Tether's Evolving Role in Compliance and Cross-Border Settlement

Summary

Executive overview

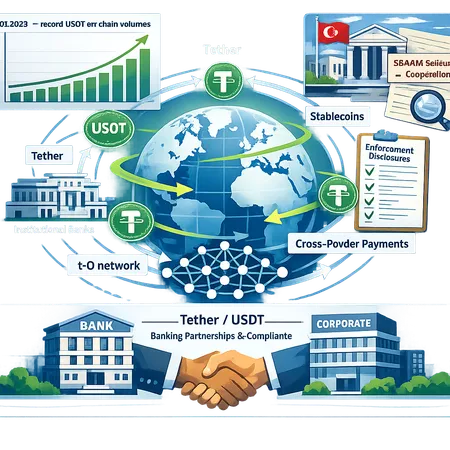

Over the past 18 months Tether has quietly moved from being seen primarily as a source of on-chain liquidity to an actor that courts regulators, supports law enforcement, and invests in institutional settlement infrastructure. Those shifts are visible across three concrete developments: public cooperation in a $544 million Turkish seizure and a broad disclosure of law-enforcement cases; a record surge of USDT on-chain transfer volume in Q4 2025; and a strategic investment in the t-0 network to enable faster, institutional cross-border USDT payments. Together these moves change how product teams, payments architects, and policy analysts should think about stablecoins, banks, and compliance.

This primer walks through the facts, technical implications, and practical considerations for teams building payments products or assessing stablecoin utility and compliance posture.

What happened: enforcement cooperation and disclosure

In late 2025 Tether publicly disclosed that it had assisted Turkish authorities in a crypto seizure valued at roughly $544 million, and that the company has supported a multi-billion-dollar cumulative law-enforcement record. The disclosure — covered in detail by Blockonomi — marks a notable shift in transparency and willingness to engage with investigators on on-chain tracing and custodial account relationships. (Blockonomi coverage)

Why this matters: for years, a common critique of stablecoin issuers was opacity around how they handle law enforcement requests, sanctions screening, and frozen or reclaimed funds. Public cooperation in a high-dollar seizure signals two things. First, Tether has operational channels to respond to requests (which implies internal compliance teams, legal gates, and data-sharing capabilities). Second, it is willing to make that cooperation public — a reputational move designed to reassure banks, custodians, and regulators about its compliance posture.

For policy-focused readers, the Turkish case is a live demonstration that on-chain traceability combined with issuer cooperation can yield actionable results. For banks and custodians, it reduces some of the perceived counterparty risk when doing correspondent relationships with stablecoin-related businesses.

Record USDT on-chain transfer volumes: Q4 2025 dynamics

Q4 2025 closed with a striking statistic: USDT on-chain transfers reached record levels, hitting aggregate flows reported at $4.4 trillion. The scale and velocity were highlighted in industry reporting as emblematic of continued demand for dollar-pegged liquidity even as parts of the crypto market struggled. (Currency Analytics report)

Interpreting the numbers: large on-chain transfer volume does not equal circulating market capitalization, but it does tell us about the role USDT plays as a settlement and liquidity rail. High transfer volume can indicate:

- Heavy intra-exchange and inter-platform rebalancing.

- Use as a corridor for cross-border value transfer where traditional rails are slow or constrained.

- Institutional and OTC flows that prefer a blockchain-native dollar proxy for speed and traceability.

From an architectural perspective, the follow-on questions are operational: how do you manage intraday liquidity, what settlement finality controls do you need, and what monitoring systems are capable of spotting AML red flags in near real time? High transfer volumes increase the importance of robust on-ramps/off-ramps, tight reconciliation processes, and partnerships with analytics providers that can surface transaction context.

t-0 network: Tether's bet on instant institutional settlement

Tether has signaled intent to invest in and support the t-0 settlement network, a solution oriented toward instant or near-instant cross-border settlement for institutional USDT payments. News.Bitcoin covered the investment as part of a broader push to make USDT a predictable, bank-friendly settlement rail for enterprises and financial institutions. (News.Bitcoin coverage)

What is at stake technically? A t-0-style network promises same-day or immediate settlement finality rather than the multi-step, prefunding-heavy processes of correspondent banking. That changes product design in three concrete ways:

Liquidity architecture — Institutions must decide whether to hold prefunded USDT pools on the network, use atomic swaps and on-chain liquidity, or rely on custodian-managed hot/cold splits. Netting capabilities can reduce gross funding needs but require trusted settlement engines and legal frameworks.

Custody and interoperability — Instant settlement raises the bar for custody providers to offer fast signing, secure key management, and continuous availability. It also amplifies the need for standards around transaction messaging, similar to ISO 20022 work in payments.

Compliance orchestration — Faster settlement compresses the window to perform AML/KYC checks unless controls are embedded at the rails. That implies a mix of pre-screening, post-settlement monitoring, and automated travel-rule messaging.

For product managers, the t-0 model is attractive because it reduces settlement risk and settlement-time volatility. But operational readiness — treasury automation, reconciliation tooling, and legal agreements — is required to realize those benefits.

Banking relationships and correspondent risk: why banks care

Banks and regulated custodians historically treated stablecoin issuers with caution. The combination of large on-chain flows, issuer responsibility for redemptions, and unclear regulatory expectations made correspondent relationships fraught.

Tether's public cooperation in enforcement and its t-0 investment change the calculus several ways:

Risk signalling: Demonstrable law-enforcement cooperation and published enforcement records reduce informational asymmetry. Banks can better evaluate compliance controls when issuers publish their engagement history.

Predictability of flows: If institutional clients use t-0 for same-day settlement, banks can model intraday liquidity needs with more certainty — and potentially offer wrapped services (custody + settlement) linked to USDT rails.

Integration opportunities: Banks can offer custody, KYC/AML as-a-service, and on/off-ramp facilities that integrate directly with settlement networks, positioning themselves as the bridge between fiat rails and blockchain settlement.

Still, counterparty due diligence remains critical: banks will want contractual protections, audited reserves, and agreed-upon incident response plans that cover sanctions screening, wallet freezes, and dispute resolution.

Compliance and regulatory posture: real-world implications

Tether's actions reflect an industry trend: stablecoin issuers are adapting to regulatory expectations by embedding compliance into operations. That has several implications:

Visibility: Public disclosures about enforcement cooperation create precedents for transparency. Regulators may expect similar reporting from other issuers.

Tooling: Real-time analytics firms, sanctions screening engines, and travel-rule messaging services become mandatory infrastructure for serious payment rails.

Policy leverage: When issuers can credibly trace and assist in confiscations, policymakers have fewer grounds to dismiss stablecoins as uncontrollable. That can accelerate nuanced regulation that encourages safe market participation rather than blanket bans.

For policy analysts, the key takeaway is that operational compliance — not only legal compliance — matters. The technical capabilities to trace, freeze, and map flows shape regulatory options.

Practical guidance for payments architects and product managers

If you are designing stablecoin-based payment solutions or evaluating a t-0-enabled settlement option, consider these practical steps:

Model liquidity both gross and net. Prepare for volatility spikes where USDT flows increase and design automated rebalancing.

Build or integrate compliance orchestration. Combine pre-flight screening (counterparty whitelisting) with post-settlement monitoring and automated alerting.

Contractual clarity. Negotiate Service Level Agreements (SLAs) with settlement providers for availability, finality times, and dispute handling.

Custody strategy. Choose custody models (single custodian, multi-custodian, or hybrid) that support instant signing and clear recovery plans.

Bank-ready reporting. Implement reconciliations and auditable trails so banks and auditors can validate transaction provenance and reserve status.

Platforms across the ecosystem — from exchanges to P2P services and installment providers such as Bitlet.app — will need these capabilities to safely scale product offerings that rely on USDT rails.

Strategic outlook: adoption, competition, and standardization

Tether’s twin strategy of demonstrating compliance and investing in settlement rails is likely to accelerate institutional adoption of stablecoins, but not without friction. Expect competition at multiple layers: other stablecoin issuers will respond by beefing up compliance, analytics vendors will race to offer lower-latency monitoring, and banks will pilot tightly controlled corridors to protect liquidity.

Standardization will be crucial: common formats for metadata, travel-rule messages, and assurance frameworks (audits and attestation for reserves) will help lower the transaction cost of bank-stablecoin integration. Over time, a combination of technical standards and regulatory frameworks could make USDT-like rails analogous to SWIFT corridors — faster, but with comparable compliance guardrails.

Conclusion: a more institutional Tether — and a roadmap for adoption

Tether’s public cooperation in enforcement, record on-chain transfer volumes, and investment in t-0 settlement together represent a strategic pivot toward institutional maturity. For payments architects, stablecoin product managers, and regulators, the signal is clear: stablecoins are not just speculative plumbing anymore — they are becoming operational rails that require the same rigor as traditional payment systems.

Adoption will hinge on the intersection of technical readiness (instant settlement, custody, netting), compliance capabilities (real-time analytics, travel-rule compliance), and trusted banking relationships. Those who design systems with these realities in mind will be best positioned to leverage the speed and composability of blockchain settlement while meeting the expectations of banks and regulators.

For teams building products, start by codifying liquidity and compliance requirements into architecture decisions, and choose partners that can demonstrably support law-enforcement cooperation, audits, and fast settlement.

Sources

- Blockonomi — Tether assists Turkey in $544 million crypto seizure; reveals $3.4B global enforcement record

- Currency Analytics — USDT hits $4.4 trillion on-chain transfers in Q4 2025

- News.Bitcoin — Tether targets cross-border payments with t-0 network investment

For context on broader market signals, remember that on-chain rails interact with asset classes like NFTs and memecoins and infrastructure domains such as DeFi and blockchain analytics. And for teams building consumer or P2P payment features, internal bank integration and reconciliations will be the difference between a pilot and a production-grade offering — a lesson platforms like Bitcoin watchers and DeFi practitioners can attest to.