Ripple's EU EMI License: Payments Strategy and XRP Escrow Market Impact

Summary

Executive summary

Luxembourg’s CSSF has granted Ripple Payments a full Electronic Money Institution (EMI) license, a regulatory milestone with immediate commercial ramifications for EU payments corridors and regulated on‑ramps. The license clears legal pathways to issue e‑money and provide payment services across the EU, enabling a push on On‑Demand Liquidity (ODL) and fiat rails that pair with XRP liquidity. At the same time, recurring XRP escrow unlocks — including reports of roughly 1 billion XRP becoming tradable during recent price stress — create a continuing source of potential supply shock and reputational optics that can amplify volatility.

This piece breaks down what the EMI license allows, the real commercial opportunity for cross‑border payments in Europe, how escrow unlocks mechanically and psychologically affect markets, and three plausible price/volume scenarios if the EU rollout accelerates. I reference primary coverage of the license and escrow activity and offer nuance about sell pressure, OTC absorption, and structural adoption dynamics.

What the CSSF EMI license legally permits Ripple Payments to do across the EU

The Luxembourg CSSF EMI license is not merely symbolic. Under EU law an EMI authorization allows a firm to issue electronic money, provide payment initiation, and execute payment services governed by PSD2 and related frameworks — and crucially, to passport those services into the EU single market from Luxembourg once national registration steps are completed.

Several practical permissions flow from that framework:

- Issue e‑money and operate regulated customer wallets that can represent fiat in electronic form. That supports regulated rails for fiat settlement and customer on‑ramps.

- Operate payment services (payment initiation, acquiring, and transfer services) under an EU regulatory umbrella rather than via individual bilateral arrangements in every jurisdiction.

- Passporting and cross‑border services: from a Luxembourg hub Ripple can scale services across EU member states with lower incremental licensing friction compared with separate local licenses.

CoinDesk and The Block summarize the license as the final EU e‑money approval that lets Ripple operate more fully in the single market (CoinDesk report, The Block coverage). Independent commentary highlights the operational implications for payments settlement and regulated custody of fiat balances in Europe (Blockonomi).

Commercial opportunity: EU payments, regulated on‑ramps and ODL adoption

An EU EMI license materially reduces legal friction for several commercial value propositions:

- Regulated fiat on‑ramps: Licensed e‑money issuance enables Ripple to operate compliant fiat wallets and rails — attractive to exchanges, fintechs, and corporate treasury desks that need regulated custody and AML/KYC controls.

- Cross‑border FX efficiency: ODL uses XRP as a bridge asset to minimize pre‑funding in corridor currencies. In low‑liquidity corridors this can cut working capital and settlement times; in Europe, the opportunity is less about latency (SEPA is fast) and more about cost and non‑SEPA corridors linked to EUR flows.

- Bank and fintech partnerships: A local EU license helps persuade conservative banking partners to trial or integrate Ripple rails since counterparty legal risk is clarified.

That said, the commercial runway is not automatic. SEPA instant rails, existing correspondent banking, and rising stablecoin adoption (regulated and unregulated) are competing solutions — and banks have limited appetite to adopt a crypto bridge unless the economic case is clear. For many traders, Bitcoin remains the primary market bellwether; similarly, incumbent rails remain the default for many corporates.

Bitlet.app and other payment integrators will watch how quickly Ripple converts regulatory permission into bank partnerships, on‑ramp volumes and merchant flows.

XRP escrow, monthly unlocks and the mechanics of market impact

Ripple placed a large portion of XRP into time‑locked escrows with a monthly release schedule (historically 1 billion XRP monthly, with unused portions returned to escrow). That program is intended to provide predictable liquidity for ecosystem incentives and working capital while reducing the risk of indefinite dump pressure. Still, monthly unlocks are a recurring narrative risk.

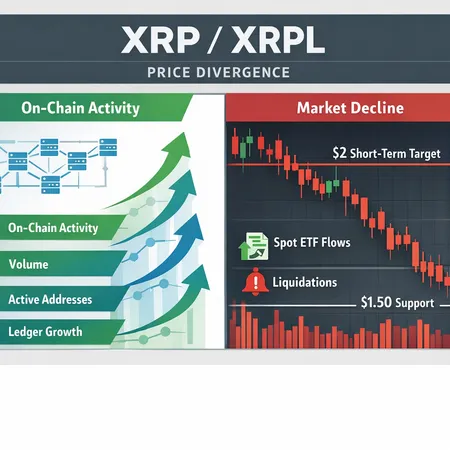

Recent reporting alleges that roughly 1 billion XRP became available and was associated with heavy selling during a price crash, triggering headlines and social media narratives about 'market dumps' (U.Today report). Independent analysis of escrow unlock history and market impact also highlights that monthly releases have historically correlated with short‑term price pressure at times, particularly when macro conditions were fragile (BeInCrypto analysis).

Important nuances about market mechanics:

- Unlocked ≠ sold: Escrow releases increase the potential circulating supply. Actual sell pressure only materializes if Ripple or counterparties sell into markets or transfer large volumes to exchanges. Ripple has historically sold some amount to fund operations and support ecosystem partners, but a large share can be distributed via OTC, strategic partnerships, or held.

- OTC and programmatic selling: Institutional sales are often routed via OTC desks and liquidity providers rather than dumped onto public order books. OTC placements are less visible but can still increase effective supply and influence price discovery indirectly as counterparties hedge.

- Market absorption depends on baseline liquidity and volatility. If EU adoption accelerates — driving new real‑world demand for XRP as a bridge asset — increased transaction velocity could absorb some of the unlocked supply without catastrophic price moves.

- Optics matter: Even if economic impact is limited, large unlocks during price drops create negative narratives that can trigger stop‑loss cascades, social media amplification, and tighter spreads — amplifying volatility beyond fundamental selling.

Scenario analysis: price and volume outcomes if EU rollout accelerates

Below are three stylized scenarios focused on the next 6–24 months. These are directional and intended to help payments‑focused strategists and EU fintech executives think through token economics and adoption interplay.

Scenario A — Conservative (license = compliance tick; slow uptake)

Assumptions:

- License helps with compliance but banks remain cautious; limited new corridor integration in 6–12 months.

- Monthly escrow unlocks continue; Ripple sells modest amounts for operations.

- Macro risk and crypto sentiment remain neutral to negative.

Market outcome:

- Short‑term: Price pressure persists around monthly unlock headlines; volatility spikes when unlocks coincide with macro tailwinds. Volume remains mostly trading volume; UX/ODL volumes negligible.

- 6–12 months: XRP price drifts lower to mid‑range as free float slowly rises and adoption fails to materialize.

Why this could happen: incumbents stall on integrations, stablecoins capture on‑ramp demand, and headlines about escrow unlocks dominate.

Scenario B — Base (steady commercialization with cautious partners)

Assumptions:

- Ripple converts the EMI license into pilots and several bank/fiat on‑ramp partnerships across EU corridors over 6–12 months.

- ODL corridors expand into non‑SEPA flows (e.g., EUR→emerging market currencies) with measurable volume.

- Ripple manages escrow releases with transparent communication and primarily uses OTC placements to fund growth.

Market outcome:

- Short‑term: Periodic volatility on unlock dates, but increasing real‑world volume improves market depth. Some unlocked supply is absorbed by on‑chain and off‑chain demand to fund rails.

- 12–24 months: If ODL volume scales to tens of millions USD daily across corridors, XRP transaction velocity and utility rise materially; price could appreciate modestly (single‑digit to mid‑double‑digit percent from baseline), with higher sustained trading volumes.

Why this could happen: Clear commercial wins, banks accept regulated gateway through Luxembourg, and stable demand from payment flows reduces marginal sell pressure.

Scenario C — Accelerated (fast EU rollout + network effects)

Assumptions:

- Rapid integration with major EU fintechs and at least one or two incumbent banks, plus meaningful corridors for EUR liquidity to non‑SEPA markets.

- Ripple uses escrow liquidity strategically to seed liquidity pools, market‑make and create regulated on‑ramps rather than immediate sell‑side liquidity provision.

- Regulatory clarity inspires institutional counterparties to use XRP for settlement and market‑making, increasing demand for short‑term XRP liquidity.

Market outcome:

- Short‑term: Paradoxically, unlock headlines still cause knee‑jerk moves, but increased utility and deeper liquidity absorb sales quicker.

- 12–24 months: Significant increase in real use case volume and velocity could materially tighten spreads and raise price — mid‑double to triple‑digit percent gains are possible from a depressed baseline if adoption is broad and sustained.

Why this could happen: EU licensing materially reduces counterparties’ legal risk, driving rapid onboarding and real demand for XRP as a settlement bridge.

Key variables that will determine which scenario plays out

- Clear bank partnerships and pilot scale: Without real bank corridors, regulatory permission is inert.

- Behavior on escrow releases: Transparent, measured use of unlocked XRP (liquidity seeding, long‑term partnerships) will reduce negative optics.

- Competition from stablecoins and CBDCs: If regulated stablecoins or CBDCs win the rails, XRP’s bridge use case shrinks.

- Macro and crypto market sentiment: A stressed macro environment amplifies unlock headlines and squeezes liquidity.

- Operational execution by Ripple Payments: pace of integration, local liquidity provisioning, and market‑making strategy.

Practical implications for EU fintech executives and payments strategists

- Treat the EMI license as enabling, not conclusive. It lowers legal friction but commercial momentum requires bank buy‑in and proven cost benefits vs incumbents.

- Model escrow unlock timing into liquidity planning. If partnering with Ripple, ask for clarity on how unlocked supply will be used and whether OTC placements are anticipated.

- Consider staged pilots in non‑SEPA corridors where ODL’s value proposition is clearest — these corridors present the highest chance of proving ROI quickly.

- Watch for improved market depth as a leading indicator: growing depth around EUR pairs and lower spreads on XRP rails signal absorption of supply and real utility.

Also useful to monitor related market narratives — for many crypto professionals traditional metrics remain instructive: on‑chain flows, exchange inflows/outflows around unlock dates, and OTC desk reports. If you track cross‑asset correlations, compare XRP dynamics with broader crypto indices and even DeFi liquidity shifts.

Conclusion

The CSSF EMI license is a real and tangible milestone that positions Ripple Payments to build regulated EU payments rails and fiat on‑ramps — a prerequisite for meaningful ODL adoption in Europe. But a license alone doesn’t guarantee adoption, and recurring XRP escrow unlocks complicate the token story by increasing headline risk and potential free float.

For fintech executives and payments strategists the right question is not whether Ripple can get a license (it has) but whether that license translates into partnerships and demonstrable corridor economics that create sustainable demand for XRP. If Ripple successfully pairs licensing with rapid corridor integration, then escrow unlocks become easier to absorb and token economics could shift in XRP’s favor. If not, unlocks will continue to be a recurring source of volatility.

Sources

- The Block — Ripple secures full EMI approval in Luxembourg: https://www.theblock.co/post/387959/ripple-secures-full-emi-license-luxembourg

- CoinDesk — Ripple secures full EU e‑money license in Luxembourg: https://www.coindesk.com/markets/2026/02/02/ripple-secures-full-eu-e-money-license-in-luxembourg

- U.Today — Ripple unlocks roughly 1 billion XRP during price crash: https://u.today/ripple-unlocks-giant-1000000-xrp-as-price-crashes-1729?utm_source=snapi

- BeInCrypto — Analysis of monthly XRP escrow unlocks and price impact: https://beincrypto.com/xrp-escrow-unlock-price-low-february-2026/

- Blockonomi — Independent take on EMI license implications: https://blockonomi.com/ripple-secures-full-emi-license-from-luxembourgs-cssf-for-eu-operations/

(Analysis informed by reporting above and market convention; Bitlet.app users and partners may find the commercial vs token‑economics distinctions useful when assessing integrations.)