Compliance

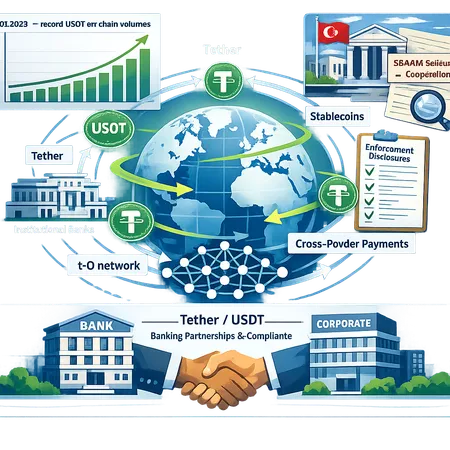

Tether is shifting from a pure liquidity provider to an active participant in enforcement cooperation and institutional settlement. This primer reviews its role in a $544M Turkish seizure, record USDT on-chain flows in Q4 2025, and its bet on the t-0 settlement network — and what that means for stablecoin adoption, banks, and regulators.

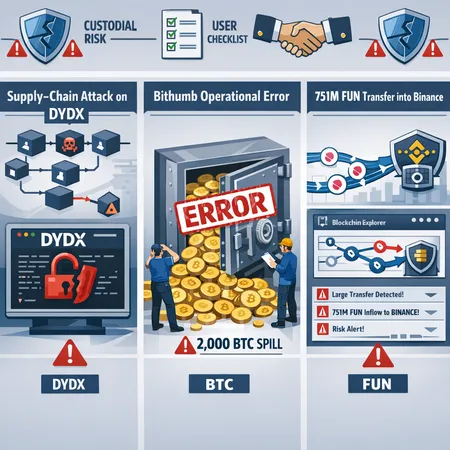

Three recent security incidents — malicious packages targeting dYdX users, Bithumb’s accidental 2,000 BTC distribution, and a 751M FUN transfer to Binance — illustrate different faces of custody and protocol risk. This feature breaks down technical mechanics, trader signals from large on‑chain deposits, mitigation checklists, and policy implications for regulators and exchanges.

USD1’s rapid climb past PYUSD and recent on‑chain incidents expose tradeoffs between adoption and centralized stablecoin risk. This guide helps treasurers and compliance officers evaluate reserves, cross‑chain custody, and counterparties.

Recent divergent regulatory moves—from Russia’s ban on Whitebit to setbacks in Nigeria’s crypto sandbox and the UK’s finalized consultation—are fragmenting liquidity and raising operational risk for exchanges. This feature maps immediate market effects (WBT, SAND), mitigation playbooks for operators, and practical steps for retail and institutional users.

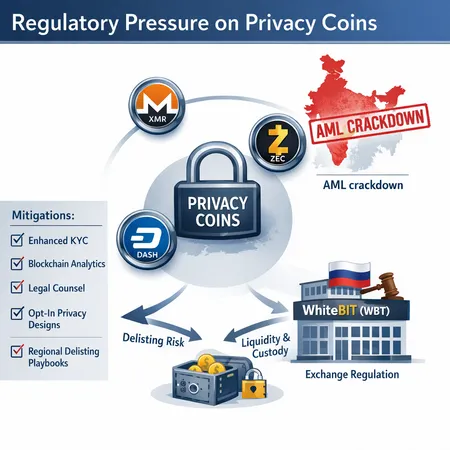

Regulators are tightening the squeeze on privacy coins like XMR, ZEC and DASH while regional politics expose exchanges to new risks. This analysis maps legal basis, market impact, and actionable mitigation steps for developers, exchanges and traders.

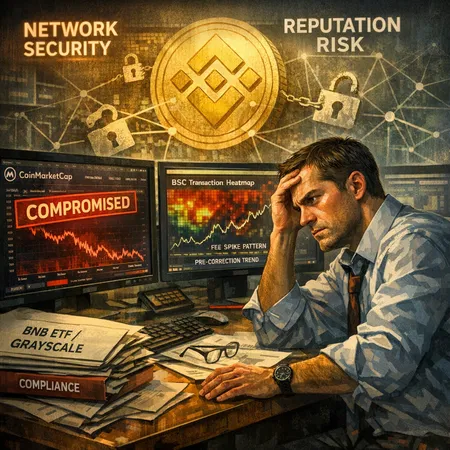

A suspected CoinMarketCap profile compromise targeting BNB Chain exposed how reputational attacks can ripple through an active network—especially as BSC sees fee surges and institutional interest in a BNB ETF heats up. This investigation connects the dots between brand-security, on-chain activity, and governance vulnerabilities.

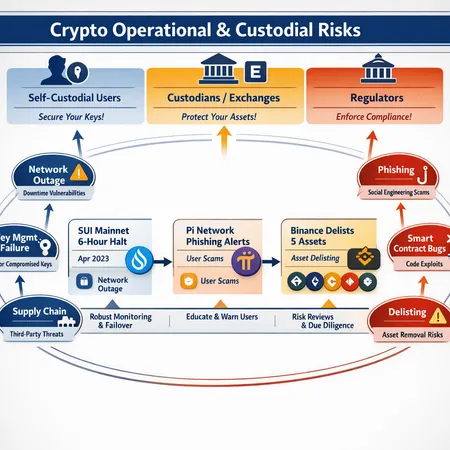

A deep investigation into how recent incidents — the Sui mainnet halt, Pi Network phishing alerts, and Binance support cuts — reveal the evolving attack surface for users and custodians. Practical controls, exchange decision drivers, and a regulatory checklist for hardening operations are provided.

Dubai’s recent ban on privacy tokens and reworked stablecoin rules, combined with high-profile freezes like Tether’s $182M action on TRON, are forcing exchanges, custodians, and privacy projects to rethink listings, custody and compliance strategies.

In 2026 the stablecoin landscape is defined by geopolitical moves, institutional custody evolution, and multichain settlement choices. Compliance officers and treasury managers must reassess rails—USDT, ENA, TRX-based tokens, and regionally targeted issuances like RLUSD—against new regulatory and custody realities.

Polymarket’s tie-up with Parcl to launch real‑estate prediction markets marks a strategic push into on‑chain real‑world assets, but recent controversies such as the Nicolás Maduro bet expose how quickly reputation and token value (e.g., PRCL) can be affected. Product teams and compliance officers must rethink governance, provenance and surveillance to preserve market integrity.