XRP after the SEC settlement: why the euphoria faded, what 10M RLUSD means, and whether it’s a buy

Summary

Executive overview

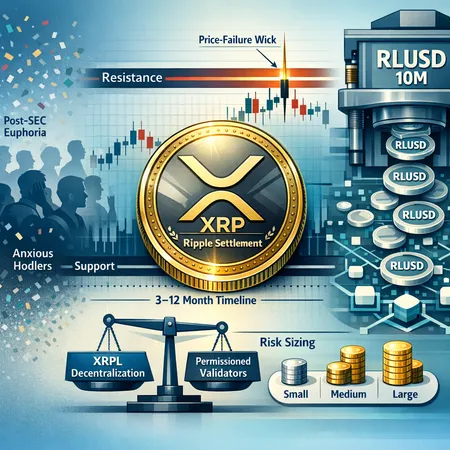

The Ripple settlement with the SEC cleared a major legal overhang and produced an immediate market reaction: a surge of buying and headlines. That early euphoria, however, faded quickly as traders confronted liquidity, order‑flow and broader market realities. Meanwhile, on‑ledger activity has shifted the narrative — most notably the minting of 10 million RLUSD on the XRPL — which adds a real‑world use case beyond speculation. This article unpacks the settlement aftermath, the current technical price structure, what RLUSD means for XRPL adoption and liquidity, the decentralization debate, and practical scenarios for the next 3–12 months with guidance on how to size risk.

1) Recap: Ripple’s SEC settlement and the market’s initial reaction

When Ripple reached its settlement with the SEC, many market participants treated the news as legal finality: no prolonged litigation, fewer headline negatives, and a clearer path for institutional partners. Early commentary framed this as a catalysts that could re‑ignite retail and institutional interest. Financial columnists even published bullish 2026 outlooks that assumed the settlement would materially change investor behavior and unlock regulatory clarity for related products. See one of those post‑settlement takes for context here.

Yet the price reaction was not a straight line up. The rally was front‑loaded, driven by short covering and headline chasing. Once the immediate flow reversed, the market revealed that legal clarity alone does not guarantee sustained demand. Traders began to ask: who will actually use XRP day to day, and where is the on‑chain activity to justify a materially higher valuation? Those questions set the stage for today’s debate.

2) Technical price structure: where XRP stands now

From a technical perspective, XRP has shown a pattern that’s common after news‑driven rallies: a sharp spike followed by failure to hold intermediate highs. Analysts observed that XRP failed to sustain its rebound at several key levels, allowing sellers to regain control and exposing lower supports (analysis and charts summarized in this breakdown). For a concise technical read on the recent failed rebounds and support levels, consult this piece that walks the chart logic step by step.

Two practical price levels matter most for traders right now: the immediate support zone (where aggressive hodlers have historically stepped in) and the next critical support that would signal structural weakening. If the near‑term support breaks decisively on heavy volume, technical momentum would favor lower targets; conversely, reclaiming and holding the prior rebound highs would suggest the rally has more legs. Order‑book and flow analysis indicates that internal liquidity structure is intact but lacks directional conviction — a nuanced view examined in detailed market flow reporting.

Key takeaways for technical traders:

- Watch whether XRP can reclaim and hold the recent rebound highs; a clean retake would flip short‑term bias bullish.

- If the immediate support zone fails on volume, treat the move as structural risk rather than a cheap dip.

- Use volume and on‑chain activity signals (not headlines alone) to validate any price breakout.

3) RLUSD stablecoin minting: practical implications for XRPL adoption and liquidity

The minting of 10 million RLUSD on the XRPL is a notable development because it converts narrative into on‑ledger reality. RLUSD is a stablecoin denominated on XRPL rails; large mint events create native liquidity that can be used for corridors, AMMs, market‑making, and as an on‑chain cash leg for OTC desks. The minting story is not just symbolic — it introduces new demand drivers for XRPL services and can increase on‑chain volumes that historically correlated with token value.

Why RLUSD matters:

- Native stablecoins reduce reliance on cross‑chain bridges and external rails, lowering frictions for liquidity providers who want to use XRPL for settlements.

- Stablecoins attract treasury flows and DeFi experiments; if RLUSD finds product‑market fit it can underpin XRPL‑native markets and encourage market‑makers to quote tighter spreads in XRP pairs.

- The existence of real stablecoin supply makes it easier for institutional counterparties to route payments and hold positions on XRPL without constant conversions.

That said, minting alone is not a guarantee of demand. The effect on XRP price depends on whether the RLUSD is actively used (circulation, pairs, AMM liquidity) or sits inert in custody. Early indications of usage trends should be monitored: trading volume in RLUSD pairs, integration into wallets and custodians, and announcements from counterparties who adopt the stablecoin corridor. For the initial report on the mint, see the on‑ledger details here.

4) The decentralization debate: permissioned validators and market relevance

Debates over XRPL decentralization have re‑surfaced after the settlement, with critics pointing to validator lists and historic permissioning. Ripple insiders and ex‑employees have publicly rebutted some of the more viral claims about centralization, arguing the network’s validator design and governance are more nuanced than headlines suggest. A former Ripple CTO pushed back on exaggerated centralization narratives, a useful counterpoint for investors weighing technical governance versus perception.

From a market perspective, two realities matter: perception and practice. If market participants believe XRPL is centralized, that perception can limit institutional uptake or attract regulatory scrutiny. Conversely, if XRPL demonstrates visible decentralization through diversified validators, independent operators, and transparent governance, that improves market confidence and can encourage custodians and exchanges to list more products.

Pragmatically, decentralization is a slow variable. It changes through validator composition, client diversity, and demonstrated independence of infrastructure providers. Investors should watch on‑chain governance metrics and announcements more closely than social media claims. The technical design choices are important, but so is the market’s belief that XRPL can operate without single‑party control.

5) Scenarios for the next 3–12 months and how to size risk

No outcome is certain, but we can frame realistic scenarios and the corresponding sizing and risk strategies.

Bullish scenario (20–35% probability):

- RLUSD adoption accelerates, on‑chain volumes rise, and XRP reclaims key technical levels. Institutional corridor usage and market‑maker participation tighten spreads. In this case, a staged accumulation makes sense: small initial allocation (1–2% of capital), add on confirmed on‑chain adoption or a decisive breakout, and use trailing stops.

Base/neutral scenario (40–55% probability):

- Settlement remains in the rearview mirror; XRP trades in a wide range as RLUSD adoption is gradual. Market reacts to macro events and liquidity cycles rather than XRPL‑specific adoption. For most retail investors, a conservative stance is to keep cumulative exposure low (1–3%) and treat any buys as tactical with clear stop‑losses.

Bearish scenario (20–30% probability):

- Technical support breaks and sellers exploit headline fatigue; RLUSD fails to meaningfully circulate, and decentralization concerns persist. In this case XRP could revisit lower structural supports; risk management requires tight stops and small position sizes. Avoid averaging down without new fundamental evidence.

Sizing guidance (practical):

- Conservative retail: 0.5–1% of portfolio — exposure for speculative upside with minimal disruption to core holdings.

- Balanced retail/intermediate: 1–3% — allows for meaningful participation without overconcentration.

- Risk‑tolerant traders: up to 5% tactical position — only if thesis‑driven triggers (active RLUSD adoption, reclaim of key chart levels) occur.

- Always define an explicit stop or thesis exit: breakpoints could be a decisive close below critical support levels or failure of on‑chain adoption metrics.

Platforms such as Bitlet.app that offer installment and P2P services can be useful for dollar‑cost averaging, but remember that position sizing and stop discipline are the real risk controls.

Practical checklist before adding XRP to a portfolio

- Confirm on‑chain RLUSD activity: look for circulation, exchange pairs, and AMM liquidity.

- Validate technical levels: identify immediate support and the level that would invalidate your trade idea.

- Monitor validator composition and governance announcements; see whether decentralization metrics are improving.

- Size your position according to risk tolerance and set explicit stops or time‑based re‑evaluations.

- Use volume‑weighted metrics and order‑flow (not headlines alone) to validate breakout strength.

Conclusion

The post‑settlement story for XRP is more complex than a single headline can capture. Legal clarity removed a major overhang, but it did not instantly create sustainable demand — and early euphoria gave way to technical weaknesses and sober questions about real usage. The 10M RLUSD mint is an important development because it anchors an on‑chain use case and can catalyze liquidity if it circulates; however, adoption will determine whether this is transformative or merely symbolic. Meanwhile, decentralization debates matter because perception affects institutional adoption.

For most retail and intermediate investors, the prudent path is measured exposure with clear risk controls. Treat any XRP allocation as a speculative, thesis‑driven position: small, defined, and actively monitored for both on‑chain adoption signals and technical confirmations.

Sources

- "My 2026 prediction for XRP" — The Motley Fool: https://www.fool.com/investing/2026/01/23/my-2026-prediction-for-xrp-ripple-might-shock-you/

- "10,000,000 RLUSD minted on XRP Ledger — details" — U.Today: https://u.today/10000000-rlusd-minted-on-xrp-ledger-details?utm_source=snapi

- "XRP price breakdown: risk, hodler support" — BeInCrypto: https://beincrypto.com/xrp-price-breakdown-risk-hodler-support/

- "Ripple: XRP isn't breaking down yet, but sellers still haven't let go" — CryptoPotato: https://cryptopotato.com/ripple-xrp-isnt-breaking-down-yet-but-sellers-still-havent-let-go/

- "Ex‑Ripple CTO shuts down viral XRP rumors" — U.Today: https://u.today/not-a-valid-argument-ex-ripple-cto-shuts-down-viral-xrp-rumors-once-and-for-all?utm_source=snapi

For ongoing analysis of how on‑chain trends affect markets, readers might also track developments on broader rails like DeFi and cross‑market bellwethers such as Bitcoin; and for token‑specific updates, follow XRP.