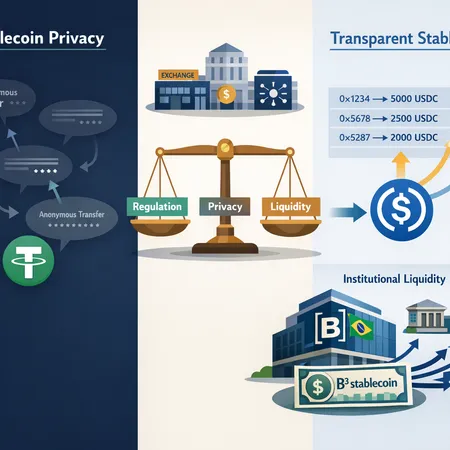

Stablecoin Privacy vs Institutional Cash: Balancing Transparency, Liquidity, and Regulation

Summary

Why the stablecoin debate matters now

Stablecoins are no longer a niche plumbing detail of crypto — they're becoming foundational to institutional payments, treasury management, and on-chain markets. That shift surfaces a hard trade-off: transparency helps regulators and counterparties verify reserves and trace flows, while privacy matters to corporate treasuries and users who don't want internal reconciliations or client relationships exposed on-chain. For compliance officers and product managers, the question is practical: how do you design or adopt stablecoin rails that meet regulatory expectations without needlessly exposing sensitive wallet history?

This explainer contrasts three vectors shaping the debate: the privacy implications revealed by USDC transaction traceability, the institutionalization of tokenized cash via Brazil’s planned B3 stablecoin, and top industry warnings about macro and technology-driven risks. It finishes with an operational framework and checklist for teams building or integrating stablecoins.

USDC traceability: transparency is a double-edged sword

Recent reporting and community threads have drawn attention to how transfers of certain fiat-backed tokens can expose wallet history more readily than people expect. A widely-circulated Reddit example and accompanying commentary from industry leaders highlighted how a USDC transfer can reveal previous counterparties and activity — not a theoretical privacy concern but a practical one for treasuries and corporate wallets (Benzinga coverage links the discussion and CZ's comments).

Why this matters:

- On-chain traceability improves auditability and makes AML investigations faster. Regulators and compliance teams prefer tokens where provenance can be reconstructed.

- The flip side: corporate treasuries, exchanges, and OTC desks often rely on privacy by obscurity — internal counterparty relationships, balance allocations, and strategic flows become visible if a single on-chain address can be clustered.

- Different stablecoins take different stances. USDC (a reserves-backed, transparency-forward token) is designed to be auditable, while USDT historically had less public reserve detail and different compliance practices. That variance affects counterparty trust, legal risk and the operational controls institutions require.

Practical impact on treasuries and exchanges:

- Corporate treasuries may avoid using a single on-chain hot wallet for sensitive flows or implement on-chain privacy controls (mixing off-chain settlement with on-chain finality).

- Exchanges must weigh whether to offer direct custodial flows in USDC for institutional counterparties or provide intermediated, privacy-preserving settlement rails.

Tokenized cash and the B3 stablecoin: institutional liquidity arrives

National exchanges and financial market infrastructure entering the stablecoin space marks a turning point. Brazil’s B3 stock exchange announced plans to issue a stablecoin next year to enhance market liquidity and settlement efficiency — a clear move to institutionalize tokenized cash and bring regulated rails on-chain (see the B3 announcement coverage here).

What B3-style stablecoins change:

- They embed familiar legal and regulatory frameworks into a token: clearer custody law, recognized settlement finality and a known supervisory authority.

- Institutional liquidity improves because pension funds, custodians, and brokers may feel comfortable holding tokenized cash issued by a national exchange.

- Settlement cycles compress: tokenized cash enables same-day (or immediate) cross-market settlement and atomic settlement with tokenized securities, lowering counterparty and intraday credit risk.

New trade-offs and risks:

- Centralized governance: regulated issuers can implement whitelists, blacklists, and KYC gates — useful for compliance but limiting composability and the permissionless benefits of public blockchains.

- Jurisdictional fragmentation: a B3 stablecoin may be tightly regulated and optimized for Brazilian markets, complicating cross-border usability unless interoperable standards emerge.

- Custodial concentration risk: institutional adoption can concentrate liquidity in a few issuer-custodian combos, increasing systemic exposure if operational faults or policy changes occur.

Industry warnings: macro, AI bubbles, and stablecoin resilience

Beyond privacy and governance, market-level risks can stress stablecoins. Executives in the space have flagged significant concerns: Tether’s leadership has called out macroeconomic vulnerabilities and potential asset bubbles — including risks tied to AI hype — as top threats that could reshape liquidity dynamics in coming years (coverage summarized here).

Why these warnings matter for stablecoin operations:

- Procyclical liquidity: in stress events (macro shocks or concentrated tech sell-offs), liquidity providers may retract, leading to expensive redemption queues or price divergence on less liquid on-chain venues.

- Correlation risk: stablecoins are often treated as cash proxies, but if reserves, counterparties, or market-making capacity are correlated with stressed asset classes, that perceived safety erodes.

- Diversification and stress testing are therefore operational necessities for exchanges and treasuries.

Regulation: the tightening perimeter

Regulators globally are signaling that stablecoins will be tightly supervised. Expect greater emphasis on:

- Reserve transparency and attestations, including audited proof of reserves for fiat-backed tokens.

- Travel rule and enhanced KYC/AML monitoring for transfers, especially those crossing custody boundaries.

- Supervisory oversight for token issuers, particularly if they target retail or institutional investors.

Compliance officers must plan for more than spot checks: continuous monitoring, robust record-keeping and a playbook for sanctions screenings are table stakes. At the same time, regulators will likely favour token models that allow for effective oversight — which pushes the market toward more transparent, permissioned architectures.

A practical framework: balancing privacy, transparency, and regulation

Below is a concise operational framework product managers and compliance teams can use when choosing or building stablecoin rails.

- Define risk appetite and use cases

- Ask whether the coin is for intra-firm treasury settlements, exchange custody, or broad retail rails. Institutional liquidity needs (high-value, low-latency settlement) justify different trade-offs than consumer remittances.

- Choose a design model

- Permissioned, regulated issuers (e.g., B3-style tokenized cash) give strong regulatory alignment and easier reconciliation but limit composability.

- Permissionless, public stablecoins offer broad liquidity and composability at the cost of greater due-diligence needs.

- Layer selective disclosure and privacy-preserving tooling

- Adopt selective disclosure: on-chain transactions remain auditable to regulators while metadata or memo fields use cryptographic consent models so counterparties can selectively reveal details when required.

- Consider privacy-enhancing tech like confidential transactions or zero-knowledge proofs for balance privacy while maintaining verifiable reserves off-chain.

- Implement robust monitoring and AML tooling

- Integrate chain analytics, sanctions screening, and automated alerting into the settlement flow. Treat on-chain tracing as a first-class input to treasury reporting.

- Governance, audits and legal wrappers

- Require periodic third-party attestation of reserves and clear legal contracts that define issuer obligations, redemption rights, and jurisdictional governance.

- Multi-stablecoin strategy and liquidity diversification

- Avoid concentration in a single stablecoin issuer. Use a blend (e.g., USDC, USDT, and regulated tokenized cash like a B3 issuance) and maintain committed lines with market makers for dry powder liquidity.

- Stress testing and playbooks

- Run periodic redemptions and stress scenarios (counterparty failure, market freeze, mass redemptions) to validate operational readiness.

- Regulatory engagement and sandboxing

- Engage early with regulators; consider pilot programs or sandboxes to validate design choices under supervisory oversight.

Recommendations for exchanges, treasuries, and product teams

- Exchanges: Offer custody options that separate hot wallet exposure from settlement wallets; provide customers with privacy-preserving custodial settlement when requested; instrument real-time monitoring and disclosure controls.

- Treasuries: Avoid mono-wallet strategies; keep on-chain hot pools limited and reconcile off-chain ledgers frequently; consider using tokenized cash from regulated issuers where legal clarity is a priority.

- Product Managers: Bake compliance into UX — enable consented metadata sharing, build auditable trails, and provide options for customers to choose their privacy/transparency profile.

Bitlet.app teams and others integrating stablecoins should view privacy not as binary but as a configurable property: tailor it to risk posture and legal obligations.

Practical checklist for integration

- Perform a legal and custody review for each stablecoin issuer.

- Map flows that could leak sensitive counterparty information and design mitigations (e.g., off-chain netting, transaction aggregation).

- Integrate chain analytics plus counterparty credit monitoring.

- Establish SLA-backed liquidity lines with multiple market makers and issuers.

- Require quarterly reserve attestations and a public incident disclosure policy.

- Create an internal playbook for rapid on-chain tracing requests from authorities and a protocol for handling privacy breach incidents.

Conclusion

The stablecoin landscape is moving faster than any one standard can contain. USDC-style transparency helps regulators and auditors but exposes wallet-level history; B3-style tokenized cash offers institutional clarity and liquidity but centralises control; macro and technology-driven market risks demand robust stress testing and diversification. For compliance officers and product managers, the solution is not a single choice but a layered one: clear risk definitions, multi-stablecoin strategies, strong monitoring, selective privacy engineering, and proactive regulatory engagement.

Stablecoins will be the rails of institutional crypto finance — designed well, they can deliver settlement efficiency and liquidity; designed poorly, they can leak strategic information or concentrate systemic risk. Use the framework above to make explicit trade-offs, document them, and iterate with both auditors and regulators.

Sources

- Coverage of a Reddit post and CZ’s comments on USDC transfer privacy: https://www.benzinga.com/crypto/cryptocurrency/25/12/49500957/binance-founder-says-crypto-payments-are-a-problem-as-reddit-post-exposes-how-usdc-transfer?utm_source=benzinga_taxonomy&utm_medium=rss_feed_free&utm_content=taxonomy_rss&utm_campaign=channel&utm_source=snapi

- Announcement that Brazil’s B3 stock exchange will issue a stablecoin next year: https://news.bitcoin.com/historic-brazils-b3-stock-exchange-to-issue-a-stablecoin-next-year/

- Tether executive commentary on macro/AI bubble risk and stablecoins’ liquidity role: https://crypto.news/bitcoin-bulls-eye-2026-as-tether-ceo-flags-ai-bubble-as-top-market-risk/