Tether

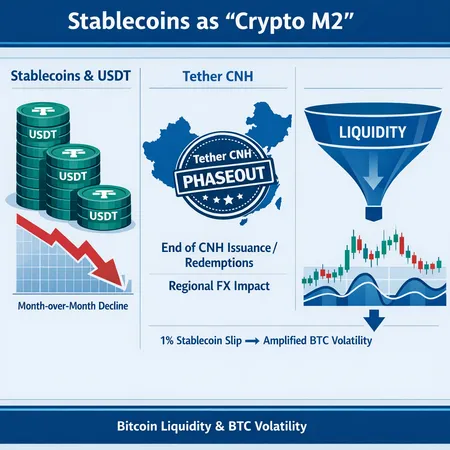

Stablecoins function as crypto’s deployable cash — a small shrink in supply or a regional issuance change can meaningfully reduce on‑ramp liquidity and amplify Bitcoin volatility. This piece investigates the mechanics behind a 1% stablecoin slip and Tether’s CNH phaseout, and models plausible stress scenarios for BTC markets.

New stablecoin primitives — from Tether’s USDT0-backed perpetuals to Ripple’s RLUSD surge on Ethereum — are changing how perpetuals are collateralized, settled and liquidated. This article breaks down mechanics, liquidity benefits, cross-market risks and regulatory questions for DeFi product leads and derivatives traders.

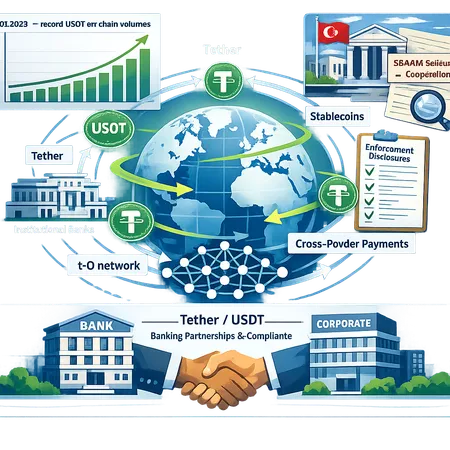

Tether is shifting from a pure liquidity provider to an active participant in enforcement cooperation and institutional settlement. This primer reviews its role in a $544M Turkish seizure, record USDT on-chain flows in Q4 2025, and its bet on the t-0 settlement network — and what that means for stablecoin adoption, banks, and regulators.

Tether's $150M stake in Gold.com signals a strategic shift: major stablecoin issuers are moving into tokenized gold to diversify reserves, deepen liquidity for RWA, and build new revenue lines. That pivot will accelerate tokenized-asset adoption while raising custody, audit and regulatory stakes for the stablecoin sector.

Tether’s Q4 2025 jump to a $187B market cap concentrates USDT liquidity and reshapes on‑chain capital flows — a mixed signal for treasurers weighing liquidity efficiency against concentration and counterparty risks. This article breaks down the implications and practical mitigation steps for institutional risk teams.

Tether’s decision to shrink a planned multi‑billion fundraising round highlights investor concerns about private valuations and stablecoin counterparty risk. The move has implications for USDT’s market confidence and strategic choices across the stablecoin sector.

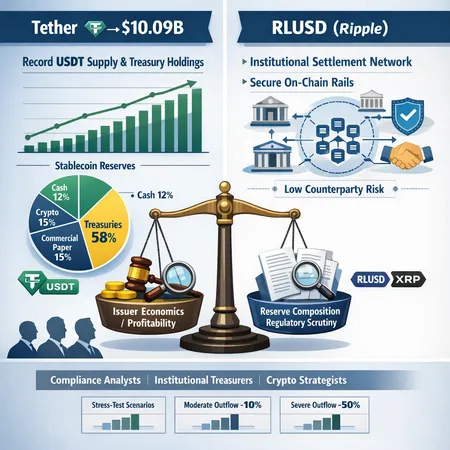

Tether's reported $10+ billion 2025 profit reshapes the stablecoin conversation — from market share and commercial strategy to regulatory scrutiny and reserve transparency. This analysis breaks down drivers of the profit, systemic leverage implications, and scenarios for competitors and RWA integration.

Tether reported a 23% profit decline in 2025 amid record USDT supply and rising treasury holdings, raising fresh questions about issuer economics, reserve resilience, and regulatory risk as new entrants like Ripple’s RLUSD target institutional flows.

Tether’s large-scale accumulation of physical gold and the launch of USAT change the balance of reserve composition and competitive dynamics between stablecoins. This analysis examines custody, market impact, credibility implications for USDT/XAUT, and how USAT pressures USDC in U.S. corridors.

Tether’s disclosed Q4 2025 purchase of roughly 8,888 BTC — lifting its stack above ~96k BTC — changes how institutional treasuries and markets price liquidity and counterparty reserve risk. This article unpacks the scale, reasoning, market effects, and regulatory questions for compliance teams and institutional investors.