Pakistan, WLFI and the USD1 Stablecoin: Economics, Tech, and the U.S. Political Backlash

Summary

Executive summary

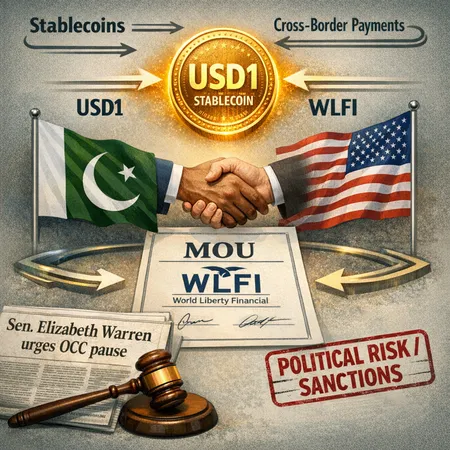

Pakistan's memorandum of understanding with World Liberty Financial (WLFI) to explore a USD-pegged stablecoin (branded in media as USD1) is a pragmatic bid to modernize cross-border payments. The economics are attractive: faster settlement, lower fees for remittances and trade finance, and an alternate FX corridor. But the project landed amid U.S. political scrutiny—Senator Elizabeth Warren asked the OCC to pause a bank-charter review tied to WLFI—raising conflict-of-interest, reputational and sanctions-related questions. This explainer decomposes the MOU, the potential benefits and frictions, technical rails, and the regulatory and political risk profile, and then sets out steps to mitigate those risks.

What the MOU with World Liberty Financial actually says

Reports from multiple outlets indicate Pakistan signed a memorandum with WLFI to explore using a USD-linked stablecoin for payments, cross-border transfers and related digital payment infrastructure. Coverage of the agreement appears in mainstream crypto press and trade reporting, outlining cooperation to assess payment use cases and potential pilots (The Block, Coinpedia, CryptoNews).

The MOU is exploratory rather than binding: it frames technical feasibility studies, pilot architecture, and potential commercial arrangements. Key open questions the MOU leaves for later stages include the legal vehicle for issuance, reserve custody, the on‑chain vs permissioned ledger choice, and compliance arrangements with FATF and OFAC-style frameworks.

Why Pakistan is considering a USD-linked stablecoin

Use cases and immediate benefits

- Remittances: Pakistan is a major remittance recipient; a USD-pegged token could reduce transfer fees and accelerate settlement times vs traditional remittance rails.

- Trade and import payments: For importers and exporters who invoice in USD, a USD1 instrument could simplify FX conversion steps and reduce float and operational lag.

- On‑ramp/off‑ramp for digital payments: A credible USD-backed medium could create new rails for merchant settlement and payroll in dollarized segments.

These are classic stablecoin use cases that payments professionals and central banks evaluate when considering private dollar tokens.

FX, reserves and monetary implications

A USD-pegged instrument means runs and convertibility pressure will fall on the issuer and any reserve banks. For Pakistan, the macro implications include:

- Reduced FX friction in dollar invoicing, but potential increased demand for USD liquidity if users redeem en masse for USD bank balances.

- If the government promotes USD1 for cross-border settlement, the central bank must assess reserve adequacy and whether to accept USD1 in official foreign-exchange operations.

- Monetary sovereignty concerns: wide adoption of a USD-pegged private token can complicate domestic monetary policy transmission if it becomes a significant payments medium.

The net effect depends on who holds the reserves, whether redemptions are on demand, and how the token interacts with capital controls and existing FX intermediation.

Technical feasibility and rails: how USD1 might be built and operated

To be operationally viable for cross-border payments, USD1 needs three clusters of capability: issuance + reserves, clearing/settlement rails, and compliance/integration.

Issuance & reserve mechanics

- Full-reserve model: USD-backed tokens redeemable at par for bank USD balances or commercial bank accounts. This is the simplest credibility model but requires a custodian bank and audited reserves.

- Synthetic or algorithmic hybrids: These carry more FX and market risk and are unlikely to win regulatory approval for sovereign-level payment use.

- Custody: Reserves should be held with regulated banks (preferably in multiple jurisdictions) and subject to regular, public audits and a legal trust/escrow framework.

Clearing and settlement rails

- Public blockchain vs permissioned ledger: A public chain eases liquidity access but raises AML/custody complexity; a permissioned ledger can embed KYC/limits but reduces interoperability.

- On/off‑ramp rails: Integration with correspondent banking, licensed money transmitters, and local RTGS systems is crucial—USD1 must not be an island token. For many real-world flows SWIFT and established correspondent relationships remain important.

- Market-making & liquidity: To avoid severe spreads, professional market makers, trusted custody, and liquidity backstops are necessary for reliable convertibility into bank USD or PKR.

Compliance, AML/CFT, and operational security

- Sanctions screening and OFAC-style lists must be embedded into on/off‑ramp partners and settlement nodes.

- KYC/CDD: Issuer and primary custodians must enforce strong identity verification and transaction monitoring.

- Technology: Multi‑sig governance, hot/cold key separation, insurance for custodial failures, and robust incident response plans are non-negotiable.

These are solvable technical problems, but they cost time and money—and the architecture chosen will determine how tolerant counterparties and correspondent banks are toward USD1.

The U.S. political and regulatory backlash: Senator Warren and the OCC review

In the wake of the Pakistan MOU, U.S. political scrutiny intensified. Senator Elizabeth Warren publicly asked the Office of the Comptroller of the Currency (OCC) to pause its review of a bank charter application tied to World Liberty Financial, citing conflict-of-interest and oversight concerns (NewsCrypto).

Why this matters:

- A U.S. bank charter or access to U.S. regulated banking services is often central to credible dollar reserves; political pushback on the charter process can stall or block the custodial rails that underpin USD-backed tokens.

- The pause request signals congressional willingness to scrutinize not only the commercial merits of stablecoins, but the political relationships and reputational exposures of issuers—heightening policy risk for sovereign partners.

Regulators take conflicts seriously because a bank charter confers trust and direct access to U.S. payments infrastructure; if a charter process appears influenced by political ties, oversight agencies may react with extra caution, which in practice can delay or derail operational timelines for a stablecoin.

Reputational, legal and sanctions risk of partnering with a politically connected firm

Even if WLFI's technical proposal is sound, the political dimension materially shifts risk calculations for Pakistan and third‑party banks.

Key risk vectors:

- Reputational contagion: Partnerships with firms publicly linked to political families invite media scrutiny and may deter international banks and counterparties wary of reputational transfer.

- Conflict-of-interest and governance risk: Regulators worry about preferential treatment or policy capture—questions that Senator Warren raised in asking the OCC to pause the review.

- Sanctions and OFAC exposure: If a partner or related individuals are subject to sanctions or become entangled in geopolitical disputes, counterparties could face secondary sanctions or de-risking by major correspondent banks.

- Loss of correspondent banking: U.S. dollar clearing depends on relationships with U.S. banks; perceptions of heightened political risk can trigger de-risking, which would frustrate the very FX and settlement benefits USD1 seeks to deliver.

From a legal standpoint, the state must ensure that contractual and governance arrangements do not vest unilateral control in opaque entities, and that there are clear remedial pathways if U.S. or international regulators take adverse action.

Practical risk mitigation: a checklist for policy analysts and payments professionals

- Full, public legal and ownership transparency: Require a detailed beneficial ownership disclosure for WLFI and any strategics tied to issuance or custody.

- Independent custody in multiple jurisdictions: Prefer regulated banks and custodians outside a single political orbit, with ring-fenced trust accounts for reserves.

- Robust audit and attestation regime: Quarterly independent attestations of reserves and monthly proofs of liabilities, with public summaries.

- Phased pilots: Start with low‑value, specific corridors (e.g., remittances from a small set of corridors) before scaling.

- Strong AML/CFT and sanctions screening: Embed OFAC/FATF-compliant controls at on/off‑ramps and require real‑time sanctions filtering.

- Clear contingency planning: Pre-negotiated fallback rails (traditional correspondent pathways), insurance, and liquidity backstops in the event of de‑banking or sanctions actions.

- Independent governance oversight: An oversight board including independent international payments and legal experts, with veto rights over reserve movements.

These measures increase credibility and reduce the chance that political concerns cause operational failure.

Scenarios and potential outcomes

- Best case: WLFI and Pakistan deliver a transparent pilot with independent custody, strong AML controls and audited reserves; correspondent banks remain engaged, and USD1 improves remittance costs without threatening monetary stability.

- Middle case: Technical pilots work but U.S. political scrutiny slows bank charters and correspondent integration, causing delays and higher operational costs; adoption remains limited to niche corridors.

- Worst case: Political controversy triggers a de-banking cascade for WLFI or its custodians, sanctions risk materializes, and Pakistan faces disruption to FX corridors rather than relief.

Recommendations for decision-makers

- Treat the MOU as a feasibility step, not a deployment commitment. Public procurement and contracting standards should apply.

- Insist on diversified custody and counterparty risk reduction before any widespread rollout.

- Engage multilateral institutions (IMF, World Bank) and FATF channels to ensure compliance with global AML/CFT and macroprudential advice.

- Prepare communication and reputational playbooks that transparently present governance, reserve mechanics and independent audits to reassure correspondent banks and markets.

Payments professionals should evaluate integration costs with existing rails (SWIFT, RTGS), the realistic market‑making requirements for tight spreads, and the operational expense of continuous sanctions screening.

Closing thoughts

Private USD-linked stablecoins can deliver real efficiency gains for remittances and trade—but they are not a panacea. The WLFI–Pakistan story is an illustrative case where technical feasibility collides with geopolitics. If Pakistan and WLFI move forward, success will depend less on clever token engineering and more on legally robust reserve arrangements, transparent governance, independent oversight, and the ability to weather political scrutiny in major correspondent jurisdictions.

For practitioners watching similar deals, the lesson is plain: payments innovation must be married to conservative compliance, diversified custody, and contingency planning. Platforms and services across the crypto market, including consumer-facing solutions like Bitlet.app, show how compliance-minded design helps projects scale—political risk, however, demands an equally rigorous and public governance posture.

Sources

- https://thenewscrypto.com/us-senator-elizabeth-warren-questions-occ-review-of-world-liberty-financial-application/?utm_source=snapi

- https://www.theblock.co/post/385513/pakistan-signs-mou-usd1-stablecoin

- https://coinpedia.org/news/pakistan-partners-with-world-liberty-financial-wlf-for-usd-linked-stablecoin/

- https://cryptonews.com/news/pakistan-wlfi-sign-agreement-for-stablecoin-payments/

(Internal topics referenced for context: Stablecoins and DeFi.)