Market Liquidity

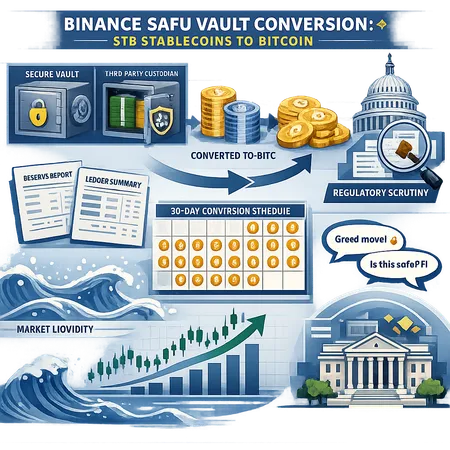

Binance’s move to convert $1 billion of its SAFU reserve from stablecoins into BTC raises questions about exchange reserve practices, custodial risk, market liquidity and regulatory optics. This analysis unpacks the mechanics, likely market impact, and what institutional and retail users should watch next.

Tether’s disclosed Q4 2025 purchase of roughly 8,888 BTC — lifting its stack above ~96k BTC — changes how institutional treasuries and markets price liquidity and counterparty reserve risk. This article unpacks the scale, reasoning, market effects, and regulatory questions for compliance teams and institutional investors.

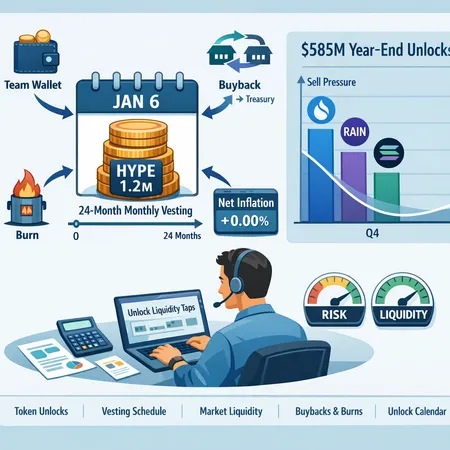

A focused explainer on Hyperliquid’s Jan 6 team vesting of 1.2M HYPE and the wider $585M token‑unlock calendar. Practical modeling, net‑inflation math, and disclosure best practices for PMs, treasury teams, and traders.

Standard Chartered has introduced direct spot trading for Bitcoin and Ether, enhancing market liquidity and providing institutional investors with more accessible crypto trading options. This move signifies growing mainstream acceptance and offers new opportunities for strategic investment.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility