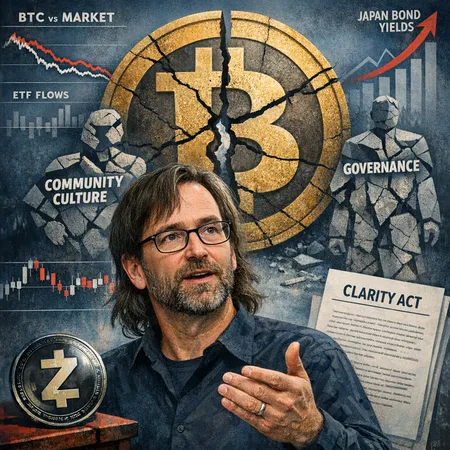

Can Bitcoin's Community Culture Erode Its Moat? A Critical Look at Zooko Wilcox's Warning

Summary

The claim: Bitcoin's culture as an existential risk

Zooko Wilcox, founder of Zcash (ZEC), recently framed Bitcoin's community culture as a potential Achilles' heel: a governance and social cohesion problem that could, over time, undermine BTC's ability to adapt to shocks and preserve its network effects. His critique isn't primarily technical — it's about incentives, norms, and the informal rules that shape which ideas get adopted, which get ignored, and how disputes are resolved. That kind of sociological argument deserves examination: culture shapes upgrade paths, funding, and how the ecosystem responds when liquidity, regulation, or macro forces bite.

What Zooko is actually saying

At its core, Zooko's position is that insular communities tend to ossify. When a protocol's leadership, developer corps, and vocal stakeholders share narrowly aligned views, alternative solutions and adaptive governance can be dismissed out of hand. For Bitcoin, that could look like rigid resistance to funding models, conservatism around protocol change, and a tendency to defer decisions to social consensus rather than structured mechanisms. The claim is not that BTC is doomed tomorrow; it's that cultural brittleness raises long-term tail risk.

Market signals: underperformance, muted demand, and consolidation

Technical and market evidence can help validate or refute whether culture is translating into structural weakness. Several independent signs are worth noting.

Underperformance vs broader markets

Analysts have documented periods where BTC has lagged equities and other crypto segments, arguing that some of the lag reflects structural market mechanics and narrowing appetite for fresh BTC exposure. Commentary that BTC is "underperforming" points to a mix of reduced speculative flows, concentration of on-chain activity, and a lack of new-demand drivers outside macro narrative. For a protocol whose moat is partly defined by ubiquity, prolonged relative underperformance can weaken perceptional dominance and open the door for alternatives to attract developer and investor attention (Bitcoin Is Underperforming).

Muted ETF demand and liquidity dynamics

Expectations around institutional products have been high, but ETF demand has sometimes been softer than bullish forecasts implied. Muted appetite for ETF allocations (relative to some expectations) reveals more than investor sentiment: it exposes how regulatory, custody, and marketing frictions can limit inflows. When capital doesn't arrive at scale, mining economics, layer growth, and developer funding channels feel the squeeze — and a community without robust funding channels may struggle to respond.

Range-bound price action and the 'calm before the storm'

Price consolidation — long periods of sideways movement within a defined range — compresses economic signaling. Technical analysts note that BTC's range-bound behavior can store volatility and create a stress test for governance if the market suddenly re-prices risk. Consolidation reduces transaction volume, tightens miner margins in some cycles, and can incentivize short-term tactical thinking over long-term institutional planning (Bitcoin price analysis: Is BTC in the calm before the storm?).

Regulation and macro: multipliers for cultural faults

Culture doesn't operate in a vacuum. Legal and macro shocks can magnify the consequences of governance weaknesses.

The Clarity Act — a legal shock or a paper tiger?

Washington's debates around frameworks like the so-called Clarity Act generate headlines about regulatory safety and asset classification. Analyses suggest that legislative moves may not instantly upend Bitcoin's status, but they do raise uncertainty that forces communities into reactive postures rather than proactive planning. That uncertainty disproportionately punishes projects with brittle funding or slow decision-making because they must balance compliance, lobbying, and technical priorities at once (Why the Clarity Act Probably Won't Change Anything).

Macro linkages: rising Japanese bond yields and trader nervousness

Macro dynamics can shift capital flows abruptly. For example, rising bond yields in Japan have contributed to renewed risk-off behavior among some traders, tightening liquidity and increasing funding costs for levered positions. Such shifts alter short-term demand for risky assets, and for Bitcoin that can mean smaller margins for error when cultural debates take months to resolve. The more fragile the governance mechanisms, the harder it is to coordinate swift, sensible responses to capital shocks (Why Japan's Rising Bond Yields Are Making Bitcoin Traders Nervous).

Does culture cause market weakness — or is it the other way around?

Causality is messy. Culture can make a protocol slow to react, but market and regulatory pressures also shape culture. Underperformance and muted demand can harden conservative instincts: stakeholders dig in, fear changes, and the community becomes less receptive to experimentation. Conversely, a more dynamic, better-funded governance structure can convert stress into constructive upgrades rather than factional fights.

Zooko's worry is that Bitcoin's current norms bias it toward conservatism, which could be adaptive in many scenarios (preserving sound money traits), but maladaptive if the system needs faster, better-funded responses to new threats.

Where Bitcoin's strengths complicate the critique

It's important to balance critique with Bitcoin's durable advantages. BTC benefits from unmatched liquidity, brand recognition, deep exchange listings, and a vast institutional pipeline built over a decade. The very features that attract capital — predictability, a strong anti-change reputation, and a perceived commitment to sound monetary properties — are also what Zooko criticizes. Changing culture risks eroding what made BTC dominant in the first place.

Concrete fixes: corporate, developer, and governance changes that could reduce tail risk

If Bitcoin's goal is to preserve dominance while lowering cultural brittleness, it can pursue targeted, low-regret changes that respect its trust-minimized ethos.

Corporate and institutional layer

- Establish more formalized institutional outreach and coordination channels so exchanges, custodians, and ETF sponsors can engage proactively with core devs and miners. Better information flow reduces surprise and misalignment.

- Encourage diverse custody and service providers to avoid concentration risk; that means supporting open-source reference implementations and interoperability tooling.

- Create non-invasive funding vehicles (industry-led grants, foundations with transparent charters) to ensure sustained engineering resources without centralizing power.

Developer and technical funding

- Adopt sustainable developer funding similar to models used in other ecosystems — not to centralize control, but to guarantee critical maintenance. A modest, transparent treasury or matched-grant schemes could secure long-tail work (wallets, infra, security audits).

- Standardize improvement proposal processes with clearer timelines, RFCs, and conflict-resolution pathways so contentious changes aren't decided purely by social loudness.

Governance and social design

- Formalize off-chain governance signals (structured signaling, periodic convenings) while keeping on-chain changes subject to strong consensus thresholds.

- Codify norms around community conduct, review, and inclusion to reduce gatekeeping and bring in new perspectives — particularly from regions and institutions that now hold a lot of BTC.

- Build explicit contingency playbooks: what to do in the event of severe regulatory action, market dislocations, or miner-exchange conflicts. Having a rehearsed response is different from changing policy on the fly.

These are not trivial shifts, but they are modest in ambition and compatible with Bitcoin's principles if implemented transparently.

Lessons from other protocols and the ZEC contrast

Zcash (ZEC) offers a useful foil: its founding community explicitly built governance and funding models (foundations, developer grants) that enabled quicker decisions and sustained research. That structure helped Zcash iterate on privacy tech, but it also introduced different centralization trade-offs and market perceptions. The lesson is dual: governance tooling buys agility but requires safeguards against capture, and cultural norms matter as much as formal rules.

Practical takeaways for investors and governance researchers

- Treat community culture as a credible, measurable risk: look beyond on-chain metrics and study funding flows, developer churn, and dispute-resolution records.

- Don't assume short-term underperformance equals cultural failure: it can be cyclical. But persistent lag combined with shrinking funding is a red flag.

- Advocate for small, transparent governance experiments: matched grants, shared infrastructure funds, and structured signaling processes minimize tail risks without rewriting Bitcoin's ethos.

For traders and platform designers watching these dynamics — including those building services on Bitlet.app — the interplay of culture, capital, and regulation should inform allocation and product strategies.

Conclusion: a sober middle path

Zooko Wilcox's critique is a valuable provocation. Bitcoin's community culture is both a protective filter and a potential brake on adaptation. Market underperformance, range-bound behavior, and regulatory noise increase the stakes, but they don't prove inevitability. The pragmatic route is incremental institutionalization: bolster funding for maintenance, improve coordination between corporate actors and developers, and adopt clearer governance signals. Those moves reduce the tail risk Zooko fears while preserving the trust-minimized core that made BTC the dominant network in the first place.

Sources

- Zooko Wilcox on cultural risks: Zcash founder reveals biggest reason why he's bearish on Bitcoin

- Market underperformance analysis: Bitcoin is underperforming

- Legal context and the Clarity Act: Why the Clarity Act Probably Won't Change Anything

- Macro pressures from Japan's bond yields: Why Japan's Rising Bond Yields Are Making Bitcoin Traders Nervous

- Technical consolidation context: Bitcoin price analysis: Is BTC in the calm before the storm?