Institutional Demand

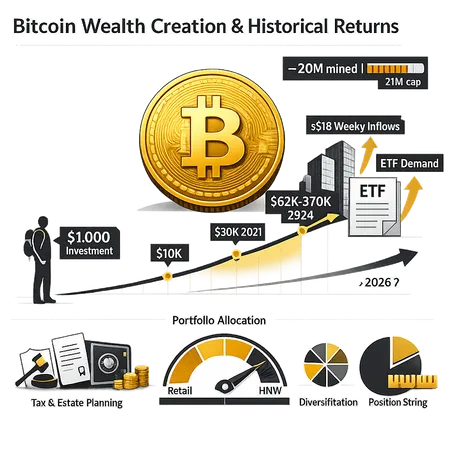

Bitcoin’s early price trajectory produced extraordinary paper wealth for tiny stakes — a useful lens to reassess allocation, scarcity, institutional demand and risk management in 2026. This article breaks down the historical numbers, supply dynamics, recent ETF/institutional flows, tax and estate implications, and pragmatic portfolio rules for retail and HNW investors.

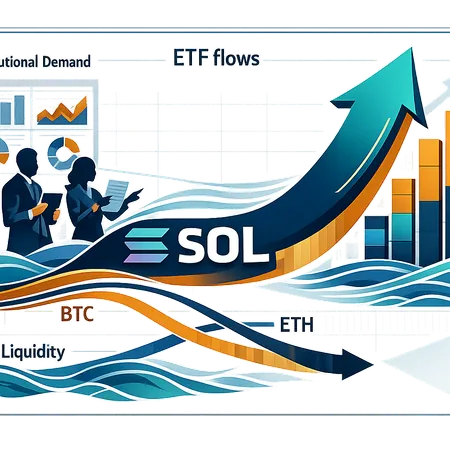

Solana‑linked ETFs have shown steadier inflows this month even as BTC and ETH ETF demand cooled, revealing structural reasons tied to application activity, perceived yield and liquidity dynamics. This analysis unpacks flow data, price effects on SOL, index‑tracking risks and lessons for the next wave of altcoin ETFs.

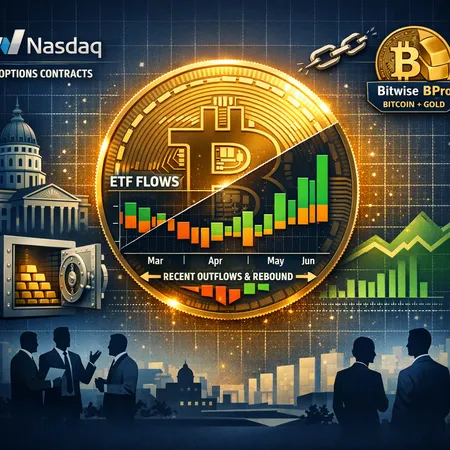

U.S. spot Bitcoin ETFs show roughly $53B in cumulative net inflows even as funds experienced meaningful short‑term outflows. This article explains the chronology, ETF mechanics, and practical sizing rules for portfolio managers and swing traders navigating ETF‑driven liquidity events.

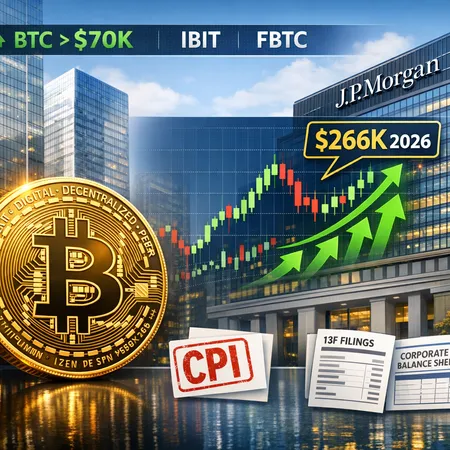

Major institutions maintain a bullish stance on Bitcoin despite choppy price action — driven by structural supply dynamics, growing ETF adoption, and macro tailwinds such as cooling CPI. This article unpacks JPMorgan’s $266K projection, the CPI-ETF rebound above $70K, 13F evidence of shifting allocations, and practical portfolio takeaways.

ETF mechanics, recent outflows, and product innovation are changing how institutions access BTC. Changes in options rules and new hybrid funds — plus state-level proposals — could turn apparent ETF weakness into a structural bid.

A single‑day $457M inflow into spot Bitcoin ETFs reignited debate over institutional demand, price mechanics and custody readiness. This analysis unpacks who led the flows, how ETF mechanics interact with leveraged retail, and practical rules for allocators.

Institutional capital is flowing into Solana‑linked ETFs even as network and project issues persist. This feature explains the drivers behind ETF inflows, case studies from the Solana ecosystem, and practical takeaways for SOL holders.

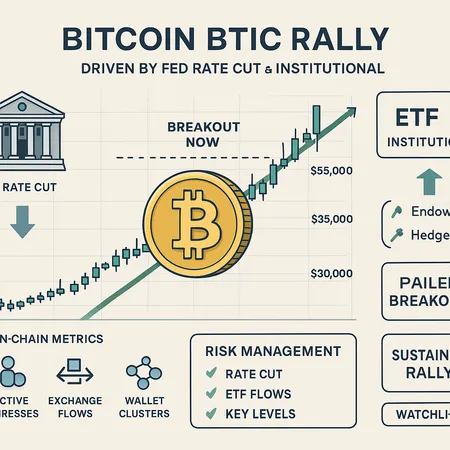

Bitcoin’s year‑end momentum looks increasingly linked to an anticipated Federal Reserve rate cut and renewed institutional demand via spot ETFs and large allocators. Traders should track ETF flows, treasury yields, and on‑chain supply metrics to distinguish a genuine breakout from a short‑lived spike.

Tokenized gold’s $3 billion milestone signals a maturing market for digital commodities. This primer breaks down product types (PAXG, XAUT), institutional drivers, custody and legal risks, and practical due diligence for integrating tokenized metals into portfolios.

An integrated macro-to-onchain briefing on how recent Fed liquidity moves, ETF flows and structure, Strategy Inc.'s contingency rules, and Goldman Sachs’ Innovator buy will affect BTC liquidity, volatility and the price path into 2026.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility