Mining

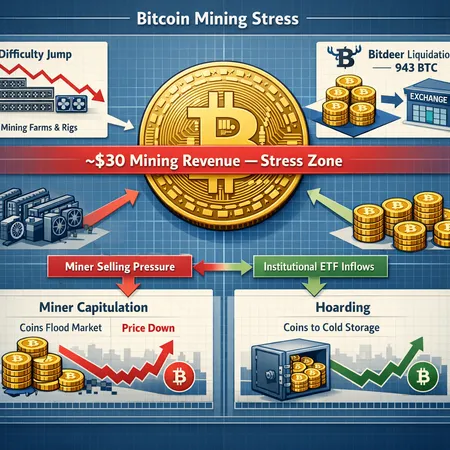

Early‑2026 mining stress—rising difficulty, falling hashrate and compressed miner revenue—has pushed some operators to liquidate reserves, but the same dynamics can also set the stage for a sustained BTC rebound. This analysis explains the mechanics and outlines price scenarios depending on miner behavior.

Sustained US spot Bitcoin ETF outflows are coinciding with macro shocks and network-level volatility (hashrate swings and a 15% difficulty jump), raising new liquidity and price-support risks for BTC. This piece integrates ETF flow data, on-chain signals, miner operational stress, and sentiment indicators into an actionable risk framework for institutional allocators.

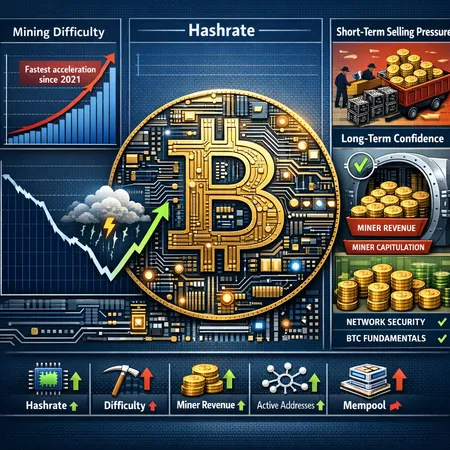

A rapid, record-setting jump in Bitcoin mining difficulty and a V‑shaped hashrate rebound signal shifting miner economics and stronger network security — but consequences for short‑term supply and price dynamics are nuanced. This explainer breaks down technical causes, miner behavior, on‑chain signals to watch, and practical trading/hedging takeaways.

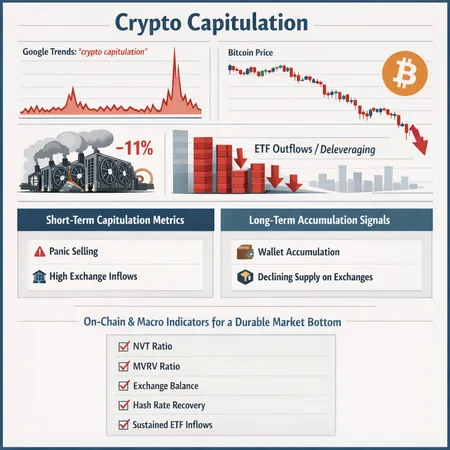

Capitulation signs are flashing across crypto — from Google Trends to an abrupt drop in mining difficulty and ETF-driven deleveraging. This piece diagnoses what those signals mean for a sustainable BTC market bottom and lays out a practical checklist of on-chain and macro indicators to watch.

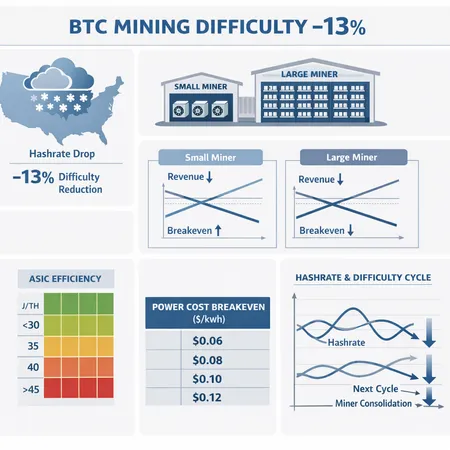

A technical guide for operators and institutional investors on the operational and P&L implications of the imminent ~13% Bitcoin difficulty reduction. Covers cause, short-term revenue shifts, ASIC efficiency modeling, breakeven sensitivity, and what it means for future difficulty cycles and consolidation.

A recent U.S. winter storm knocked roughly 12% of Bitcoin hashrate offline, exposing supply‑side vulnerabilities that rippled through block times, fees and market liquidity during a sharp BTC sell‑off. This piece investigates the technical effects, the market interplay with liquidations and practical contingency steps for miners and exchanges.

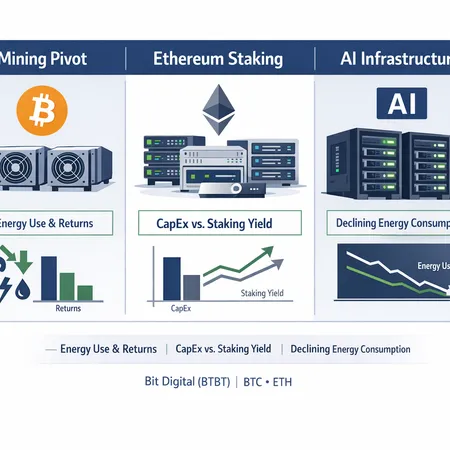

Bit Digital is repositioning away from Bitcoin mining toward Ethereum staking and AI infrastructure — a move that reshapes its capital profile, revenue drivers, and energy footprint. This brief unpacks the strategic rationale, compares PoW mining economics with staking, and outlines what public‑market investors should monitor.

Hashrate has slipped while improbable solo-mining windfalls still happen — and corporate Bitcoin buys are reshaping miner economics. This piece explains why these trends co-exist and what mining operators and analysts should do next.

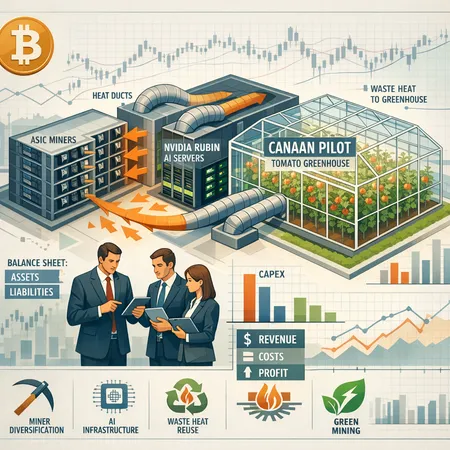

Miners are expanding beyond block validation by entering AI infrastructure and capturing waste heat for industrial uses. These moves reshape CAPEX/OPEX dynamics, improve ESG profiles, and reduce long‑term BTC sell pressure.

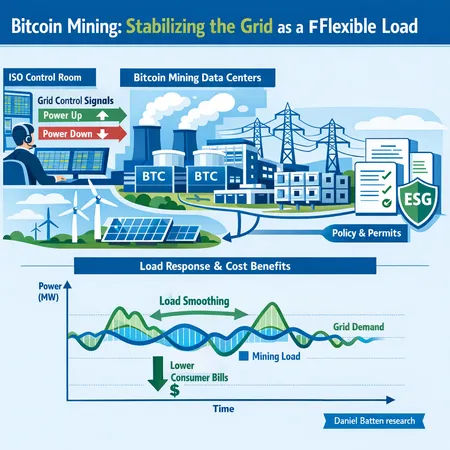

New research and market behavior suggest modern Bitcoin mining — when run as a flexible, dispatchable load — can strengthen grids and reduce consumer costs. This explainer unpacks the evidence, mechanisms, objections, and policy consequences for investors and regulators.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility