Crypto Billionaires in State Politics: Inside the $40M Grow California Campaign

Summary

A $40M Bet: What Grow California Signals

When a group led by Chris Larsen and Tim Draper announced a roughly $40 million push to oppose California’s proposed wealth tax, it changed the political terrain. That sum — significant for any state ballot campaign — is notable because it is anchored in crypto wealth and headed by high‑profile founders. According to reporting on the campaign, the effort, branded Grow California, is framed as an opposition to a tax that would target unrealized gains and high‑net‑worth households, but the political optics are unmistakable: tech and crypto capital mobilizing to protect its balance sheets and business models (Cryptonews report).

This is not corporate philanthropy. It is political defense. For crypto executives and policy watchers, the key question is less the headline dollar figure and more what that spending buys: framing, narrative control, and legal defenses that can shape both state and federal regulatory environments.

Strategy and Scale: Beyond Billboard Ads

The $40M figure buys more than TV spots. Modern ballot campaigns use layered tactics: high‑frequency digital advertising targeted by voter demographics, grassroots outreach in key counties, paid signature gathering to qualify measures, and legal teams prepared to litigate ambiguous ballot language. The Grow California effort appears calibrated for all of these vectors. Large sums allow rapid signature collection (if needed), sustained ad saturation, and the ability to fund litigation or rapid response teams.

Crypto donors bring an advantage: many are familiar with digital ad targeting and donor networks that can be activated quickly. That said, playbooks matter less than perception. A well‑funded initiative led by crypto figures introduces new narrative risks — opponents can cast the campaign as wealthy insiders protecting special interests rather than a neutral policy debate.

Motivations: Tax Policy, Capital Protection, or Industry Preservation?

On paper, the campaign is about tax policy: opponents argue a wealth tax would penalize entrepreneurship, drive out talent, and chill investment. Those are familiar arguments from tech and finance. But unpacking motivations shows overlap between public policy concerns and private interest preservation.

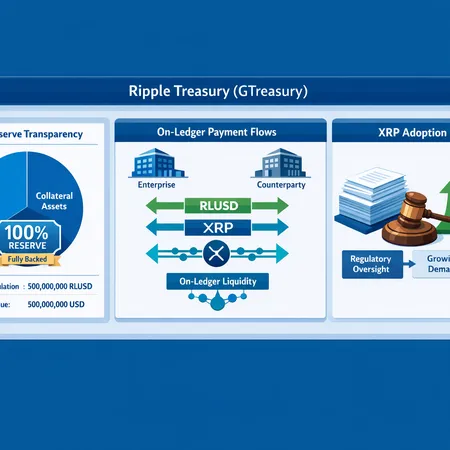

Crypto founders hold a disproportionate share of wealth in illiquid instruments or token holdings that would be heavily affected by taxation regimes targeting unrealized gains. A wealth tax creates valuation and liquidity complications for holdings like XRP, which have seen concentrated founder ownership and regulatory entanglements in recent years. For many donors, opposing a wealth tax is both an ideological stance and a direct protection of asset values.

This dual motive — policy plus portfolio protection — is not unique to crypto. What is different here is how overt the link is between crypto fortunes and political spending. That visibility can harden public opinion against the industry, particularly when opponents frame the debate as billionaires blocking fair taxation.

Precedent: Crypto Industry Political Spending to Date

Crypto lobbying is not new. Over the last five years, companies and industry groups have increased federal lobbying, state‑level advocacy, and PAC contributions. Exchanges and high‑profile firms have hired veteran lobbyists and spent heavily on shaping rules around taxation, securities classification, and consumer protections. But much of that spending had been either corporate or channeled through trade associations — less tied to individual founders’ names.

Grow California represents a shift: founder‑led, publicly fronted political spending on an existential policy matter. That mirrors earlier tech fights where prominent founders took center stage, but for crypto the stakes include token valuations, litigation exposure, and the question of whether digital assets are treated like securities, commodities, or something else entirely.

State Fights as Templates for Federal Policy

States are laboratories. A successful defeat of a wealth tax in California could become a template for other states considering similar measures, while a failure could embolden national conversations about wealth redistribution. For crypto lobbyists, state wins can blunt federal momentum; conversely, high‑profile state fights can catalyze federal regulators to act more aggressively, especially if the public perceives industry influence as disproportionate.

Regulatory risk is therefore two‑way: spending to block unfavorable policy can reduce short‑term legislative risk but increase long‑term regulatory scrutiny. Federal agencies, watching a patchwork of state outcomes, may feel pressure to standardize rules — and sometimes that standardization takes the form of stricter enforcement.

Reputation, Tokens, and Legal Tail Risk: XRP vs WLFI

Founder political activity influences public perception in ways that ripple back onto tokens. XRP is a useful example: Ripple and its executives have already faced heightened regulatory scrutiny, including high‑profile litigation. When a founder like Chris Larsen leads a major political campaign, critics can braid narratives — suggesting that lobbying, litigation strategy, and political donations are interconnected efforts to protect favorable outcomes for a token and its holders.

Contrast that with WLFI, which recent reporting linked to concerns about foreign investor influence in governance structures. The Coinpaper piece on Abu Dhabi money tied to a WLFI governance token shows how funding sources can create a different set of risks — foreign influence, contested governance legitimacy, and questions about who benefits from token control (Coinpaper report).

Both scenarios — domestic founder‑driven political spending and foreign investment in token governance — highlight how financial backing shapes narratives about legitimacy and risk. For tokens like XRP, overt founder political activity can expose the asset to reputational attack lines that complicate regulatory defense. For governance tokens like WLFI, external funding sources can trigger national security or foreign influence debates.

What Crypto Executives and Policymakers Should Watch

- Transparency matters: public disclosure of donors, funding flows, and political aims reduces the impression of secretive influence. Consider more proactive disclosure even where not legally required.

- Diversify engagement: combine policy arguments with community outreach to avoid the perception that political spending is purely self‑serving. Grassroots coalitions and policy papers can balance ad buys and legal actions.

- Prepare for spillover: a state‑level media blitz will attract federal attention. Build legal playbooks and compliance teams expecting multi‑jurisdictional scrutiny.

- Governance hygiene: token projects should document governance decisions, investor sources, and voting arrangements to reduce the chance that funding becomes a legal or reputational liability.

For industry platforms — including payment and installment services — the implications are direct. Firms such as Bitlet.app and others watch these debates because state rules on wealth and taxation shape consumer behavior and capital formation in crypto markets.

Conclusion: A New Phase of Political Risk

Grow California is a marker: crypto founders are moving from lobbying rooms and trade associations to the center of public political fights. The strategy — heavy spending, rapid mobilization, and high‑profile messaging — can win battles, but it also amplifies scrutiny and creates fresh narratives regulators can use. For policy‑minded readers and crypto executives, the takeaway is pragmatic: influence requires strategy beyond cash. Transparency, governance robustness, and a willingness to engage public concerns will determine whether political spending preserves industry freedom or accelerates tighter regulation.

Sources

- https://cryptonews.com/news/ripple-co-founder-leads-40m-push-to-counter-california-wealth-tax/

- https://coinpaper.com/14202/abu-dhabi-money-linked-to-trump-crypto-project-raises-foreign-influence-questions?utm_source=snapi

For broader context on market signaling, see how Bitcoin still acts as a bellwether for policy reactions, and how governance debates in DeFi projects often presage regulatory questions about token influence and funding.