Corporate Treasury

Metaplanet’s recent run-in over its BTC buying and options program has exposed weak spots in disclosure practices and board oversight for companies with large crypto treasuries. This investigation breaks down the timeline, the mechanics of the strategy, comparable failures, regulatory lessons, and a practical governance checklist for public firms holding crypto.

Strategy (formerly MicroStrategy) continued to add Bitcoin even as its corporate holdings moved underwater — a move that raises concrete balance-sheet, covenant and dilution questions for corporate treasuries. This article breaks down the disclosed buys, compares cost basis to the market, and offers a practical risk/return framework for CFOs and institutional allocators.

A comparative analysis of divergent national crypto policies using Russia’s blacklist of WhiteBIT and Japan’s corporate Bitcoin-treasury initiative led by Animoca/Rootstock. Practical guidance for general counsel and treasurers weighing jurisdictional risk, compliance and onchain treasury opportunities.

Steak ’n Shake’s $10M Bitcoin purchase highlights a growing trend of corporate BTC allocations. This article breaks down motivations, accounting and tax implications, governance design, and a practical CFO checklist before executing a treasury buy.

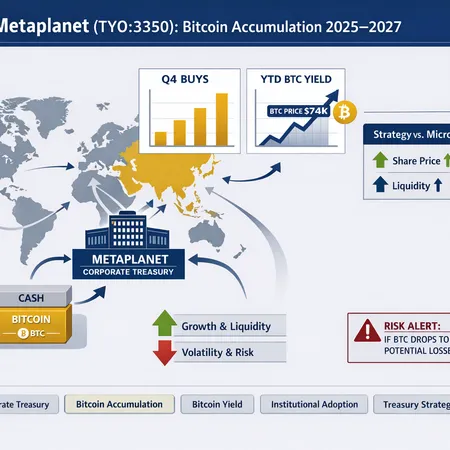

Metaplanet accelerated BTC accumulation in Q4 2025, adding 4,279 BTC and reporting record BTC yield for the year — a playbook that reshapes treasury math, liquidity and institutional signaling across Asia and beyond. This analysis quantifies the balance-sheet impact, compares the approach to Strategy/MicroStrategy, and outlines risk and hedging considerations for CFOs.

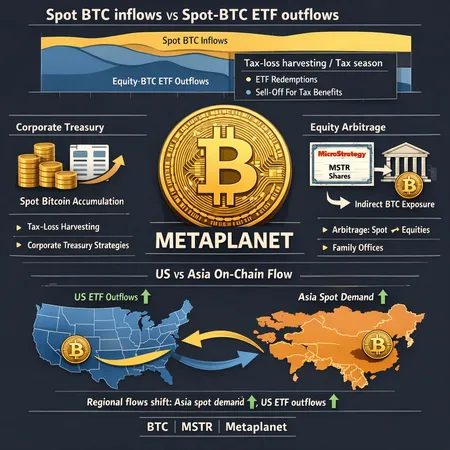

Institutional routes to BTC exposure are diverging: direct corporate accumulation plans like Metaplanet’s 210k BTC target sit alongside equity-based exposure via MicroStrategy, while tax-loss harvesting pushes seasonal ETF outflows that reshape on-chain and regional flows. This analysis unpacks mechanics, cross-asset arbitrage, and tactical takeaways for allocators and family offices.

Miners are turning waste heat into revenue while corporates expand treasuries beyond BTC, eyeing assets like LTC. This feature unpacks business models, high-profile US investments, and a practical ESG/regulatory checklist for CFOs evaluating miner partnerships.

Ripple's recent $1 billion acquisition of GTreasury marks a significant milestone in enhancing corporate treasury management and streamlining cross-border payments. This strategic move combines Ripple's blockchain-based payment solutions with GTreasury's advanced treasury management software, promising greater efficiency and cost savings for businesses worldwide.

Ethereum smart contracts are transforming corporate treasury management by enhancing security, automation, and transparency. Additionally, installment-based crypto purchase options, like those offered by Bitlet.app, are revolutionizing how businesses acquire cryptocurrencies by enabling flexible payment methods.

Discover how Ethereum smart contracts are transforming corporate treasury management in 2025 by automating processes, enhancing transparency, and reducing costs. Learn about Bitlet.app's role in enabling crypto installment services for seamless digital asset acquisition.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility