Token Unlocks

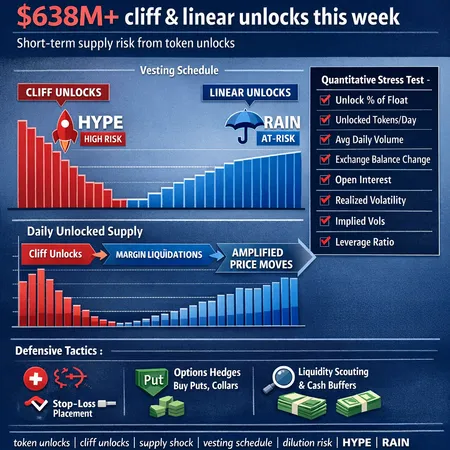

A practical, repeatable framework for modeling short-term supply risk from scheduled token unlocks and defending NAV in stressed markets. Includes a quantitative checklist, scenario math, and tactical hedges for tokens like HYPE and RAIN during this week's $638M+ unlock window.

A comprehensive, on‑chain and legal synthesis of XRP's market structure after the SEC vs Ripple closure and ahead of the Feb 1, 2026 1B XRP escrow unlock. Actionable scenarios and risk controls for active traders and long‑term holders.

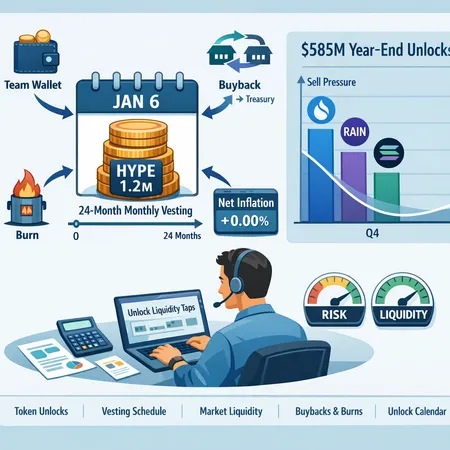

A focused explainer on Hyperliquid’s Jan 6 team vesting of 1.2M HYPE and the wider $585M token‑unlock calendar. Practical modeling, net‑inflation math, and disclosure best practices for PMs, treasury teams, and traders.

A late‑2025 rotation back into BTC and ETH has elevated bitcoin dominance and thinned altcoin liquidity, placing large‑cap tokens under renewed pressure. This briefing unpacks the drivers, highlights vulnerable names (SHIB, DOGE, UNI, PI), and gives a practical framework to spot the next altcoin trough‑to‑trend reversal.

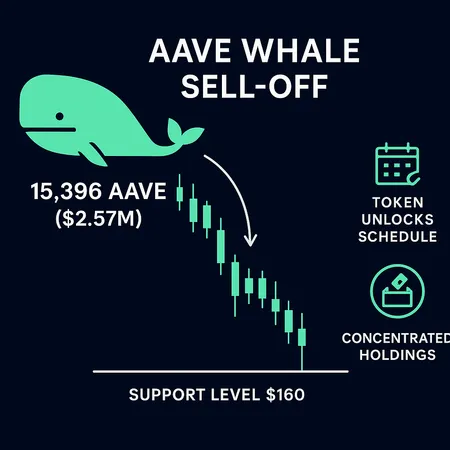

A 15,396 AAVE ($2.57M) whale sale has renewed downside risk for AAVE, putting the $160 support level in focus. Traders and governance participants should track exchange inflows, unlock schedules and on-chain concentration to gauge whether this was an isolated dump or the start of a broader capitulation.

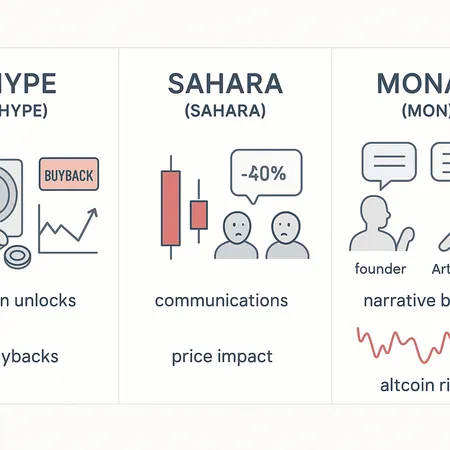

Token unlocks often reshape altcoin markets—this case study compares HYPE’s buyback response, SAHARA’s panic-driven plunge, and MON’s public narrative clash to extract a practical due-diligence playbook. Learn how unlock schedules, on‑chain signals and team communications change price impact and altcoin risk.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility