Governance

ZeroLend’s wind-down exposes how fragile small, multi-chain lending protocols can be when TVL, token incentives and cross-chain complexity are misaligned. This article breaks down the failure modes and gives a practical stress-test checklist for projects, DAOs and LPs.

Polymarket's trademark filings for 'POLY' have ignited debate on what a native token could enable — and what regulatory scrutiny it would invite. This investigation examines likely utilities, monetization and governance designs, parallels to past token launches, and U.S. legal risk scenarios.

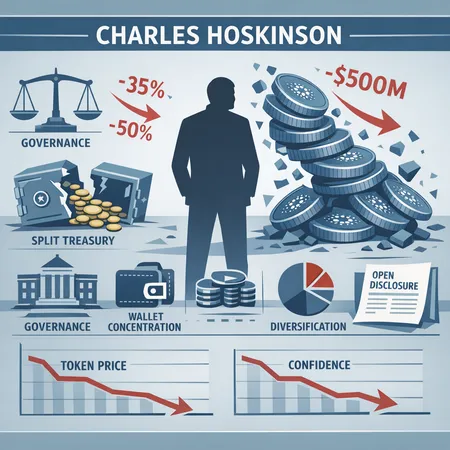

Charles Hoskinson’s public claim of losing over $3 billion in crypto holdings shines a light on founder balance-sheet concentration, market signalling and the gap between personal and project risk management. This article unpacks the facts, historical parallels, best-practice disclosure rules and what ADA holders should demand from Cardano’s governance.

Aave's decision to wind down the Family wallet and retire the Avara brand reflects an intersection of governance friction and regulatory risk that many DeFi teams now face. This case shows how consolidation under a single engineering/legal umbrella can reduce regulatory exposure while reshaping product roadmaps and community dynamics.

Vitalik Buterin now backs anonymous voting plus prediction markets, and an Ethereum DAO accepted Tornado Cash-funded deposits — forcing a rethink of privacy, governance risk, and regulatory exposure for DAOs.

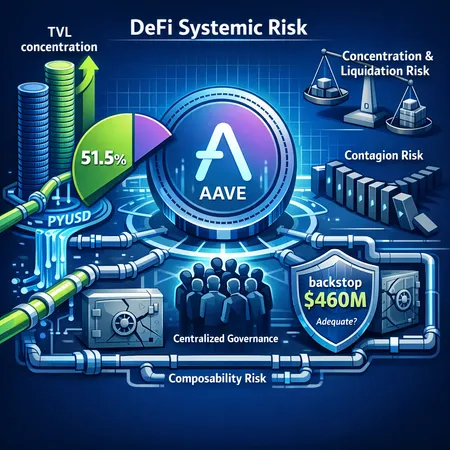

Aave now controls a majority of DeFi lending — an investigation into how it got there, what a $460m backstop really means, and protocol and policy fixes to decentralize lending markets.

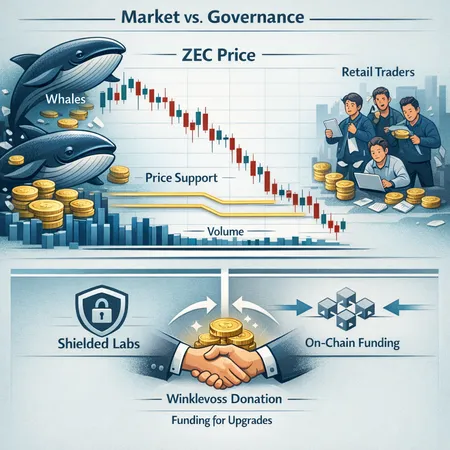

Zcash shows short-term price weakness while on-chain flows and governance moves diverge — notably a Winklevoss donation to Shielded Labs. This article breaks down technical support, whale accumulation, the governance rift, and tradeable scenarios for intermediate traders.

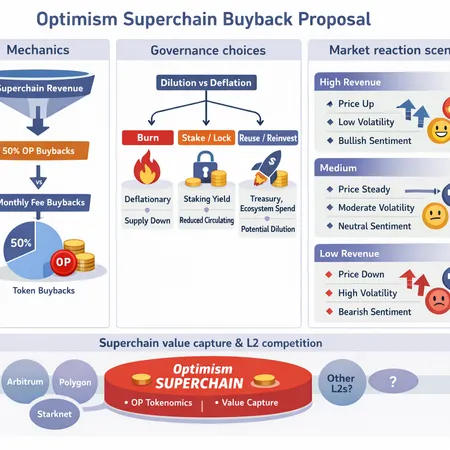

Optimism’s proposal to route Superchain revenue into OP buybacks forces a choice between steady supply-sink mechanics and flexible treasury policy. This deep-dive explains the buyback mechanics, compares a 50% revenue rule vs monthly fee-based buys, and outlines governance trade-offs — burn, stake or reuse — plus market scenarios and competitive implications for L2 value capture.

The Electric Coin Company’s full development-team departure triggered a governance showdown with Bootstrap, a double‑digit ZEC selloff, and a larger warning about foundation‑dependent privacy projects. This explainer maps the timeline, technical and trust risks, market fallout, and a practical risk checklist for asset managers and custodians.

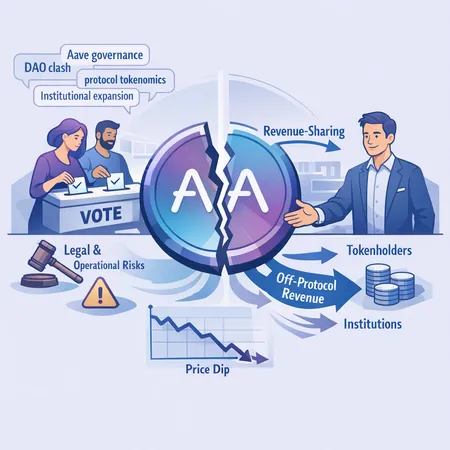

Aave’s recent DAO clash over an IP-transfer sparked a new proposal from the founder to share off‑protocol revenue with AAVE holders. This article breaks down the timeline, mechanics, incentives, legal risks, market reaction, and what other DeFi teams should watch.