Solana Pullback: Durable Top or Buy‑the‑Dip? RWA Tokenization vs Falling DEX Volume

Summary

Market snapshot: rejection, context, and why this matters

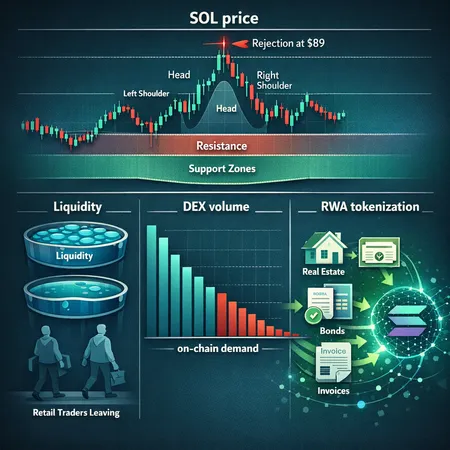

Over the past 24 hours SOL price experienced a notable rejection near the ~$89 area after failing to clear resistance, a move that came alongside a measurable decline in DEX volume. That combination—price frustration at a prior pivot plus fading on‑chain exchange activity—raises two immediate questions for market participants: is this a durable top born of structural weakness, or a buy‑the‑dip setup where lower prices simply shake out weak hands?

The short answer: both narratives carry weight. The technical picture points to vulnerability; the on‑chain flow picture shows less speculative demand. But beneath both, an emerging cohort of institutional flows via RWA tokenization could change the balance between transient speculation and enduring on‑chain demand.

Technical structure: head & shoulders, key bands, and the $89 rejection

Several technical analysts have flagged a head‑and‑shoulders pattern on intermediate timeframes, a classic topology that increases the odds of a meaningful downside if the neckline gives way. While chart interpretations differ, the setup implies that failure to reclaim the recent highs keeps lower support bands (and deeper percentage retracements) in play. CoinPaper discusses this pattern and notes upside targets around $114.35 still exist in some scenarios even as downside risks are flagged, which underscores the market's bifurcated potential.Solana charts flag head‑and‑shoulders and support risk

The ~ $89 rejection matters because it was a near‑term supply zone where buyers previously showed interest. A quick retest and successful reclaim would signal that the sell‑off was corrective. But a sustained rejection with rising selling volume would increase the probability that larger structural support levels are revisited. For traders, watch the behavior around that band: tight consolidation and a volume pickup on green candles favors a bounce; widening range and falling DEX liquidity favors the downside.

What ‘support bands’ mean here

Think in bands, not single lines: short‑term intraday supports, multi‑week structural supports, and longer‑term macro troughs. Some analyses highlight material downside risk quantitatively (mid‑range supports and deeper retracements), so treat stops and position size with that in mind rather than assuming a one‑line floor.

Falling DEX volume: why it’s more than noise

Decentralized exchange (DEX) volume is a leading on‑chain signal for retail activity and speculative flow. Recent reports show a meaningful drop in Solana DEX volume as price struggled at resistance—a combination that often precedes volatility or consolidations driven by thinner liquidity. BeinCrypto's analysis emphasizes how DEX volume decline accompanied the price pressure, which implies fewer traders interacting on‑chain and less immediate natural buying pressure from retail market makers.Analysis of Solana price under pressure and DEX volume decline

What does this signal in practical terms? Lower DEX volume can mean:

- Reduced retail flow and inventory rotation, which makes price moves sharper because liquidity is thinner.

- Potential concentration of activity in centralized venues instead of on‑chain, so on‑chain metrics understate total market engagement.

- A stress test for TVL‑linked mechanics—if users withdraw assets or reduce swap activity, protocols that rely on fees or active liquidity provisioning can see revenue and incentive pressure.

DEX volume alone isn't a death knell, but paired with price weakness it increases the chance that stops cascade and liquidity gaps widen. That makes it a critical variable when deciding whether to buy the dip.

RWA tokenization on Solana: scale and characteristics

Meanwhile, Solana has been active in the real‑world asset (RWA) tokenization narrative. Recent coverage shows RWA tokenization value on Solana reaching a record level—on the order of $1.66 billion—suggesting institutional demand for tokenized assets is not hypothetical but growing in scale and frequency.Solana RWA tokenization growth and the $1.66B record

How do RWA flows differ from retail DEX volume?

- Institutional flows tend to be larger ticket, longer‑duration, and often involve locked or escrowed liquidity, which supports a more predictable demand profile for the underlying chain.

- RWA issuers and buyers may source SOL for staking, fee payments, or collateral, creating sustained on‑chain demand rather than one‑off speculative trades.

- However, RWA demand is contingent on legal, custody, and compliance frameworks; regulatory hiccups or tokenization model changes can slow issuance abruptly.

So while RWA flows can be stabilizing, they are not an instant replacement for speculative DEX activity—and they may take time to translate into meaningful spot demand for SOL.

Can RWA issuance offset speculative declines? A balanced assessment

RWA tokenization is a structural positive: it creates longer‑dated demand profiles, ties capital to on‑chain primitives, and diversifies who needs SOL. But there are limits and lags.

- Scale: the headline $1.66B milestone is meaningful, yet the crypto spot market and speculative velocity are still much larger in aggregate. RWA flows will need sustained growth to materially re‑rate SOL price solely on institutional demand.

- Mechanics: RWA strategies often involve stablecoin rails, custody wrappers, or yield marketplaces; they may increase protocol TVL without requiring immediate market purchases of SOL.

- Timing: institutional allocations are slow and subject to approvals. If DEX volume collapses quickly, RWA flows are unlikely to close that gap within days or weeks.

In short: RWA issuance can help offset speculative declines over months, but it is unlikely to prevent short‑term price stress driven by evaporating DEX liquidity and technical breakdowns.

Scenario analysis — what to expect and how to act

For traders: best, base, worst cases

Best case (buy‑the‑dip setup): SOL holds above the lower structural band, DEX volume stabilizes or rebounds, and price reclaims $89 with conviction. Look for improvement in on‑chain swap volume, fewer large outflows from liquidity pools, and supportive order‑book depth on centralized venues. Tactical approach: stagger buys (DCA), use tight risk controls, and target a favorable risk/reward toward previous resistance levels.

Base case (prolonged consolidation): Price drifts lower into multi‑week support bands as DEX volume remains muted. RWA issuance grows but accumulates gradually. Traders should reduce leverage, trim size, and treat rallies as opportunities to exit or rebalance rather than assume a durable breakout.

Worst case (structural top): Neckline of a head‑and‑shoulders fails, DEX liquidity thins further, and stop cascades push SOL into deeper support zones identified by technical scans. In this scenario, aggressive buyers can be trapped. Defensive approach: preserve capital, widen stops only if part of a disciplined plan, and watch for institutional re‑entry signals rather than bottom‑picking purely on price.

For builders and DeFi teams

Best case: RWA pipelines mature, protocols lock assets in tokenized forms that need Solana‑native rails, increasing TVL and fee revenue. Builders lean into composability and integrate tokenized asset flows with lending, collateral, and settlement primitives.

Base case: RWA adds incremental TVL and long‑duration liquidity but is insufficient to replace retail swap revenue. Builders should diversify revenue streams—fees, subscription models, or institutional integrations—and design incentives that don’t rely exclusively on ephemeral DEX volume.

Worst case: RWA issuance slows due to legal/regulatory friction, while retail volume migration causes short‑term liquidity drains. Builders should maintain runway, keep incentives adaptive, and prioritize capital efficiency over growth for growth's sake.

Practical watchlist: metrics and triggers to monitor

- DEX volume trend and active liquidity (not just TVL): a sustained uptick in swaps per day signals returning retail engagement.

- Behavior at key price bands (the $89 area and the multi‑week supports noted by technical scans): reclaim with volume is constructive; rejection with thinning volume is not.

- RWA issuance cadence and the nature of tokenized assets: are funds locking on‑chain or moving off‑chain custody models? Higher locked‑duration supply is more bullish.

- Large transfers and concentration: watch for big SOL movements to exchanges or to cold storage—both can precede price moves.

- Protocol health: TVL across lending, AMMs, and staking markets—falling TVL across the board is a red flag.

For traders using installment or recurring buy strategies, platforms like Bitlet.app can help dollar‑cost average exposure in volatile markets without requiring precise timing. Use such tools as part of a broader risk framework rather than a substitute for stops and sizing discipline.

Conclusion

Solana's 24‑hour rejection near $89 and falling DEX volume are meaningful signals that increase short‑term downside risk. Technical patterns—such as the head‑and‑shoulders topology noted by market analysts—add a structural edge to that concern. At the same time, RWA tokenization on Solana represents a material, structural buyer that could support on‑chain demand over the medium term, but it is unlikely to instantly replace evaporating retail flows.

For traders: treat the current environment as high‑risk, favor position sizing and staged entries, and look for confirmation in both price and on‑chain volume before assuming a durable bottom. For builders: accelerate product hooks to RWA flows, but safeguard against episodic liquidity shortfalls by diversifying revenue and incentives.

Ultimately, RWA issuance improves Solana's narrative but does not negate the need to respect market structure and liquidity realities in the near term. Watch the interplay between DEX volume, price behavior around the $89 pivot, and the cadence of institutional tokenization—those three variables will tell you whether this is a lasting top or a time to accumulate with discipline.