Memecoins

A data-driven breakdown of the recent weekend memecoin surge and why PEPE, PI and DOGE outperformed. Learn how whale accumulation, tokenomics and CPI-driven rotation created momentum — and how active traders should size positions and hedge risk.

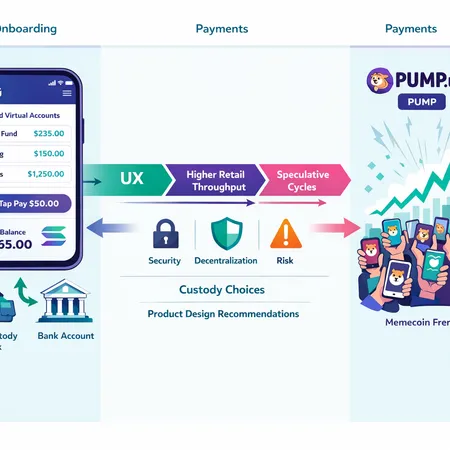

Avici’s named virtual accounts on Solana and a spike in memecoin activity are narrowing the gap between bank‑like UX and self‑custody. This report examines whether UX fixes are driving higher retail throughput and speculative cycles, and what product teams should build next.

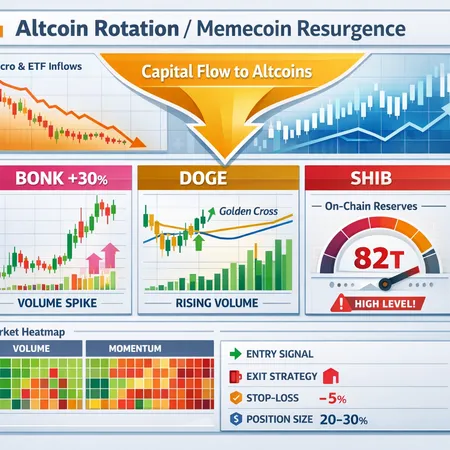

A tactical narrative on the 2026 memecoin revival: why SHIB, BONK and PEPE have run, what on-chain and social signals matter, and a practical framework for sizing, entries and exits.

A practical analysis of why BTC dominance is slipping into high‑beta altcoins and memecoins, which names are leading the move (BONK, DOGE, SHIB), and concrete rules for entry, exit, and position sizing for active traders.

Early 2026 saw a sharp memecoin comeback led by DOGE and PEPE as risk appetite returned and retail flows re-entered crypto. This guide explains the drivers, on-chain signals, historical patterns, and practical rules for sizing speculative meme positions without blowing up.

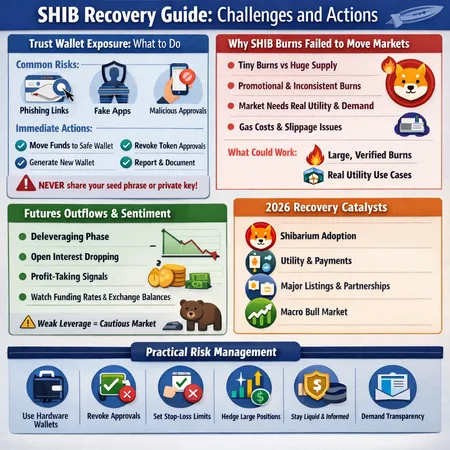

SHIB faces a mix of security and market-structure headwinds that complicate any 2026 recovery narrative. This feature breaks down the Trust Wallet exposure, recent burn data, large futures outflows, roadmap claims, and practical risk controls for holders.

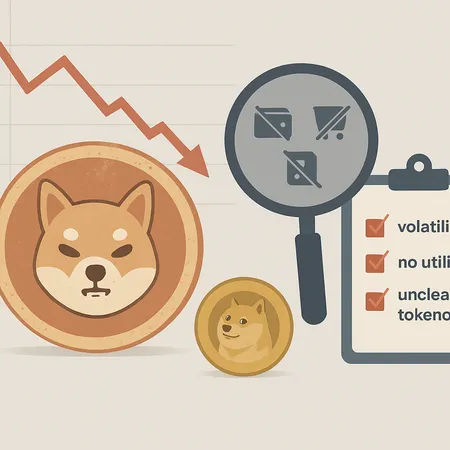

After 65–80% drawdowns across DOGE, SHIB and PEPE, memecoins sit at a crossroads. This article dissects tokenomics, technical breaks, macro drivers and a step‑by‑step framework to judge revival potential vs permanent loss.

SHIB remains far below its multi-year highs and lacks clear, widely adopted utility. This article critiques the late-2025 investment case for Shiba Inu and offers a practical risk checklist for memecoin investors.