Uniswap

The recent dismissal of the amended class action against Uniswap and the Aave Chan Initiative's exit together highlight how legal outcomes and delegate dynamics shape DeFi governance risk. Builders and governance teams should rethink developer protections, delegation models, and on‑chain safety nets to reduce protocol risk.

A practical guide for DeFi users, community managers, and security teams on defending against fake ads and phishing, dissecting recent Uniswap-targeted scams and confusing breach claims like the IoTeX kerfuffle.

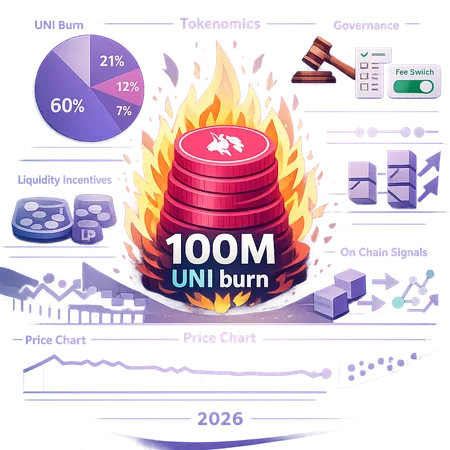

Uniswap’s decision to burn 100 million UNI was significant on paper but produced a muted market response. This explainer unpacks the burn mechanics, governance context around the fee switch, on‑chain signals, and how investors should treat similar supply‑reduction moves in 2026.

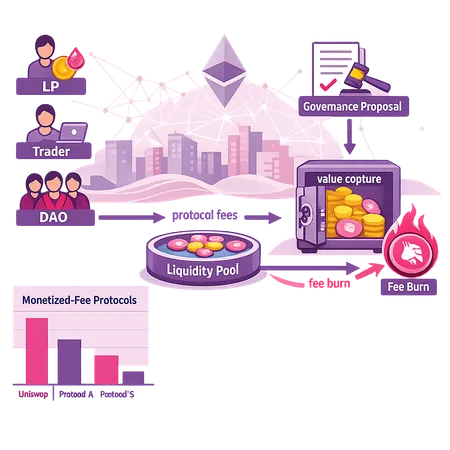

Uniswap’s governance push to enable protocol fees and use proceeds to reduce UNI supply is a pivotal tokenomics experiment. This guide breaks down the proposal specifics, how fee flows would affect LP economics and governance revenue, and plausible market outcomes.

Uniswap’s community has activated protocol fees and executed a large UNI token burn — a shift that could reshape token economics, LP incentives, and how DeFi protocols capture value. This explainer breaks down what happened, the immediate UNI price reaction, and the longer-term governance and market implications.

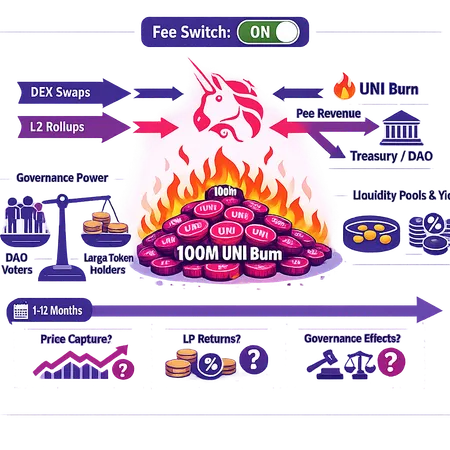

Uniswap’s DAO approved a $100M UNI burn and activated the long‑dormant fee switch, shifting UNI toward a revenue‑capture role. This article dissects what that means for governance, token value capture, L2 strategies, and LP decisions over the next 12 months.

A practical deep dive into Uniswap’s UNIfication governance decision, the planned $100M UNI burn, and how the new revenue-linked burning mechanism reshapes tokenomics and market dynamics.

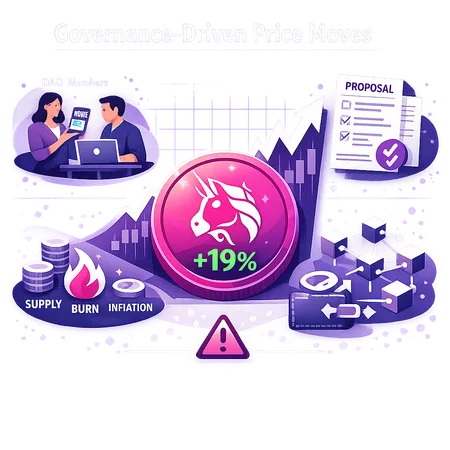

Uniswap’s recent 19% UNI surge shows how DAO voting can rapidly reprice tokens when tokenomics or treasury changes are on the table. This piece unpacks the proposal that triggered the move, how on-chain voting translates into price action, where the risks lie, and a practical playbook for traders and DAOs.

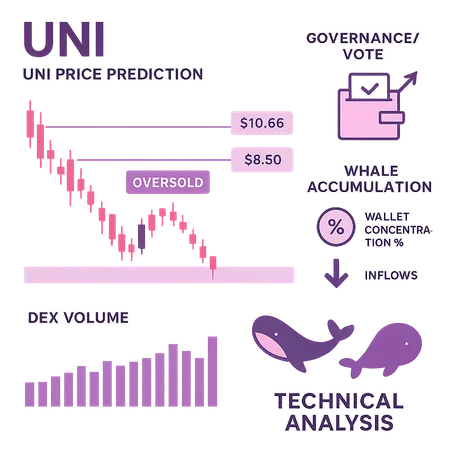

A focused, evidence‑based UNI trade thesis: oversold technicals, whale accumulation and improving DEX volume together open an $8.50–$10.66 recovery window — here’s the setup, on‑chain context, and a practical risk plan for intermediate traders.

Uniswap's integration with Solana marks a significant milestone in DeFi, promising improved liquidity and a smoother user experience. This partnership leverages Solana's high-speed blockchain, benefiting traders and liquidity providers alike. Platforms like Bitlet.app complement these advancements by offering crypto installment services, enabling users to buy cryptocurrencies now and pay monthly, making DeFi more accessible.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility