Ripple's 2026 U.K. Push: FCA Approval, XRP ETFs, and Institutional Cross‑Border Liquidity

Summary

Executive snapshot

FCA approval in 2026 marks a watershed for Ripple’s U.K. strategy: it authorises Ripple to operate a regulated payments system for institutions, creating a clearer compliance path for banks and fintechs to use XRPL rails and XRP for settlement. At the same time, large spot ETF inflows into XRP have drawn institutional capital and tightened bid/ask spreads, improving price discovery and short‑term liquidity. But these positives come with caveats—ETF dynamics, stablecoin supply on XRPL (notably RLUSD), and remaining regulatory ambiguities mean pilots must be designed with explicit risk controls.

What the FCA approval actually covers and why it matters

The FCA approval allows Ripple to run a regulated payments system in the U.K., which is materially different from a generic statement of regulatory friendliness. Practically, it gives institutional counterparties a clearer legal and operational framework to connect to Ripple’s payments platform and to settle across XRP‑enabled rails under U.K. oversight (Coinpaper, Bitcoinist).

For payments teams this does three things:

- Reduces the compliance uncertainty of using a third‑party crypto payments operator in the U.K., shortening legal onboarding timelines.

- Provides a defined supervisory touchpoint for dispute, AML controls, and operational resilience expectations.

- Signals to correspondent banks and treasury desks that XRP settlement can be integrated via a regulated entity rather than purely via offshore, unregulated providers.

That said, FCA approval is jurisdictional: it streamlines adoption inside the U.K. but does not automatically immunise counterparties from cross‑border regulatory questions in beneficiary jurisdictions.

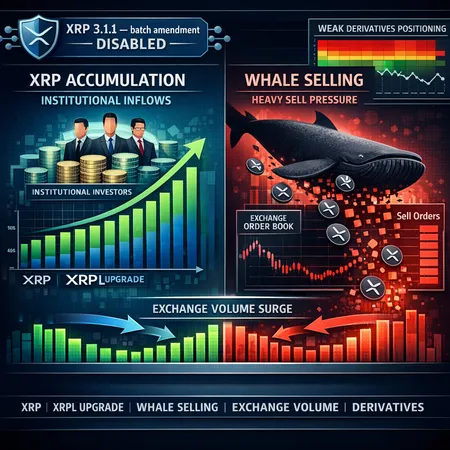

How XRP spot ETF inflows reshape institutional liquidity and price discovery

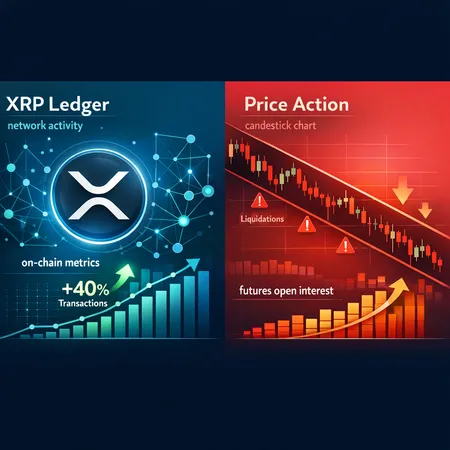

Throughout 2026, spot XRP ETFs have been a major conduit for institutional capital into the token. Large inflows provide several tangible benefits to payment corridors:

- Deeper order books and tighter spreads. ETF purchases create predictable demand layers that reduce slippage for on‑chain market makers and algorithmic liquidity providers.

- Improved price reference points. ETFs centralise custody and trading activity on regulated exchanges, helping treasury desks use ETF price data for mark‑to‑market and hedging decisions.

- On‑ramps for institutional funds. For many institutions constrained by custody rules, ETFs are a compliant exposure path—this expands the pool of counterparties willing to hold or trade XRP.

Quantitative reporting in 2026 points to meaningful ETF inflows, and market commentary links those flows to stronger institutional sentiment and tightening volatility for XRP CryptoNews. For a payments operation, that translates into lower expected transaction cost when sourcing XRP for settlement and a more consistent cost basis for liquidity provisioning.

ETF competition and withdrawal dynamics: a mixed signal

ETF windows are not a one‑way bet. Competitive dynamics matter. The high‑profile withdrawal of WisdomTree’s planned U.S. XRP ETF filing is a reminder that issuers re‑optimise to regulatory and market realities—withdrawals can throttle potential demand and temporarily compress on‑chain liquidity as market makers reassess exposure (CryptoBriefing).

For institutions: plan liquidity buffers and avoid assuming perpetual, uninterrupted ETF demand. Instead, use ETF flows as a favorable backdrop while stress‑testing corridors for episodes of ETF pause or divestment.

RLUSD, stablecoin supply on XRPL, and corridor mechanics

Stablecoins on XRPL—particularly RLUSD—are expanding as on‑chain working capital. Increasing RLUSD supply can be a force multiplier for intra‑corridor settlement, because stablecoins reduce the need to convert to volatile crypto during multi‑leg transfers (TheNewsCrypto). That said, higher stablecoin supply interacts with XRP liquidity in three ways:

- Substitution effect. Where stablecoins suffice for a corridor’s settlement needs, demand for XRP as a settlement asset could be muted.

- Liquidity layering. Large RLUSD pools can improve settlement velocity if issuers and custodians provide reliable redemption and rails between RLUSD and fiat.

- Concentration risk. If a few issuers control most RLUSD supply, their governance, reserve practices, or downtimes become systemically important for corridor reliability.

Payments architects should therefore model hybrid flows: XRP for rapid, on‑demand liquidity in FX‑sensitive legs; RLUSD or other stablecoins for value‑preservation legs where volatility is unacceptable.

Practical implications for U.K. banks and payment corridors

If you’re evaluating an XRP pilot in 2026, treat FCA approval as the starting gun for legal and operational design, not the finish line. Key actions and considerations:

- Legal and compliance integration. Update onboarding playbooks to reflect a regulated operator relationship; adjust KYC/AML, sanctions screening, and transaction monitoring to incorporate XRPL‑native activity.

- Custody and settlement windows. Decide whether to custody XRP directly, use ETF exposure for treasury allocation, or rely on regulated custodians that integrate with Ripple’s platform. ETF liquidity can reduce execution costs, but custody choices affect counterparty and operational risk.

- Liquidity sourcing strategy. Combine order‑book liquidity (exchanges, OTC desks) with dedicated market‑making and strategic ETF‑sourced allocation. Expect narrower spreads during ETF inflows, and wider ones if ETF demand retreats.

- Corridor design. For high‑value or time‑sensitive corridors, incorporate fallback rails (nostro/vostro fiat, other stablecoins) to ensure settlement continuity if XRPL liquidity becomes strained.

Also consider the competitive signalling: for many treasuries, the FCA decision plus ETF flows makes a short proof‑of‑concept credible—this is a good moment to run low‑risk pilots that instrument settlement cost, speed, and reconciliation mechanics.

Regulatory and product risks to monitor

Adoption is conditional on a moving regulatory landscape and product nuance. The principal risks:

- Cross‑jurisdictional uncertainty. FCA approval is U.K.‑focused; counterparties in other regimes may still face ambiguous treatment of XRP and XRPL instruments.

- Stablecoin operational risk. Rapid RLUSD growth can concentrate redemption and reserve risk. Examine issuer proofs, reserve audits, and redemption latency before relying on large stablecoin pools (TheNewsCrypto).

- ETF fragility and market structure shifts. Issuers may tweak filings, delay launches, or withdraw proposals—as WisdomTree demonstrated—affecting anticipated institutional demand (CryptoBriefing).

- Operational resilience and settlement finality. XRPL is fast, but integration points (custody providers, on‑/off ramps, fiat rails) are the common failure modes. Design SLRs (service level requirements) and fallbacks accordingly.

Practical pilot checklist for payments execs and institutional strategists

- Define narrow objectives: cost reduction per transaction, settlement time improvement, or corridor availability metrics.

- Run a parallel rails experiment: process a small percentage of flows over XRPL while maintaining fiat fallback rails.

- Contractually require transparency from stablecoin issuers (reserve attestations, redemption SLAs).

- Stress‑test for ETF withdrawal scenarios: model liquidity impact if large ETF buyers exit over 48–72 hours.

- Coordinate with compliance: map transaction monitoring to include XRPL addresses and ETF custody movements.

These steps keep pilots pragmatic and measurable rather than speculative.

Conclusion: an opportunistic but cautious path forward

The convergence of FCA approval and meaningful spot ETF inflows in 2026 materially improves the institutional case for pilot deployments of XRP‑enabled corridors in the U.K. Together they reduce legal friction and supply more predictable liquidity. However, the landscape remains conditional: stablecoin concentration risks (RLUSD), potential ETF filing shifts, and cross‑border regulatory gaps all demand disciplined pilot design and thorough contingency planning.

For payments executives and crypto strategists, the right posture is triangular: move quickly to test and instrument real flows, but build conservative fallbacks and rigorous monitoring into production roadmaps. The market environment today—bolstered by ETF demand and a formal U.K. regulatory anchor—creates a rare window to test whether XRP can deliver measurable improvements in speed, cost, and liquidity for institutional cross‑border payments.

Bitlet.app users and platform teams will find these considerations directly applicable when sizing pilots or integrating XRPL settlement options into existing payment stacks.

Sources

- "UK opens the gates — Ripple secures FCA approval unlocking XRP payments for institutions," Coinpaper: https://coinpaper.com/13649/uk-opens-the-gates-ripple-secures-fca-approval-unlocking-xrp-payments-for-institutions?utm_source=snapi

- "Ripple FCA approval on XRP," Bitcoinist: https://bitcoinist.com/ripple-fca-approval-on-xrp/

- "XRP price forecast: $1.22B ETF inflows flip market sentiment as breakout looms," CryptoNews: https://cryptonews.com/news/xrp-price-forecast-1-22b-etf-inflows-flip-market-sentiment-as-breakout-looms/

- "WisdomTree XRP ETF withdrawal filing," CryptoBriefing: https://cryptobriefing.com/wisdomtree-xrp-etf-withdrawal-filing/

- "XRP dips 15% as stablecoin supply on XRPL surges," TheNewsCrypto: https://thenewscrypto.com/xrp-dips-15-as-stablecoin-supply-on-xrpl-surges/?utm_source=snapi

For market context, institutional traders often compare liquidity depth in crypto assets to legacy safe havens such as Bitcoin or liquidity provisioning techniques developed in DeFi ecosystems—both useful comparators when benchmarking XRP corridor performance.