Can Cardano’s USDCx Fix Dollar Liquidity and Close the Gap with Ethereum and Solana?

Summary

Executive snapshot

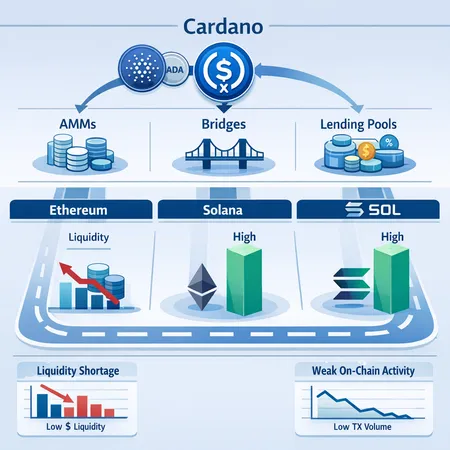

Cardano is moving to add a native dollar rail: USDCx. The goal is simple on paper—plug a widely trusted stablecoin directly into Cardano DeFi to fix the persistent dollar liquidity shortage that has limited trading depth and composability. But liquidity is not just a token issuance exercise. This article unpacks the USDCx timeline and mechanics reported by Cardano teams, examines the current shortage of dollar liquidity and muted on‑chain activity that could blunt impact, compares how Ethereum and Solana solved (or skirted) this problem, and outlines realistic short‑term effects for ADA holders and protocol teams.

What is USDCx — timeline and mechanics

Cardano contributors have indicated a push to launch a USDC-like product called USDCx by the end of February, positioning it as a native stablecoin rail to “compete” with stablecoin liquidity on Ethereum and Solana. Reporting suggests Cardano teams are designing USDCx with the explicit goal of improving dollar liquidity on the chain and enabling easier integrations into AMMs, lending markets, and payments. See the announcement summary from The News Crypto for timing and intent.

Mechanically, Cardano’s approach appears to focus on issuing or enabling a wrapped/native representation of USDC that is optimized for Cardano’s UTxO model and extended through token standards tailored to Cardano. That means teams will need to solve for: custody or minting arrangements, bridge interoperability (for inbound/outbound flows), and compatibility with AMMs and lending protocols that expect ERC‑20‑style composability. The News Crypto piece outlines the stated schedule and ambitions for USDCx, while Cardano ecosystem teams continue to clarify how minting, settlement, and cross‑chain liquidity will operate.

Why dollar liquidity has been a constraint on Cardano

Cardano's DeFi TVL and trading activity have historically lagged behind ETH and SOL, and one recurring bottleneck has been a shortage of readily available dollars on chain—stablecoins that traders and protocols use to price, swap, and collateralize. Without deep stablecoin liquidity, AMMs see wider spreads, lending markets lack depth, and arbitrageurs and market makers avoid the chain because capital efficiency drops.

Compounding the liquidity issue is muted on‑chain activity. Analysts have noted defensive price moves for ADA even as on‑chain metrics remain soft—fewer transactions, lower fee revenue, and constrained user flows are all signs that simply dropping a new stablecoin into the protocol won't instantly generate demand. AmbCrypto’s analysis raises exactly this concern: price defenses can buy time, but if activity doesn't increase, stablecoin supply alone may not translate to robust DeFi growth.

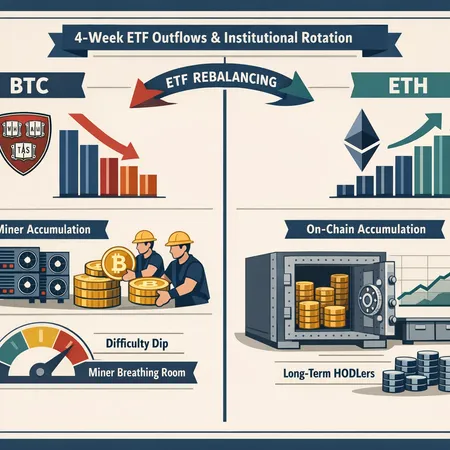

How Ethereum and Solana built stablecoin liquidity (comparison)

Looking at ETH and SOL helps set expectations. On Ethereum, stablecoin liquidity emerged via a mix of: centralized minting and strong custodial relationships (USDC, USDT), highly composable ERC‑20 standards, a dense web of AMMs (Uniswap, Curve), lending markets (Aave, Compound), and heavy activity from market makers and institutional flows. That composability—tokens that plug and play into dozens of protocols—multiplied liquidity effects.

Solana's model prioritized speed and low fees, attracting stablecoin issuances and high‑frequency market maker activity. Bridges and wrapped assets provided quick access to SOL‑ecosystem liquidity, while AMMs and concentrated liquidity strategies surfaced deep pools for SOL‑stable pairs. The practical lesson: liquidity needs both supply and demand mechanisms—low friction to move capital, incentives to plant liquidity (rewards), and composable building blocks for protocols to use stablecoins as collateral, settlement, and pricing anchors.

Integration paths for USDCx: bridges, AMMs, lending and composability

For USDCx to functionally increase dollar liquidity on Cardano it must do more than exist; it must be usable across core DeFi primitives. The main integration paths are:

Bridges: Fast, secure bridges to ETH and Solana (and major custodians) will let USDCx inherit liquidity. But bridging friction and custodial risk are non‑trivial—design and audits matter.

AMMs & DEXs: Native pools pairing ADA/USDCx, as well as multi‑token pools (stable/stable), will create on‑chain quotes. Projects need to design incentives for initial liquidity providers and consider concentrated liquidity models where applicable.

Lending markets: Integrating USDCx as a borrowable/lendable asset unlocks leverage, margin, and interest rate dynamics. Without lending integration, a stablecoin is less useful for composable DeFi.

Fiat rails & custodial partners: On/off ramps determine the rate at which external dollars enter Cardano. Partnerships with custodial services and payment processors accelerate real demand.

Each path has implementation tradeoffs. Bridges can inject liquidity quickly but transfer systemic risk. Native minting (if allowed through partnerships) reduces bridge reliance but requires strong regulatory and custodian assurance.

Short‑term market and DeFi effects for ADA holders and projects

If USDCx launches on schedule, expect several near‑term outcomes:

Narrower spreads and improved price discovery in ADA pairs, especially if liquidity mining incentives attract LPs. That benefits traders and reduces slippage for large orders.

A pickup in AMM and DEX activity but likely concentrated among yield seekers at first. Protocols that rapidly integrate USDCx into pools and farms will capture the first wave of TVL.

Lending markets may see incremental adoption, but full growth depends on oracle integrations and risk modeling. Projects that offer attractive rates or be early liquidity sinks could catalyze flows.

Market makers and arbitrageurs will probe Cardano markets; if execution and bridge latency are competitive, they will supply liquidity, but only if profit opportunities outweigh operational costs.

That said, weak baseline on‑chain activity suggests adoption may be gradual. USDCx reduces a key frictions but does not by itself create the user flows that give ETH and SOL their depth. For ADA holders, the most immediate benefit is better trade execution and the potential for new yield opportunities; for projects, it’s a chance to design incentives and integrations that convert passive token supply into active liquidity.

Risks, execution challenges, and what could blunt impact

Several risks could dilute the positive potential of USDCx:

On‑chain activity shortfall: As noted earlier, token supply without user demand leads to idle liquidity and weak TVL growth.

Bridge and custody risk: If USDCx relies on bridges or custodians, any security incident will impair trust and take time to repair.

Regulatory and compliance complexity: Stablecoins face intense scrutiny. Execution timelines could slip or features be constrained by compliance requirements.

UX and composability gaps: Cardano's extended UTxO model differs from ERC‑20 expectations; protocol teams must ensure developer tooling and standards let USDCx plug seamlessly into AMMs and lending stacks.

Each challenge is solvable but requires concerted effort across infra teams, market makers, and projects.

Recommendations for DeFi strategists and protocol teams

Prioritize composability: Ensure AMMs, oracles, and lending modules accept USDCx with minimal friction. Teams should test integrations early and provide developer SDKs.

Design liquidity incentives thoughtfully: Liquidity mining can bootstrap pools, but structure rewards to encourage durable liquidity, not just short‑term farming exits.

Partner with bridges and custodians with strong security track records: Time to market matters, but not at the expense of trust.

Focus on user flows: Build simple on/off ramp UX so end users can move fiat → USDCx → DeFi without dead ends. Projects on Bitlet.app and elsewhere can play a role here.

Monitor on‑chain activity metrics, not just TVL: Active addresses, swap frequency, and fee capture indicate healthy demand, not just parked capital.

Conclusion

USDCx is a meaningful step toward solving Cardano’s dollar liquidity problem. A native USDC‑style rail could reduce swap friction, attract LP capital, and enable lending and composability—provided it is integrated across bridges, AMMs, and lending markets with solid UX and security. However, the launch is not a guaranteed short‑term catalyst for a liquidity revolution. Without parallel growth in on‑chain activity, developer tooling, and trusted custodial infrastructure, USDCx risks sitting as idle supply rather than acting as liquid oxygen for Cardano DeFi.

For ADA holders and protocol teams, the practical play is to prepare integrations, design incentive schemes for durable liquidity, and address UX and compliance gaps now—because when USDCx lands, early movers who solved those puzzles will capture the bulk of real economic activity.

Sources

- "Cardano launches USDCx to compete with Ethereum and Solana in stablecoin liquidity" — The News Crypto: https://thenewscrypto.com/cardano-launches-usdcx-to-compete-with-ethereum-and-solana-in-stablecoin-liquidity/?utm_source=snapi

- "Cardano's 0.244 defense returns but will on‑chain activity pull ADA down?" — AmbCrypto: https://ambcrypto.com/cardanos-0-244-defense-returns-but-will-on-chain-activity-pull-ada-down/