Why Ethereum’s Record On‑Chain Accumulation Matters for the 2026 Cycle

Summary

Executive overview

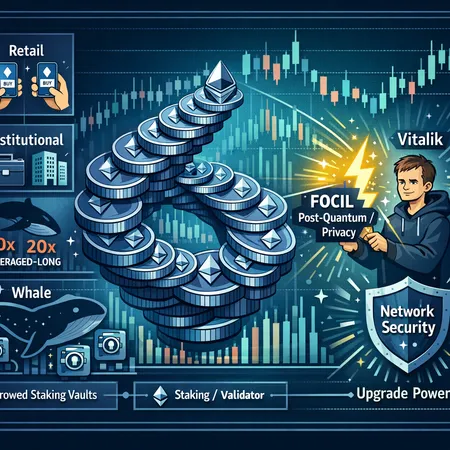

On‑chain data now points to what analysts call a fractal accumulation pattern for ETH: sustained inflows into long‑term addresses and staking contracts even while price trades sideways or declines. That pattern—reported recently as record accumulation—is a contrarian signal that often precedes a major cycle pivot, but it’s not automatically bullish. The profile of who is accumulating (retail holders, institutional buyers, or custodial/'paper' staking providers) and the distribution of those holdings matter for how that accumulation translates into price in the 2026 cycle.

This article breaks the fractal signal down, compares current monthly structure to prior cycles, evaluates the quality of accumulation, examines concentration and whale risks, and explains how Vitalik Buterin’s push for bolt‑on, cypherpunk‑aligned upgrades (FOCIL, privacy, post‑quantum readiness) could reshape Ethereum’s fundamentals and market psychology ahead of 2026. For traders and long‑term holders this is about actionable context: where are the real risks, and where lies asymmetric upside? Platforms such as Bitlet.app make access to staking and P2P liquidity simpler, but the macro on‑chain mechanics remain the key to timing and sizing.

What the ‘fractal’ accumulation signal means—and why it matters

A fractal accumulation signal is less a single metric and more a recurring pattern: persistent net inflows into non‑exchange wallets, declining exchange balances, rising deposits into staking and custody, and longer average holding periods across cohorts. The recent reporting of "record accumulation" points to exactly that combination—on‑chain behavior that echoes past pre‑bull phases even while price momentum is weak (Coinpaper report).

Why does it matter? Liquidity begets price stability. If a significant portion of supply moves off exchanges and into illiquid hands (long‑term cold storage, active validators, or locking via liquid staking providers), the available float for sellers shrinks. Historically, when supply tightens while macro liquidity remains constant, price can amplify to the upside once demand returns. The fractal analogy specifically highlights that accumulation is repeating at multiple timeframes (daily, weekly, monthly) the way it did in prior cycles.

However, not all accumulation is created equal. A growth in derivative or custody exposures (i.e., 'paper' staking or wrapped claims) behaves differently from an increase in active validators. That distinction controls tail‑risk and the speed at which on‑chain accumulation converts into a supply squeeze.

Monthly structure today vs prior cycles: similarities and differences

Comparing monthly charts of on‑chain behavior across cycles provides perspective. In earlier cycles (2015–2017 and 2019–2021), accumulation typically followed a clear pattern: a long accumulation base, subtle on‑chain movement (decline in exchange balances), then a compression of volatility preceding a breakout. Today’s monthly structure shows familiar elements—lengthened accumulation phases, lower volatility in spot markets and steady staking growth—but with a few differences:

- Timeline compression: Market narratives move faster today; accumulation phases can compress as algorithmic trading and liquid staking create new pathways for capital deployment.

- Higher staking share: A larger share of ETH supply is now staked or held by custody services compared with earlier cycles, which changes liquidity dynamics.

- Fragmented custody vs active stake: Liquid staking tokens and custodial solutions create apparent accumulation that may still be economically liquid through derivatives; that complicates the naive reading of supply reduction.

These differences mean the current fractal feels like prior pre‑bull phases but with higher complexity. The accumulation is there, but the translation to price depends on who is truly taking supply out of circulation.

Who is doing the buying: retail, institutions, or ‘paper’ staking?

Parsing the buyer profile is crucial:

Retail and long‑term holders: On‑chain metrics such as rising long‑term holder cohorts, increased UTXO‑like age for ETH (balance aging), and declining exchange inventories typically indicate retail and private accumulation. These cohorts are traditionally high conviction and low turnover.

Institutions: We’ve seen concrete institutional purchases—public examples include large posturing by funds and miners increasing allocation—illustrating real sovereign‑class demand that can hold through cycles. For instance, recent reporting highlighted BitMine/Tom Lee‑linked purchasing activity adding tens of millions of dollars to long institutional positions, a sign that macro buyers are willing to dollar‑cost‑average into weakness (CoinGape coverage). Institutional accumulation tends to be sticky but can create concentrated pressure points if large players change strategy.

‘Paper’ staking and custodial deposits: This is the murkiest bucket. Reports suggest that headline numbers claiming 50% of ETH is “staked” mask the fact that only roughly 31% is in active validator participation, with the remainder represented by custodial claims, derivatives and paper exposures (CoinTribune analysis). That split matters: funds parked as a liquid staking derivative can be re‑wrapped, re‑synthesized, or used as collateral — functionally more liquid than a true active validator stake and therefore less of a supply sink.

In short: accumulation is a mix. Retail and institutions are definitely adding size, but a meaningful portion of the rising “staked” aggregate is custodial or paper‑based, which blunts the supply‑squeeze thesis unless those claims are burned or locked at scale.

Concentration, whale long positions and systemic risks

Concentration amplifies both upside and downside. When large balances—whether staked, custodial, or held by exchanges—are clustered in a few hands, market events can cascade:

Liquidation and deleveraging risk: If whale holders or institutional desks have large long exposures financed with leverage, a sharp price move can force deleveraging that cascades into measurable selling pressure. Derivatives open interest and funding rates become critical early‑warning indicators.

Staking concentration: Heavy reliance on a few staking providers (or custodial wallets) increases slashing risk, centralization pressure and governance attack vectors. Even if slashing is rare on Ethereum, the market reaction to a concentrated technical failure could be severe.

‘Paper’ unwind: If a significant tranche of apparent staking is actually synthetic (liquid staking tokens backed by custodial claims), a confidence shock could prompt rapid unwrapping and selling of the underlying ETH, regenerating supply into markets quickly.

These dynamics argue for monitoring not just absolute staking totals but active validator participation, top‑holder concentration, on‑chain flows into/out of known custody addresses, and derivatives positioning. No single metric gives the full picture—combining them does.

Vitalik’s bolt‑on push: what FOCIL, privacy and post‑quantum thinking change

Vitalik Buterin’s recent public commentary frames the next phase for Ethereum development as a set of bolt‑on improvements that are cypherpunk‑principled: targeted upgrades that increase user sovereignty, privacy, and robustness without upending composability or decentralization. He mentions hardening FOCIL (a proposed mechanism for decentralization/hardening) and emphasizes non‑ugly, bolt‑on enhancements in governance and protocol design (NewsCrypto roundup).

Why would that matter for market structure and the 2026 cycle?

Network security and trust: Improvements that reduce attack surfaces and harden consensus make ETH a safer long‑term store of value and collateral. That can attract risk‑off institutional capital and reduce the perceived protocol risk premium.

Privacy and composability: Better privacy primitives broaden real‑world use cases—private payments, confidential DeFi primitives and improved UX for institutional flows. That increases optionality for ETH demand beyond pure speculation.

Post‑quantum readiness: Early work and research into post‑quantum resilience signal prudence to large custodians and sovereigns. While not an immediate price driver, signaling safety and forward‑looking resilience reduces existential risk premiums.

Collectively, bolt‑on upgrades can alter sentiment by shifting narratives: from ETH as a speculative application platform to ETH as a resilient, privacy‑respecting, future‑proof settlement layer. That shift would likely broaden the buyer base and support higher valuations over longer timeframes.

What this means for 2026 — scenarios and actionable takeaways

Scenario A — Base (most likely): Continued accumulation with mixed quality

- What happens: Retail and institutions continue to accumulate; a meaningful share of 'staked' ETH remains represented by liquid staking derivatives. Price grinds higher as liquidity tightens, but large sell events (derivative unwind) cause sharp, episodic corrections.

- Actionable: Scale into positions on on‑chain confirmation signals (net exchange outflows, rising long‑term holder cohorts, increasing active validator share). Keep sizes moderate; use ranges rather than single entry levels.

Scenario B — Bull (upgrade + sustained demand): Bolt‑on upgrades deliver improved security/privacy narrative and institutions double down

- What happens: FOCIL and privacy improvements accelerate institutional adoption, active validator share grows, and on‑chain accumulation converts into durable illiquidity. A classic supply squeeze propels a multi‑month/quarter rally into 2026.

- Actionable: Increase exposure, hedge tail risks with options if available, and consider longer‑dated allocation for asymmetric upside.

Scenario C — Risk event (concentration unwind): Confidence shock forces rapid unwrapping of paper stakes and deleveraging

- What happens: Derivatives or custodial unwinds return ETH to exchanges quickly; price pressures spike. Liquid staking tokens trade at discounts to underlying briefly.

- Actionable: Reduce levered exposure, monitor top holder flows and derivatives OI; be ready to add to risk‑weighted dips if fundamentals remain intact.

Across scenarios: watch three high‑value signals—exchange balances, active validator participation vs custodial/paper staking mix, and top‑10 holder dynamics. Combine those on‑chain signals with macro liquidity and derivatives metrics for timing.

Practical risk management and positioning for holders

Position sizing: Treat ETH like a core long‑term allocation but partition exposure across: cold‑storage long term (unchanged by short‑term volatility), liquid staking exposure (to earn yield and retain composability), and a tactical trading sleeve for shorter cycles.

Diversify custody: Avoid overconcentration with single custodians or liquid staking providers; multiple validators or diversified LSDs reduce single‑point risk.

Monitor: Set alerts for exchange inflows, sudden validator exit requests, and large transfers from known custody addresses. Those are early signs of de‑risking.

Follow upgrades: Track the bolt‑on roadmap. Upgrades that materially reduce protocol risk or add privacy/post‑quantum features can be catalysts for large, low‑volatility capital.

Final thoughts

Ethereum’s current accumulation profile is an encouraging macro backdrop for the 2026 cycle, but it’s not a simple, unqualified buy signal. The record accumulation headline masks important nuance: a sizable portion of the new ‘staked’ supply may be paper‑based or custodial, and concentration risks could amplify volatility if sentiment shifts. Conversely, Vitalik’s push for cypherpunk‑oriented bolt‑ons (FOCIL hardening, privacy improvements and forward‑looking security work) could materially reduce protocol risk and broaden demand in ways that make this accumulation stick.

For intermediate to advanced holders and long‑term investors, the path to asymmetric reward is not blind conviction but informed position sizing: follow the on‑chain flow, discriminate between active stake and synthetic claims, and watch upgrades and concentration metrics closely. If bolt‑on upgrades land and active participation rises, 2026 could favour holders who scaled in during this accumulation window.

Sources

- Coinpaper — Ethereum’s fractal signal meets record accumulation: https://coinpaper.com/14805/ethereum-s-fractal-signal-meets-record-accumulation-as-price-slides?utm_source=snapi

- NewsCrypto — Vitalik calls for cypherpunk‑principled bolt‑on upgrades: https://thenewscrypto.com/vitalik-calls-for-cypherpunk-principled-non-ugly-ethereum-as-bolt-on-upgrade/?utm_source=snapi

- CoinTribune — Analysis on active vs paper staking percentages: https://www.cointribune.com/en/crypto-50-of-eth-staked-on-paper-only-31-in-active-stake/?utm_source=snapi

- CoinGape — Institutional accumulation example (BitMine/Tom Lee purchase): https://coingape.com/tom-lees-bitmine-doubles-down-on-ethereum-with-34-7m-fresh-purchase/