Volatility

DOGE fell ~10% in a one‑day selloff, testing the psychological $0.10 support even as social chatter spiked in mid‑February. This piece weighs technical stress against renewed narrative momentum and offers a practical trading framework for speculative retail positions.

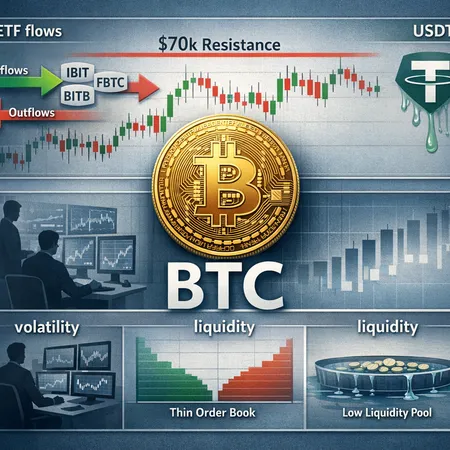

Despite steady spot-BTC ETF demand that almost erased last week’s outflows, Bitcoin remains unusually volatile. This piece parses ETF flow data, technical pressure around $69k–$70k, institutional narratives, and how stablecoin and exchange liquidity amplify swings.

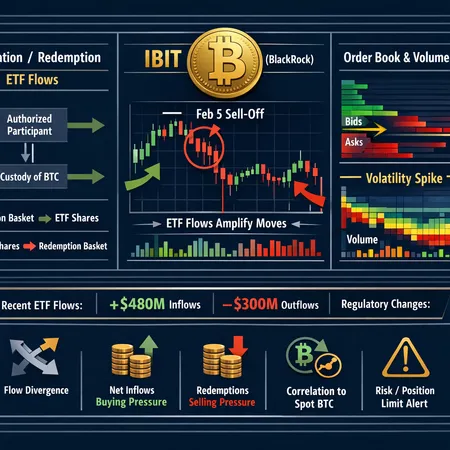

Spot Bitcoin ETFs, especially large products like BlackRock's IBIT, have become a dominant liquidity conduit that can amplify intraday moves through creation/redemption mechanics. This explainer gives intermediate traders and portfolio managers an actionable framework to read ETF-driven BTC price moves.

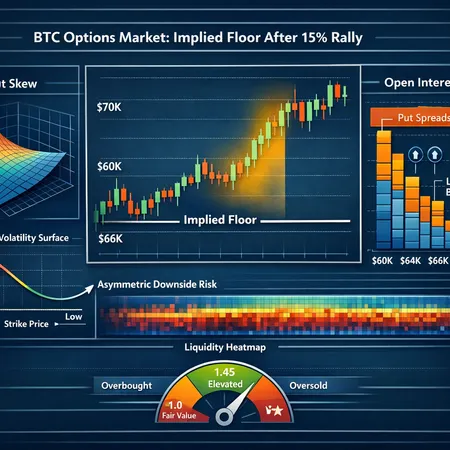

After BTC’s sudden 15% jump to ~70k, options markets are carving out an implied ‘floor’ via put skew, concentrated open interest and dealer hedging flows. This piece explains how to read that signal, combine it with Mayer Multiple and liquidity heatmaps, and translate it into actionable hedges for desks and advanced retail traders.

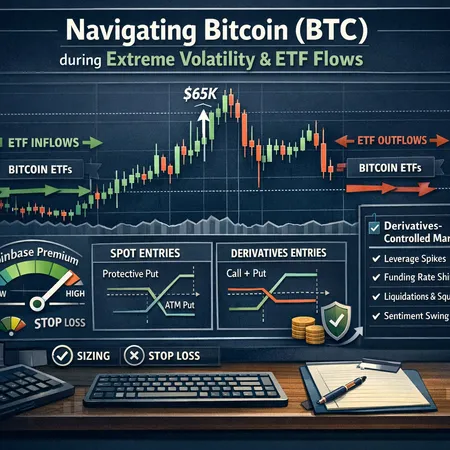

Practical rules, setups and risk controls for trading BTC when ETF flows and derivatives dominate price action. Learn how to read ETF and Coinbase premium signals, size trades in high volatility, use options hedges, and trade whipsaws effectively.

A tactical guide for active traders and PMs to convert the Feb 2 liquidation event into repeatable risk rules. Learn the anatomy of the crash, how exchange and corporate moves change liquidity, derivative signals to watch, and five concrete risk-management playbooks.

January’s sell‑off was not just spot panic — options flow and concentrated monthly expiries amplified squeezes and liquidations. This guide explains the Deribit positioning that signaled bearish hedging, the expiry mechanics that create squeezes, the metrics to watch, and practical hedging tactics for options traders and risk managers.

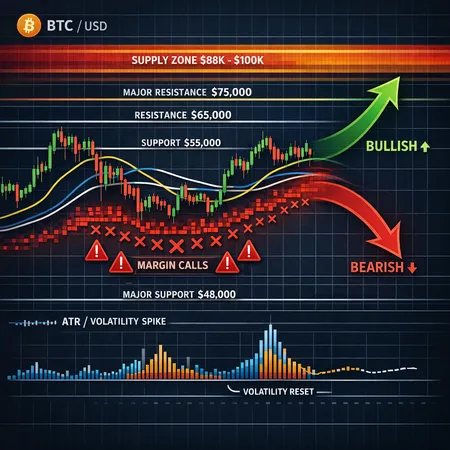

Bitcoin shows fresh signs of fragility: a concentrated invested supply above ~$88k, short-term holder pain, and technical cracks that could trigger a leverage unwind. This article maps the on-chain risks, the technical triggers, and a scenario-driven playbook for traders and allocators.

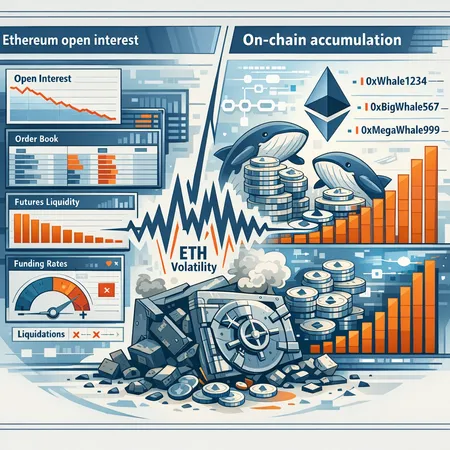

Ethereum’s on-exchange open interest has slipped even as on-chain whale accumulation picks up. This piece reconciles those signals, explains the mechanics (funding rates, liquidations, treasury moves like Ethzilla), and gives a trader’s checklist for risk and entries.

Exchange-level pruning, stalling USDT minting and ETF outflows are converging to tighten on-exchange liquidity and raise execution risk. Traders and market makers must adapt hedges, routing and risk controls to navigate amplified volatility.