Market Analysis

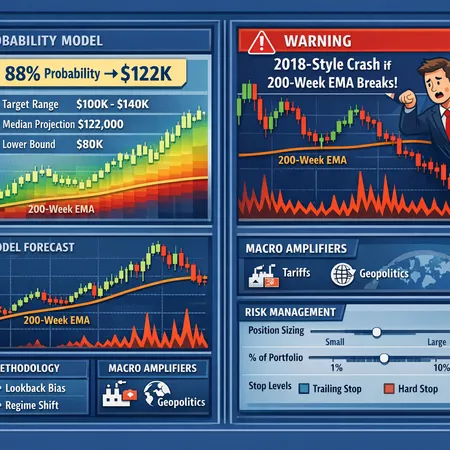

Two dominant narratives clash: statistical price models flagging an 88% chance of higher BTC vs technicians warning a 2018‑style crash if the 200‑week EMA breaks. This guide explains the methodologies, limitations, macro tail risks, and a practical framework for traders to size and manage exposure.

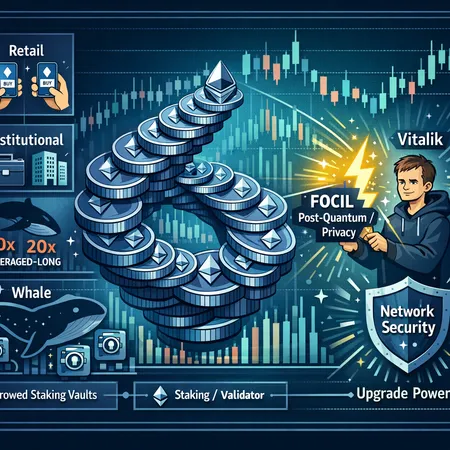

Despite a weak ETH price, on‑chain data shows record accumulation — a potentially bullish fractal that hides nuance around who’s buying and why. This deep dive parses the signal, staking concentration risks, and how Vitalik’s bolt‑on upgrade push could reshape the 2026 narrative.

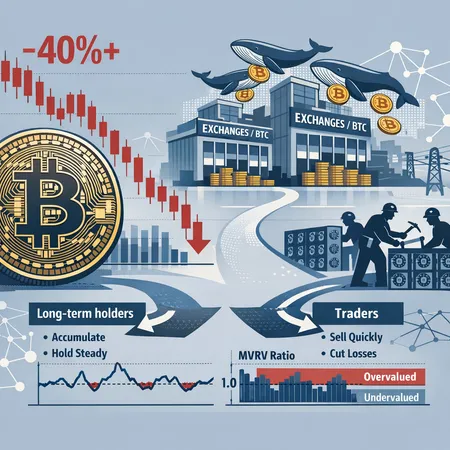

After a rapid 40%+ decline in BTC prices, investors must separate a tactical bounce from structural capitulation. This article analyzes the timeline, on-chain signals, whale selling and exchange inflows, miner and treasury implications, and concrete rules for positioning.

Bitcoin plunged roughly 15% from $98k to the low $80ks after a confluence of shrinking dollar liquidity, Fed‑chair chatter and a leverage/derivatives unwind. This article breaks down the drivers, key support levels ($84k, $75k), scenario mapping and practical trade and risk‑management ideas for spot and derivatives traders.

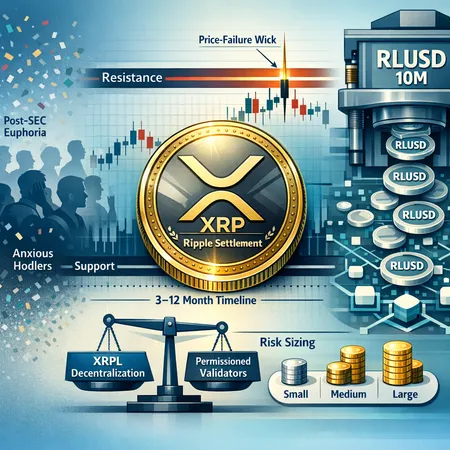

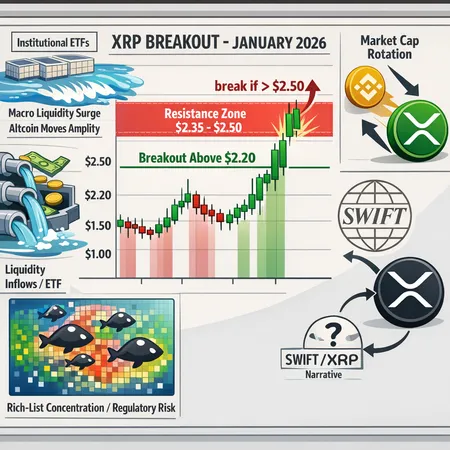

A focused microstructure review of XRP that unpacks exchange concentration, a 52% 24‑hour volume crash, and how bullish retail odds fit with on‑chain risks. Practical, risk‑managed trade ideas and watchlist levels aligned with recent price forecasts are provided for active traders.

Ripple’s SEC settlement kicked off a rally — then the air leaked out. New on‑ledger activity like 10M RLUSD minted gives the XRPL a fresh narrative, but technical weakness and decentralization debates mean risk sizing matters more than ever.

A comprehensive, on‑chain and legal synthesis of XRP's market structure after the SEC vs Ripple closure and ahead of the Feb 1, 2026 1B XRP escrow unlock. Actionable scenarios and risk controls for active traders and long‑term holders.

XRP’s sudden push above $2.20 in January 2026 was driven by large single‑day inflows, market‑cap rotation and renewed narratives around SWIFT integration. This deep dive unpacks on‑chain drivers, critical resistance levels near $2.35–$2.50, and how concentration on the rich list shapes risk.

A unified roadmap for BTC into 2026 that synthesizes spot‑ETF flows, on‑chain holder behavior, and macro variables to produce scenario-based BTC price guidance and tactical positioning. Designed for intermediate investors and portfolio managers.

A recent uptick in NFT sales — including a 45% spike in Ethereum NFT volume — sits alongside notable ETH exchange outflows and growing wallet counts. This article explains how those flows and holder distribution metrics could turn NFTs into a meaningful demand sink for ETH.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility