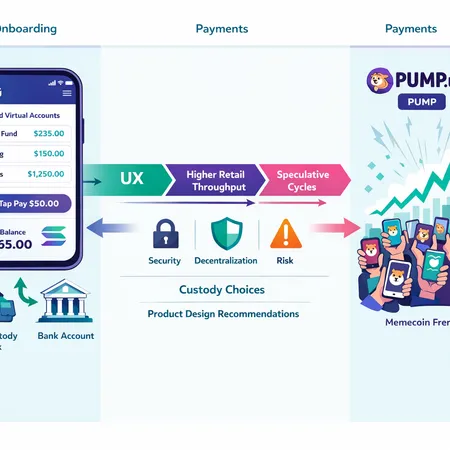

UX

Avici’s named virtual accounts on Solana and a spike in memecoin activity are narrowing the gap between bank‑like UX and self‑custody. This report examines whether UX fixes are driving higher retail throughput and speculative cycles, and what product teams should build next.

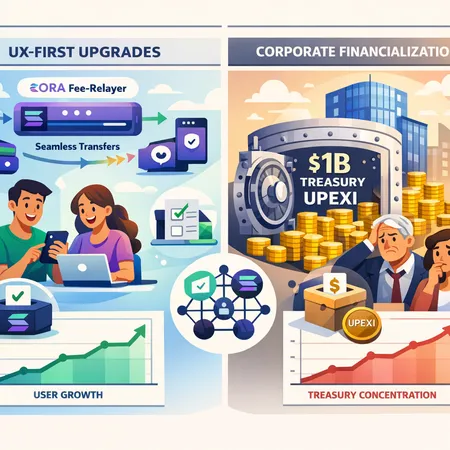

Improved mobile UX and native on‑chain execution on Solana are lowering frictions for retail traders and fueling token rallies like BONK. Jupiter Mobile V3 and broader tooling upgrades tighten SOL’s product‑market fit for decentralized trading.

Solana’s Kora fee-relayer lowers friction for dApp users, but Upexi’s $1B filing to expand the Solana treasury raises valid centralization and financialization concerns. Builders and investors must weigh faster user growth against concentrated treasury control and governance risks.