Price Discovery

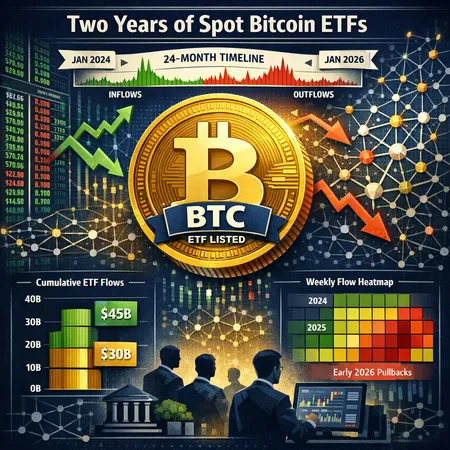

U.S. spot Bitcoin ETFs show roughly $53B in cumulative net inflows even as funds experienced meaningful short‑term outflows. This article explains the chronology, ETF mechanics, and practical sizing rules for portfolio managers and swing traders navigating ETF‑driven liquidity events.

A data-driven assessment of how two years of spot Bitcoin ETFs changed market structure, liquidity and institutional allocation decisions. We parse adoption versus gold, recent outflows in early 2026, on-chain effects, and scenarios portfolio managers should model.

A deep dive into the recent streak of spot‑XRP ETF inflows, how Cboe approval of 21Shares XR ticker channels demand, and scenario analysis for $5B–$10B in ETF assets on liquidity, price discovery and on‑chain activity.

A deep-dive into how 506 million XRP absorbed by ETFs, Bitwise’s Bitwise 10 listing, and a >$1B slide in exchange reserves are reshaping supply dynamics and the path to price discovery. Practical scenarios for $2–$10 outcomes into 2026 for asset managers and retail investors.