How Ripple Treasury and RLUSD Reframe Corporate Treasury Strategy and XRP Demand

Summary

Executive snapshot

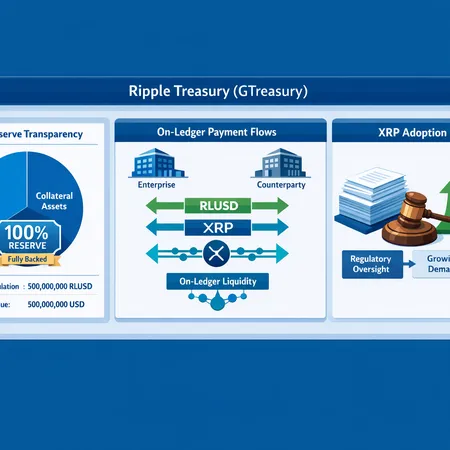

Ripple Treasury — the enterprise-facing product that pairs a stablecoin called RLUSD with payments infrastructure and integrations like GTreasury — is pitched as a way for corporate treasuries to move institutional payments and working capital onto-chain with familiar controls. For treasurers and product managers evaluating digital rails, the promise is clear: faster settlement, programmability, and potential cost savings versus correspondent banking. But the strategic decision to adopt a ledger-native stablecoin depends not only on feature parity but on credible reserve signals, custody model, and the liquidity ecosystem that supports day-to-day flows.

In short: RLUSD + Ripple Treasury reduces some frictions of on-ledger payments, but its adoption hinges on reserve transparency, third-party integrations, and how enterprises manage on-ledger liquidity needs — including whether XRP plays a role in corridor liquidity or pathfinding.

What Ripple Treasury actually offers corporate treasuries (GTreasury integration explained)

Ripple is positioning Ripple Treasury as more than a simple payments SDK. The GTreasury integration highlighted by industry coverage frames it as a working-capital product that slots into treasury management systems and treasury operations workflows. Integration with GTreasury is not incidental: GTreasury is widely used for cash forecasting, FX risk, and payment automation in mid-market and enterprise treasuries, which means Ripple’s offering is being engineered to sit alongside — not replace — existing treasury controls.

Practically, a treasury using Ripple Treasury could benefit from: faster cross-border settlement windows, programmable instructions tied to invoices, and the ability to route value on-ledger to subsidiaries or counterparties without multi-day correspondent banking cycles. For product managers, the important nuance is that this integration implies accounting and reconciliation hooks, audit trails, and a path to embed RLUSD flows into existing cash-management dashboards. Cryptoslate’s reporting on the GTreasury tie-up emphasizes this enterprise-centric framing, noting that the approach is intentionally aimed at corporate finance teams rather than retail rails (analysis of the GTreasury integration and institutional payments).

RLUSD as a ‘treasury-grade’ stablecoin — reserve signals, transparency, and credibility

The single most important question for a treasurer is: who stands behind the peg? RLUSD’s credibility depends on the size and quality of the reserves backing issued tokens, the custody arrangements for those reserves, the cadence of attestations or audits, and governance rules for minting and redemption. Public reporting on RLUSD reserves and supply growth is therefore a core input for risk committees evaluating on-chain stablecoins.

Recent data-driven pieces have tracked RLUSD issuance and reserves growth, noting material issuance activity and raising questions about transparency and long-term backing practices (data on RLUSD reserves and supply growth). Other commentary points to the strategic framing from Ripple Treasury that positions RLUSD as a finance-grade instrument for 13,000 banks and enterprises, a message that both sells scale and invites scrutiny over reserve mechanics (analysis of Ripple Treasury and RLUSD’s strategic framing).

For cautious treasuries this translates into an evidence checklist: independent third-party custody, frequent attestations or audits, conservative eligible collateral for reserves, and clear redemption mechanics. Without those, RLUSD risks being treated like other exchange-linked or centrally-issued tokens — usable for experimentation, perhaps, but not for core liquidity buffers or regulatory capital treatments.

How Ripple Treasury changes the tactical calculus for institutional payments and treasury management

If an enterprise decides RLUSD is sufficiently credible, the tactical benefits are straightforward: reduced settlement latency, lower FX layering for cross-border payouts, and programmable settlement conditions that can automate netting and supply-chain finance scenarios. On the operational side this removes friction in reconciliation: ledger-native receipts and settlement timestamps can be ingested into TMS and ERP systems, trimming manual matching.

But there are trade-offs. Holding balance sheet in RLUSD requires treasury policies for custody, counterparty exposure to the issuer and custodian, and contingency plans for peg pressure or on-chain liquidity events. Integration with GTreasury suggests Ripple understands these constraints: the product emphasizes controls that treasuries expect — permissioning, role-based access, and reporting — so adoption could be faster among teams that require centralized governance.

For institutional investors and product managers, the question is whether RLUSD complements existing FX hedging and short-term investment policies, or whether it introduces new operational overheads (custody reconciliations, smart contract risk assessments, and local legal reviews).

On-ledger liquidity and the potential implications for XRP demand

A common misunderstanding is that stablecoin-led settlement eliminates demand for native tokens like XRP. In practice, on-ledger liquidity models are nuanced. RLUSD can carry value across rails, but for certain flows — especially low-liquidity corridors and rapid payment pathfinding — XRP can be used as a bridge asset to source liquidity quickly and cheaply on the ledger. That matters when counterparties on both sides of a payment prefer different stablecoins or when deep pools of fiat-backed rails are not available.

Greater enterprise use of RLUSD could therefore increase incidental demand for XRP in two ways: operational liquidity (short-duration conversions where XRP facilitates atomic or near-instant swaps) and market-making activity (exchanges and liquidity providers needing XRP balances to service corridor flows). The net effect depends on whether Ripple Treasury chooses to route most conversions off-ledger via fiat rails or on-ledger via XRP liquidity.

For XRP holders, this is a structural bet: broader enterprise on-ledger settlement increases transactions and potentially demand for liquidity provisioning. For treasurers, the practical decision is whether to include a small operational allocation to XRP as a utility instrument for corridor management, balancing market risk with operational necessity.

(For context on XRP as a market bellwether and comparisons to other rails, many practitioners still benchmark digital-asset liquidity against legacy crypto liquidity providers and networks like DeFi and other liquid hubs.)

Regulatory tailwinds and risk: why recent court rulings matter

Enterprise adoption is not purely a product problem — it’s a legal and regulatory one. A notable shift in the risk landscape came when a U.S. court dismissed a class action against Ripple, easing a layer of regulatory overhang for enterprise counterparties considering Ripple’s tech stack. That ruling reduces perceived litigation risk tied to Ripple's business model and is often cited as improving the commercial case for integrations with banking and corporate clients (report on the U.S. court ruling).

Regulatory progress does not equal regulatory clearance. Treasuries still need to evaluate local money-transmission rules, tax reporting, and the treatment of on-balance RLUSD holdings under corporate governance. But fewer legal clouds make procurement and legal teams more willing to engage, run pilots, and negotiate custodial arrangements.

Risks, open questions, and practical guardrails

- Reserve transparency: Treasuries should require regular, independent attestations and clear rules on asset eligibility in reserves.

- Custody and counterparty exposure: Enterprise policies should define approved custodians and enforce multi-sig or institutional custody models.

- Liquidity depth and slippage: For large flows, ask for evidence of market depth in corridors and the mechanics for XRPL-based pathfinding.

- Operational recovery: What are the failover processes if RLUSD depegs, or if an issuer action halts mint/redemption?

- Accounting and regulatory treatment: Ensure finance teams model RLUSD in cash forecasts and consult regulators on treatment under local rules.

These guardrails are practical. They make RLUSD more comfortable for corporate treasuries and reduce counterparty friction.

Actionable takeaways for treasurers, institutional investors, and product managers

Treasurers: Build a pilot with narrow scope — payroll to a small subsidiary, supplier netting, or intra-company funding — and require weekly attestations and approved custody before scaling. Use existing TMS integrations like GTreasury to reduce reconciliation overhead and adopt clear policy language for smart-contract exposures.

Institutional investors: If you provide liquidity, evaluate how on-ledger rails change quoting and inventory models. Increased enterprise flow can create steady low-margin volume, but it also demands robust custody and market-making infrastructure.

Product managers: Design for auditability and role-based controls; enterprises will prioritize tooling that integrates with ERP/TMS and provides firm-level reporting. Consider the operational role XRP might play in corridor liquidity and offer configurable routing (on-ledger vs off-ledger) in product flows.

Providers like Bitlet.app are part of the growing ecosystem that can support experimenting treasuries with noncustodial rails and P2P exchange tooling — but remember to align any vendor proof-of-reserves and audit practices with corporate requirements.

Conclusion

Ripple Treasury and RLUSD represent a deliberate push to make on-ledger settlement palatable to corporate treasuries by integrating with established treasury tooling and offering a stablecoin positioned as finance-grade. The product reduces friction and unlocks programmable payments that matter to enterprise cash management, but adoption depends on credible reserve disclosure, custody safeguards, and sufficient market liquidity.

If Ripple delivers robust transparency and operational controls, enterprises may move meaningful working capital on-chain. That shift can increase demand for on-ledger liquidity and create utility-driven use cases for XRP, particularly in corridor and pathfinding scenarios. Recent legal developments have lowered certain barriers to enterprise engagement, but boards and treasurers should still approach pilots with careful guardrails.

Sources

- https://cryptoslate.com/ripple-treasury-puts-rlusd-at-the-center-for-13000-banks-and-raises-tough-questions-for-xrp-holders/

- https://cryptoslate.com/ripple-treasury-platform-gtreasury-rlusd-xrp-institutional-payments/

- https://u.today/heres-how-much-rlusd-ripple-has-in-reserve?utm_source=snapi

- https://www.cointribune.com/en/us-court-rules-in-favor-of-ripple-in-xrp-lawsuit/?utm_source=snapi