Whales

A data-driven breakdown of the recent weekend memecoin surge and why PEPE, PI and DOGE outperformed. Learn how whale accumulation, tokenomics and CPI-driven rotation created momentum — and how active traders should size positions and hedge risk.

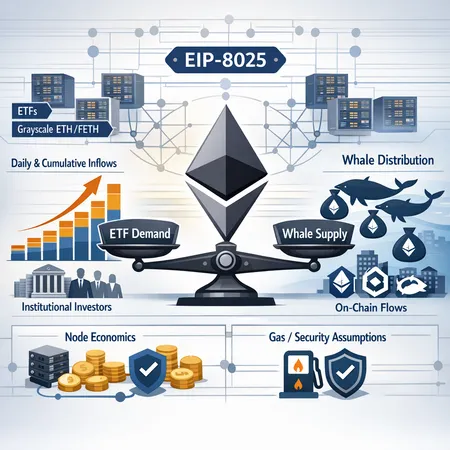

ETF inflows into ETH are rising even as many large wallets trim holdings. This piece unpacks that disconnect, weighs institutional accumulation versus whale sell-offs, and explains how EIP-8025’s shift to proof-based validation changes node economics and investor strategy.

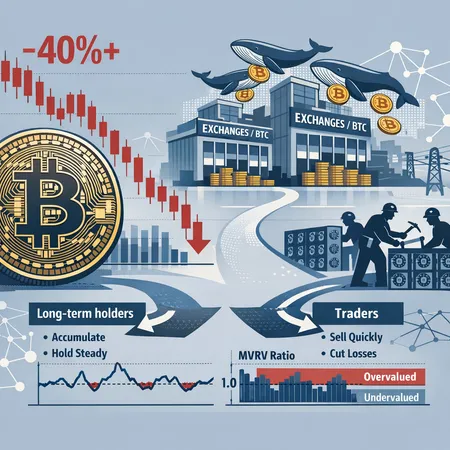

After a rapid 40%+ decline in BTC prices, investors must separate a tactical bounce from structural capitulation. This article analyzes the timeline, on-chain signals, whale selling and exchange inflows, miner and treasury implications, and concrete rules for positioning.

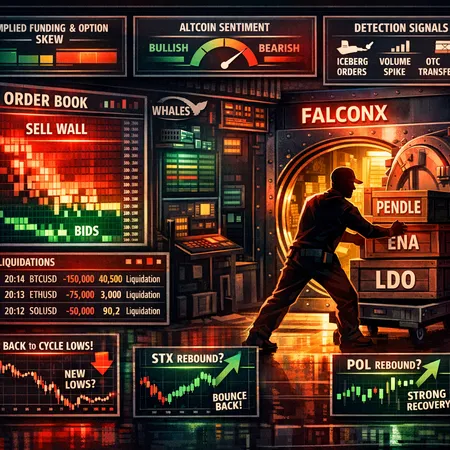

Large transfers of PENDLE, ENA and LDO to FalconX at prices below entry reframe how traders should read whale flows, order books and funding markets. This piece explains why big players use custodial/OTC counterparties, how those moves shape liquidity and derivatives, and practical signals traders can use to spot imminent exits.

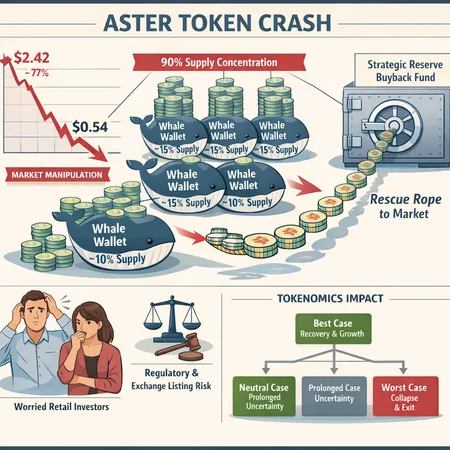

ASTER’s collapse from $2.42 to $0.54 exposed extreme supply concentration and prompted a Strategic Reserve Buyback Fund. This analysis breaks down the evidence, buyback mechanics, regulatory risks, and practical scenarios for retail holders.

A leverage-driven dump pushed XRP to a multi-month low, triggering roughly $72M in liquidations and nearly wiping a single whale. This piece quantifies the damage, maps likely support zones, and gives a trader-focused watchlist to spot accumulation vs. squeeze risk.

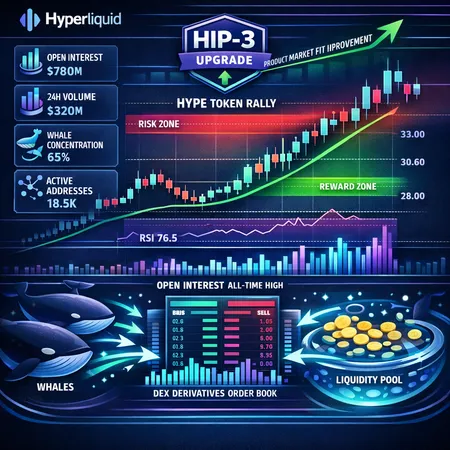

HYPE's sudden outperformance ties to HIP‑3-driven product changes, a surge in open interest and concentrated whale flows that reshaped DEX derivatives liquidity. This piece breaks down the on‑chain metrics, market structure, and practical sizing strategies for traders and LPs.

A closer look at recent whale accumulation, flows into liquid staking and the Ethereum Foundation’s new post‑quantum team shows why ETH is being re‑priced as a different institutional asset. This article breaks down on‑chain signals, liquidity dynamics and the custody/security decisions CTOs must consider for large ETH exposures.

A fresh market stress test combines large daily ETF outflows with on-chain warnings of fragile structure, while headline whales reportedly accumulate near $90k. This piece synthesizes flow data, on-chain signals, and institutional appetite to map plausible near-term BTC scenarios.

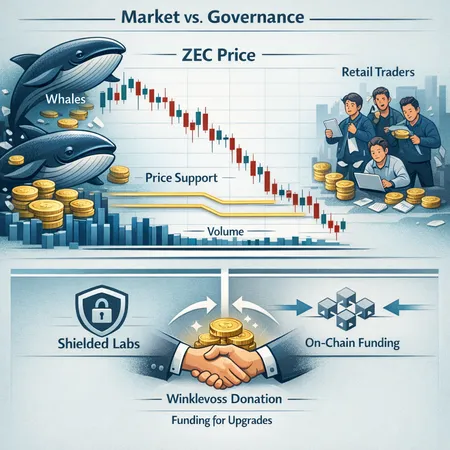

Zcash shows short-term price weakness while on-chain flows and governance moves diverge — notably a Winklevoss donation to Shielded Labs. This article breaks down technical support, whale accumulation, the governance rift, and tradeable scenarios for intermediate traders.