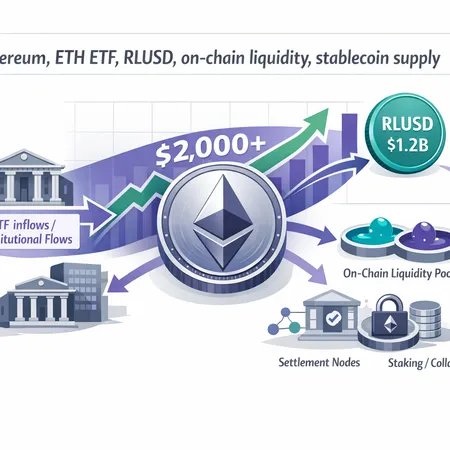

Renewed ETH spot‑ETF inflows helped ETH reclaim $2,000, while Ripple’s RLUSD expansion to ~$1.2B on Ethereum is shifting settlement and collateral dynamics. Together these forces are increasing on‑chain liquidity and altering medium‑term price scenarios for ETH.

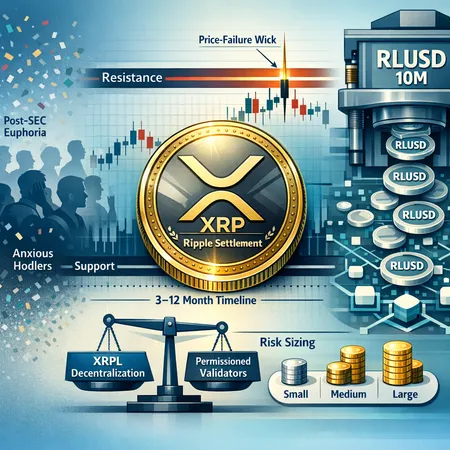

Ripple’s RLUSD landing on Binance’s XRP Ledger is a strategic milestone that enhances stablecoin utility and on‑chain liquidity. Large on‑chain XRP movements tied to exchanges may reflect deeper liquidity operations that investors should monitor.

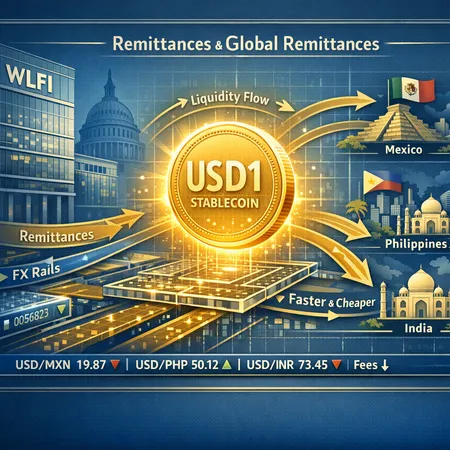

World Liberty Financial’s World Swap and the USD1 stablecoin mark a bold entry into FX and remittances by a Trump-linked firm — a move with commercial upside but heavy regulatory scrutiny. This analysis unpacks liquidity implications, competitive dynamics, AML risks, and likely policy responses across major corridors.

Tether's reported $10+ billion 2025 profit reshapes the stablecoin conversation — from market share and commercial strategy to regulatory scrutiny and reserve transparency. This analysis breaks down drivers of the profit, systemic leverage implications, and scenarios for competitors and RWA integration.

Ripple’s SEC settlement kicked off a rally — then the air leaked out. New on‑ledger activity like 10M RLUSD minted gives the XRPL a fresh narrative, but technical weakness and decentralization debates mean risk sizing matters more than ever.

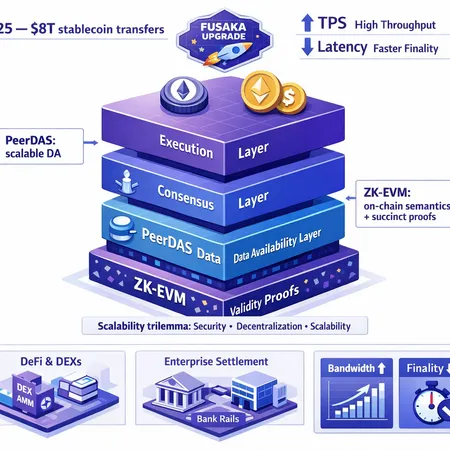

PeerDAS and production‑quality ZK‑EVMs together address key data‑availability and verification bottlenecks, while Q4‑2025’s $8T stablecoin transfer volume shows real demand for high‑throughput, low‑latency settlement on Ethereum.

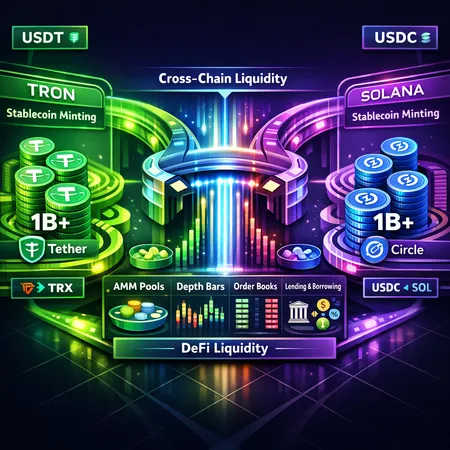

Late‑2025 and early‑2026 saw fresh billion‑token mints of USDT on Tron and USDC on Solana. This article examines why issuers pick different chains, immediate DeFi liquidity effects, and practical strategies for builders and liquidity managers.

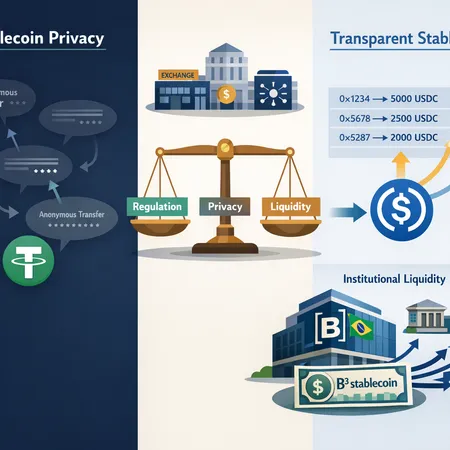

Stablecoins are evolving from retail rails to institutional tokenized cash, forcing a new trade-off between on-chain transparency and counterparty privacy. This explainer compares USDC traceability, Brazil’s B3 planned stablecoin, and industry warnings to give compliance officers and product managers a practical framework.

Visa’s pilot to settle U.S. transactions using USDC on Solana is a watershed for real-world stablecoin rails — it demonstrates issuer-to-acquirer on‑chain settlement and exposes new tradeoffs in speed, cost, and compliance. Payments and product teams must weigh throughput, liquidity, custody and regulatory controls when designing enterprise-grade on‑chain settlement.

Tether’s cash bid for Juventus — and Exor’s reported rejection — is more than a PR stunt: it signals how stablecoin issuers are testing corporate expansion, brand acquisition, and regulatory optics beyond payments. The episode raises questions about USDT’s market perception and how regulators might respond to high‑profile stablecoin M&A.