Are Better UX and Virtual Accounts Powering Solana’s Retail Rush?

Summary

Executive snapshot

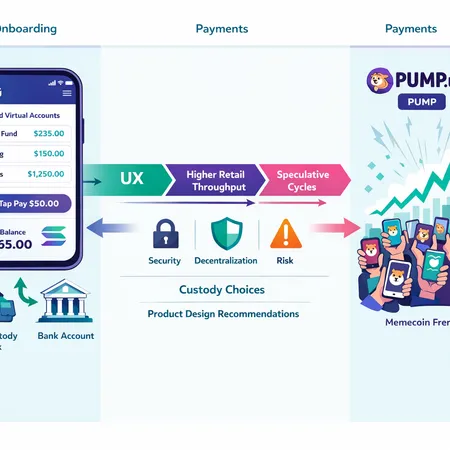

Solana’s performance, low transaction fees, and composable tooling have long attracted teams building consumer crypto products. Two recent developments crystallize a larger thesis: first, Avici’s named virtual accounts make on‑chain balances feel like bank accounts without surrendering private keys; second, memecoin throughput—exemplified by Pump.fun’s activity spike and fee revamp—shows how low‑friction UX can drive massive retail engagement. Together these trends raise a practical question for product teams: are UX innovations finally enabling sustainable retail throughput for payments and commerce, or are they primarily fueling faster speculative cycles?

For many builders, Solana now reads as a platform that can host both payments rails and high‑velocity speculative markets. This report walks through user journeys, custody tradeoffs, behavioral outcomes (including memecoin spikes around PUMP), and pragmatic product recommendations for product managers and entrepreneurs.

What Avici’s named virtual accounts change

Avici’s recent launch of named virtual accounts on Solana creates an experience that feels like a bank account while preserving user self‑custody. Instead of raw public keys and unfamiliar addresses, users get friendly identifiers tied to wallets they control. The core UX benefits are:

- Reduced cognitive load: users send to names instead of long addresses.

- Easier reconciliation: app developers can map friendly names to on‑chain accounts for better UX flows.

- Lower support costs: fewer mistaken transfers and less manual address help.

Technically, Avici layers an account abstraction/virtualization pattern on Solana that allows apps to present a curated namespace (names) while leaving the signing keys in the user's custody. The result is a middle path between custodial bank accounts and raw self‑custody: bank‑like discoverability and presentation, with private keys retained by the user-agent or device.

Read more about the launch and product goals in Avici’s announcement here: Avici launches named virtual accounts on Solana to make crypto feel like a bank account while preserving self-custody.

Why named virtual accounts matter for payments

Payments require repeatable, low‑friction flows. Named accounts help in three ways:

- Onboarding: new users expect a name or phone/email mapping, not raw keys.

- UX parity: business partners and merchants can reconcile orders against recognizable identifiers.

- Error reduction: fewer misdirected transfers means fewer customer support interventions.

But named accounts don’t magically solve custody: they are a UX wrapper. The critical distinction is whether private keys remain under the end‑user’s control (self‑custody) or are held by a service (custodial). Avici’s design intentionally keeps keys with the user, narrowing—not eliminating—the gap with traditional banking UX.

Memecoins and the retail thermostat: Pump.fun and PUMP

While UX improvements like virtual accounts smooth payments and onboarding, they also lower the activation energy for speculative behavior. Pump.fun’s recent relaunch and creator‑fee revamp coincided with a dramatic surge in Solana memecoin activity, with daily volumes reported near 30,000 transactions for certain tokens. The platform’s feature changes and the PUMP token movement illustrate how product tweaks can rapidly amplify retail throughput. See coverage of Pump.fun’s revamp here: Pump.fun revamps creator fees as Solana memecoin launches near 30,000 daily.

Memecoins thrive on three UX vectors:

- Speed: near‑instant settlement on Solana enables rapid trade and liquidity cycling.

- Simplicity: single‑click minting or swapping interfaces lower technical barriers.

- Social mechanics: discoverability, creator fees, and launch mechanisms create viral loops.

When these exist alongside bank‑like virtual accounts, the same low friction that helps retail payments also supercharges speculation. The result: higher on‑chain throughput, more frequent wallet interactions, and an increase in short‑term volume that can look like mainstream adoption but is often driven by novelty and momentum trading.

Mapping user journeys: payments versus speculative flows

Below are sketch user journeys that highlight where UX choices nudge users toward payments or towards memecoin cycles.

1) The payments-first new user

- Discovery: finds an app via merchant or friend.

- Sign up: receives a named virtual account (e.g., alice.sol/avici), links a card or on‑ramp.

- Funding: uses fiat on‑ramp to convert to SOL or stablecoin, credited to the named account.

- Payment: scans merchant QR, pays from named account; receipts and merchant settlement are straightforward.

Friction points avoided: address entry errors, custody jargon, manual reconciliation.

2) The speculative, memecoin-hunting user

- Discovery: sees a trending memecoin on Pump.fun or in social channels.

- Sign up: named virtual account lowers account creation friction; user can mint/buy quickly.

- Speculation: rapid buys/sells, cross‑swap to other memecoins, claim creator incentives.

- Exit: sells to fiat or sends to other wallets; sometimes experiences rug risks or front‑running.

This user’s journey is characterized by frequency, short holding periods, and higher tolerance for risk.

Custody tradeoffs: UX vs. control versus risk

Product teams must balance three variables: friction, custody control, and systemic risk exposure.

- Full self‑custody (high control): maximal decentralization, minimal third‑party risk, but high onboarding friction and support costs. Not ideal for mainstream payments without UX overlays.

- Custodial (low friction): seamless onboarding, easy recovery, but centralized custody introduces counterparty risk, regulatory complexity, and undermines decentralization ethos.

- Hybrid (named virtual accounts + user keys): a pragmatic compromise—better UX while preserving key ownership, but subtle implementation choices (e.g., key storage on device vs. hosted enclave) determine the true risk profile.

Named virtual accounts tilt the balance towards lower friction without fully centralizing custody, but product teams must be explicit about key management, recovery models (social recovery, seed phrases, MPC), and edge cases such as lost devices or account impersonation.

Behavioral effects: does better UX equal sustainable retail activity?

Short answer: sometimes. Better UX reduces friction and boosts throughput, but the type of activity depends on incentives and social mechanics.

- Payments: UX improvements that mirror bank flows (named accounts, instant settlement, receipts) increase the likelihood of repeated, low‑risk transactions — exactly what mainstream payments need.

- Speculation: the same improvements also lower barriers for memecoin minting and trading, accelerating speculative cycles. Features like creator fees or one‑click launch pads act as accelerants.

So UX improvement is necessary but not sufficient for