USDC

January 2026 saw on‑chain stablecoin payments explode, led by USDC processing an estimated $8.4 trillion in a single month—an event that recalibrates payments, competition, custody, and regulation. This article breaks down the scale, why USDC dominated, how rivals like Tether are responding, and what regulators will likely focus on next.

K33’s new USDC loans collateralized by Bitcoin mark a step toward more institutionalized, balance-sheet-friendly borrowing in crypto. This analysis examines product mechanics, comparisons with incumbents like NEXO, effects on BTC exchange supply and spot liquidity, and the regulatory and counterparty risks investors should weigh.

Visa’s expansion of a USDC settlement pilot to U.S. banks signals a potential shift in how card networks and banks think about the settlement layer. This analysis explores merchant flows, operational and regulatory implications for banks and card networks, and the likely liquidity and demand effects for USDC and Circle.

Visa’s pilot to settle U.S. transactions using USDC on Solana is a watershed for real-world stablecoin rails — it demonstrates issuer-to-acquirer on‑chain settlement and exposes new tradeoffs in speed, cost, and compliance. Payments and product teams must weigh throughput, liquidity, custody and regulatory controls when designing enterprise-grade on‑chain settlement.

Traditional finance is increasingly tokenizing cash and adopting crypto rails to speed settlement and reduce operational friction. This article breaks down recent bank and broker moves, custody and compliance trade‑offs, and how asset managers can pilot tokenized cash products.

Firedancer’s mainnet validator client, Double Zero’s dedicated fiber plans, and JPMorgan’s USDC‑settled commercial paper together form a stress test for Solana as an institutional settlement layer. This article evaluates technical gains, real‑world settlement mechanics, and the tradeoffs institutions must weigh.

This guide explains how recent U.S. stablecoin moves are altering cross-border flows, exchange behavior, and on‑chain liquidity, with practical compliance and operational checklists for issuers and integrators. Case studies include Bybit’s USDC push and KRW1 on Polygon to illustrate market responses.

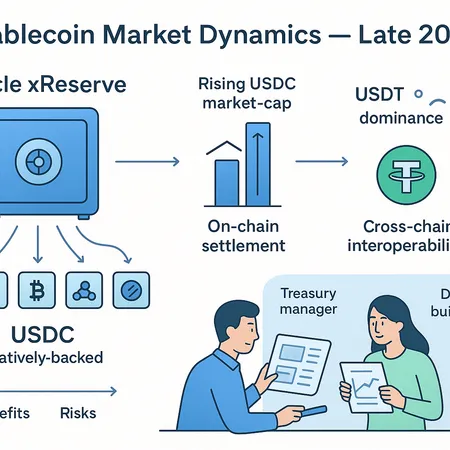

Late‑2025 stablecoin infrastructure is shifting: Circle’s xReserve pushes native USDC issuance across chains while USDT’s market share has climbed above 6%, reshaping liquidity and settlement choices for treasuries and DeFi builders.

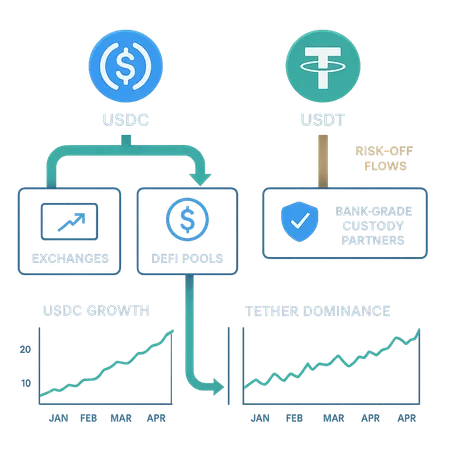

In November 2025 stablecoins — led by rising USDC circulation and a Tether dominance spike — are acting as the market’s liquidity backbone. New custody and settlement integrations are reshaping institutional on-chain flows and DeFi liquidity provisioning.

As volatility climbs, traders and treasurers increasingly rotate into stablecoins and new on‑chain RWA products for safe‑haven liquidity. This explainer compares the USDT surge, Coinbase–Kalshi USDC custody cues, and Polygon‑based R25 yield‑bearing RWA stablecoin for institutional treasury decisions.