USDT

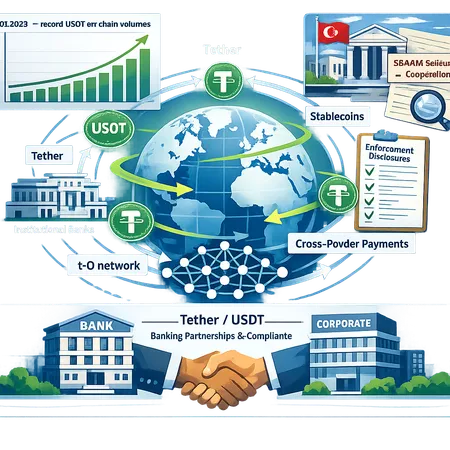

Tether is shifting from a pure liquidity provider to an active participant in enforcement cooperation and institutional settlement. This primer reviews its role in a $544M Turkish seizure, record USDT on-chain flows in Q4 2025, and its bet on the t-0 settlement network — and what that means for stablecoin adoption, banks, and regulators.

Tether’s decision to shrink a planned multi‑billion fundraising round highlights investor concerns about private valuations and stablecoin counterparty risk. The move has implications for USDT’s market confidence and strategic choices across the stablecoin sector.

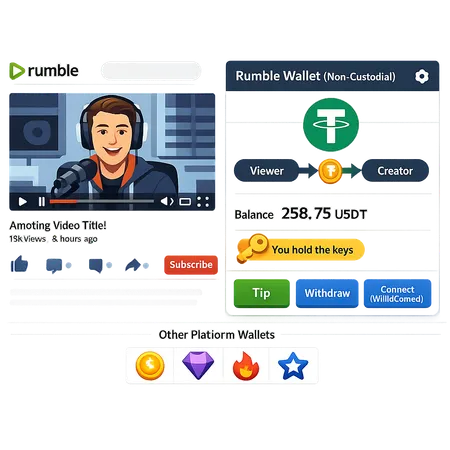

Rumble’s new noncustodial wallet (built with Tether) embeds USDT payments directly into the video platform, enabling tipping, payouts and new monetization primitives. This piece explains custody UX, settlement flows, competitive tradeoffs (WalletConnect and in‑app wallets) and practical onboarding/KYC and revenue advice for creators and product teams.

A technical, actionable guide on address-poisoning scams and exchange deposit risks after the near-$50M USDT theft. Practical hygiene, tooling fixes, and an incident-response checklist for traders, custodians and security engineers.

Tether’s reported €1B/$1.1B all-cash bid for Juventus — and the club’s rejection — illuminates a larger push by stablecoin issuers into sports, tokenized assets and real-world corporate strategies. The episode highlights strategic motives, regulatory exposure and a new front in stablecoin competition.

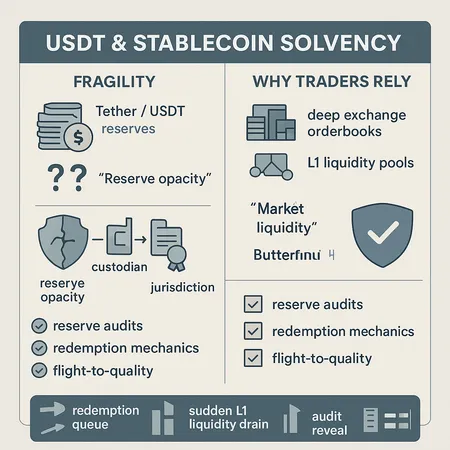

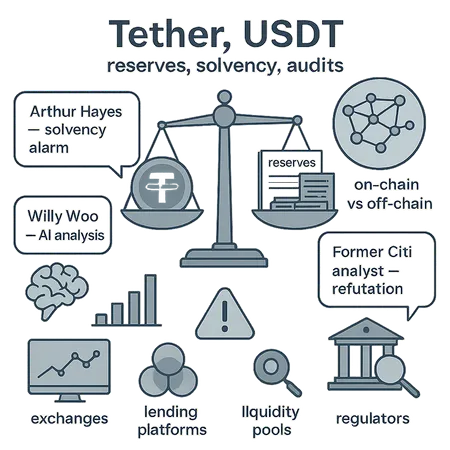

A practical explainer for treasury managers and compliance officers on assessing stablecoin counterparty risk using the Hayes vs. Butterfill debate over USDT solvency as a case study.

A recent social-media alarm over Tether’s reserves reignited long-running debates about on-chain visibility, attestation vs audit, and stablecoin liquidity risk. This explainer breaks down the facts, the analyst responses, and practical steps for investors and compliance teams.

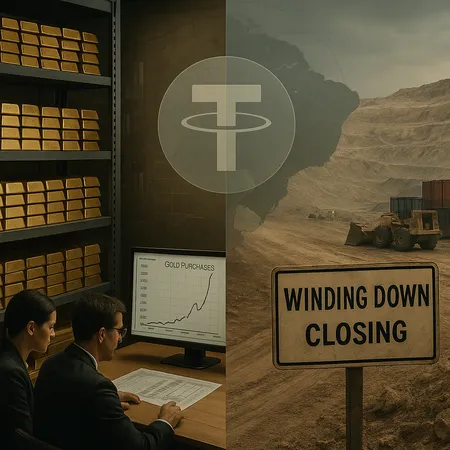

Tether’s simultaneous accumulation of gold and wind-down of mining operations in Uruguay presents a deliberate pivot in reserve strategy and operational focus. For treasury managers and macro traders, the moves raise questions about liquidity, transparency and how to size short-term exposure to USDT.

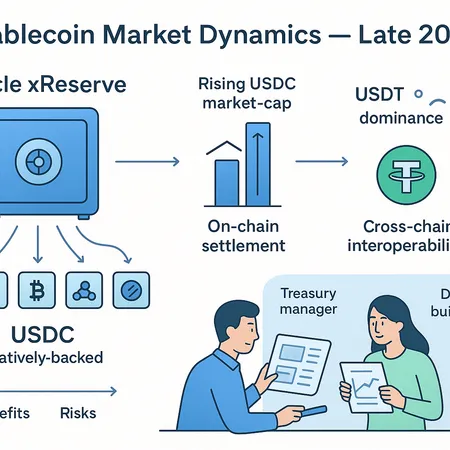

Late‑2025 stablecoin infrastructure is shifting: Circle’s xReserve pushes native USDC issuance across chains while USDT’s market share has climbed above 6%, reshaping liquidity and settlement choices for treasuries and DeFi builders.

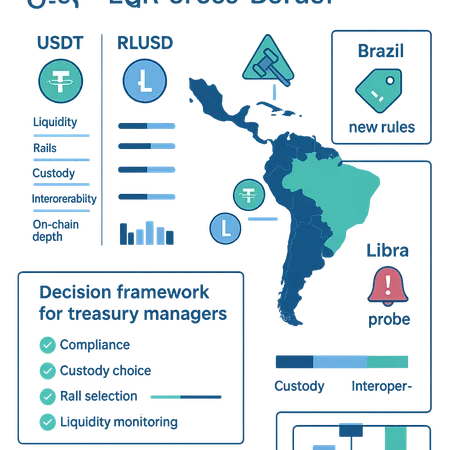

A practical explainer comparing USDT and RLUSD for Latin American cross-border rails, weighing liquidity, custody trade-offs, and Brazil's tightening rules to help treasurers choose compliant stablecoin strategies.