Is Bitcoin's 40%+ Drawdown a Buy or the Start of Deeper Capitulation?

Summary

Executive snapshot

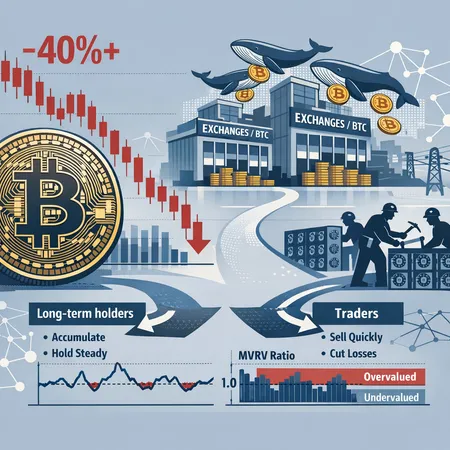

The market just lived through a violent episode: BTC fell more than 40% in a short span, driven by a mix of large whale selling, elevated exchange inflows and weak short-term on-chain signals. For many portfolio managers and intermediate investors the central question is binary but consequential — is this a buying opportunity or the opening chapter of a deeper capitulation cycle? This article breaks the timeline down, reviews the on-chain diagnostics that distinguish a final capitulation from an extended bear, examines how whale selling and exchange deposits changed market mechanics, explains the implications for miners and BTC treasury firms, and closes with tactical rules for long-term holders and traders.

For context, Bitcoin remains the primary bellwether for crypto risk assets, and platforms like Bitlet.app increasingly see clients ask for playbooks when drawdowns spike.

Timeline of the sell-off: compressed but instructive

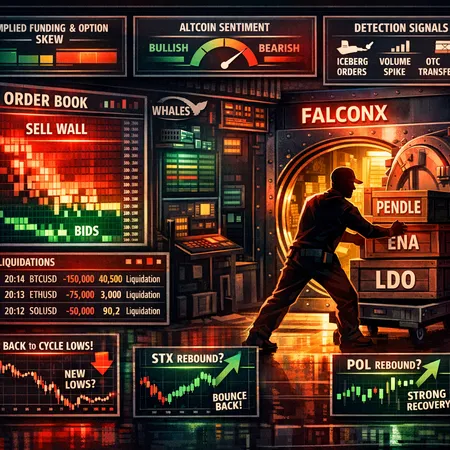

The price contraction began with increased selling pressure across several sessions and accelerated when large addresses began moving inventory onto exchanges. One widely reported incident involved a concentrated whale sell-off that coincided with a decisive breach of a key support zone, which news coverage tied to a ~50,000 BTC movement tied to large wallets at the time of the dip as reported by Coinspeaker. That dump catalyzed algorithmic selling, liquidations in derivative markets, and momentum-driven stops.

At the same time, exchange inflows spiked — particularly into major venues — increasing available liquidity for sellers. Reporting suggested massive inflows to Binance, which historically correlates with higher sell-side pressure when deposits are concentrated Blockonomi documented these inflows and their relationship to price pressure. In short: large-address selling + exchange supply = a cascade.

Which on-chain indicators separate a final capitulation from an ongoing bear?

No single metric declares “capitulation.” Rather, look for a cluster of regime-shifting signals that historically accompany final bottoms versus those that persist in multi-month bears.

Signals consistent with a final capitulation

- Realized losses spike: a dramatic rise in realized losses (older coins sold at a loss) as weak hands are flushed out. A capitulation often shows a short, sharp surge in losses followed by a period where major selling subsides.

- Exchange netflows reverse: after a prolonged inflow, a decisive and sustained net outflow (coins leaving exchanges) signals buyers are accumulating long-term rather than sellers provisioning liquidity.

- SOPR and MVRV bottom: the Spent Output Profit Ratio (SOPR) moves below 1 and then reverts; MVRV (market value to realized value) hits low percentiles that historically align with multi-year lows.

- Active supply dormancy increases: coins that move to cold wallets and stop circulating suggest stronger holder conviction.

Signals consistent with an ongoing bear market

- Persistently high exchange balances: exchanges remain net custodians of large BTC amounts for weeks to months, keeping sell-side optionality high.

- Incremental LTH (long-term holder) selling: increases in on-chain movement of older cohorts into exchanges or short-term addresses — not a single spike but sustained depletion of long-holder reserves.

- No meaningful capitulation spike in leverage metrics: liquidations and derivatives stress continue episodically rather than peaking and subsiding.

On-chain analysts who argue the decline may be part of a longer bear progression point to continuing structural selling and the absence of classic capitulation signatures NewsBTC covers on-chain views suggesting the decline may be deeper. The right read requires watching how the above indicators evolve over the next several weeks.

Whale selling and exchange inflows: why they matter more now

Large wallets and exchange deposits aren’t just headline fodder — they change market microstructure.

- Whales concentrate volatility: a single large sell order or a series of scheduled outs can overwhelm passive liquidity and trigger stop cascades. Coinspeaker’s reporting of a concentrated sell-off tied to tens of thousands of BTC illustrates how one wallet’s decisions reverberate across order books and algorithmic strategies.

- Exchange inflows create a latent supply overhang: when exchanges accumulate BTC, they make it easier for sellers to execute without chasing OTC desks. Blockonomi’s coverage highlighted how record inflows into top exchanges coincided with the price breakdown; when custody of that BTC is on exchange, the market’s capacity to absorb new sell-side flow shrinks.

Importantly, not all inflows equal intent to sell. Exchanges also receive deposits for margin collateral, withdrawals routed through custodians, and migration between venues. But unusually large, persistent inflows during a downtrend statistically correlate with increased short-term selling risk.

Implications for miners and BTC treasury firms

Miners and corporate treasuries are natural suppliers of BTC when prices drop below operational or corporate thresholds.

- Miners: their selling cadence depends on breakevens (power costs, efficiency), cash reserves, and hedges. If price remains below the marginal miner’s breakeven for an extended period, miners may increase spot sales or accelerate equipment financing sales. That said, modern public miners increasingly hedge and diversify revenue streams; the net on-chain miner sell pressure needs to be paired with hash-price metrics to judge sustainability.

- Treasury firms: companies that hold BTC as a reserve (or treasury firms that manage large allocated holdings) face accounting and liquidity decisions. Some may choose to rebalance into fiat to cover short-term obligations or to lock in losses when volatility threatens business operations. Large treasury sell events can trigger the same mechanical cascade as whale sales.

In this cycle, reported exchange inflows and publicized whale dumps likely pressured price into levels where both miners and treasury holders reassess marginal selling. That dynamic prolongs stress unless exhausted or offset by genuine accumulation.

How to read the conflicting narratives in the press

There are two common narratives right now: (1) ‘this is the final capitulation and a rare buying window’ and (2) ‘this is an unfold of a deeper bear market, not the bottom.’ A balanced stance treats both as hypotheses to be tested against data. For example, some mainstream pieces question whether Bitcoin is a buy after large plunges and summarize historical rebounds and risk-adjusted opportunities see a recent retrospective take. At the same time, on-chain research groups pointing to sequential weakness argue the decline may not yet meet structural capitulation criteria NewsBTC summarizes that on-chain reading.

Your edge is not choosing sides prematurely but defining objective, observable thresholds that would confirm one view over the other.

Tactical rules: long-term holders vs traders

Below are pragmatic, evidence-based rules tailored for intermediate investors and portfolio allocators.

For long-term holders / portfolio allocators

- Reaffirm strategic allocation ranges: do not let short-term prices dictate permanent allocation beyond your long-term plan. Use pre-defined bands (e.g., 1–5% to 10% of portfolio depending on risk budget) rather than emotional increases.

- Dollar-cost average (DCA) with graded increments: break planned new buys into tranches (e.g., 5–10 tranches) and buy on time or price thresholds. Consider increasing cadence if on-chain capitulation signals flip (e.g., sustained exchange outflows, SOPR reversion).

- Hold size sizing guardrails: cap any single incremental buy to a fixed percentage of total crypto allocation to avoid temptation to “catch the bottom.”

- Use optionality instead of all-in: consider callable structured products or buying long-dated options when available to asymmetrically benefit from upside while limiting downside.

For tactical traders and portfolio managers

- Wait for confirming on-chain signs for larger size: before committing meaningful alpha capital, look for coordinated signal flips (exchange inflow exhaustion, realized-loss spike peaking, SOPR bottom). Without these, treat rallies as bear-market relief bounces.

- Pyramid into positions with changing conviction: initiate small exposure on the first tactical bounce, add only after on-chain or price-confirmation thresholds are met (e.g., daily close above a reclaimed range or sustained outflows off exchanges).

- Hedge active positions: use options or inverse products to hedge against renewed downside if your exposure is directional; consider collar strategies around new entries.

- Active risk controls: tighten position limits, use time-based stop rules (e.g., reduce leverage after X% adverse move), and stress-test liquidity under rapid outflow scenarios.

Concrete thresholds (examples, not advice): consider materially increasing exposure only after at least two of the following occur within a multi-week window — sustained exchange net outflows, realized losses crest then fall back, and SOPR begins to revert above 1 on consolidated timeframes.

Practical checklist for the next 30–90 days

- Monitor exchange balances daily and check whether inflows reverse to outflows.

- Watch cohort selling (older coins) — increasing movement of >1-year-old coins to exchanges is a red flag.

- Track miner revenue vs estimated breakevens; rising miner sell pressure without reduction in difficulty or power cost is bearish.

- Confirm macro liquidity and risk appetite: derivatives funding rates, spot/derivative basis, and macro headlines can amplify moves.

- Keep exposure sizing disciplined and document triggers for adding or trimming positions.

Conclusion

A 40%+ drawdown is jarring and historically creates both risk and opportunity. This episode was amplified by concentrated whale selling and large exchange inflows that materially increased short-term supply. Whether this is a buy or the start of deeper capitulation depends on how a bundle of on-chain metrics evolves — especially exchange netflow dynamics, realized losses and long-term holder behavior. Portfolio managers should avoid binary thinking: define objective thresholds, use graded entries, hedge tactically, and respect miners’ and treasuries’ supply incentives. For long-term allocators, disciplined DCA and allocation guardrails remain sensible; for traders, wait for confirming on-chain regime changes before adding size.

Where relevant, triangulate these signals with reporting and on-chain commentary rather than headlines alone — the recent coverage and chain-analytics pieces provide complementary lenses on the same episode and should inform, not replace, your evidence-based positioning. Platforms that combine trading and custody data, including risk-management tools such as those on Bitlet.app, can help implement these rules operationally.

Sources

- https://www.fool.com/investing/2026/02/04/crypto-crash-is-bitcoin-a-buy-after-its-40-plunge/

- https://www.newsbtc.com/bitcoin-news/bitcoin-80000-final-capitulation-event-checkonchain/

- https://blockonomi.com/bitcoin-selling-pressure-intensifies-as-binance-records-massive-inflows-amid-price-correction/

- https://www.coinspeaker.com/bitcoin-dips-below-73k-amid-50000-btc-whale-sell-off-can-the-end-of-the-us-shutdown-boost-the-market/