Whale Accumulation

GameStop's transfer of its entire 4,710 BTC stash to Coinbase Prime triggered debate: custodial housekeeping or prelude to a corporate exit? This article parses the timeline, motives, market signal, ETF outflows, whale accumulation, tax/regulatory angles, and practical trading scenarios.

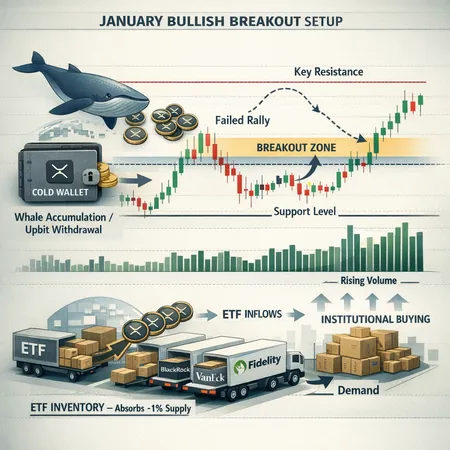

A comprehensive, on‑chain and legal synthesis of XRP's market structure after the SEC vs Ripple closure and ahead of the Feb 1, 2026 1B XRP escrow unlock. Actionable scenarios and risk controls for active traders and long‑term holders.

A rapid, multi-day wave of spot-Bitcoin ETF inflows—led by large managers—has changed the risk calculus for BTC. This piece ties those flows to whale accumulation, exchange balances, key technical thresholds near $97–101K, and scenarios that could validate or stall a move to $100K.

Two recent on‑chain reports show 414,935 LINK ($5.48M) moved into whales and two wallets adding ~409,935 LINK—what does this mean for price mechanics, oracle adoption narratives, and quant trading signals? This piece breaks down on‑chain evidence, wallet clustering, exchange flows, and practical trade hypotheses for LINK.

54 straight days of ETF inflows have refocused attention on an ambitious $2.70 XRP price target. This article synthesizes ETF flow dynamics, whale activity, new spot venues like FXRP, and near‑term liquidity risks to judge whether that target is realistic.

XRP’s January rally is being driven by concentrated whale flows, rising on‑chain volume and spot‑ETF demand that reportedly absorbs ~1% of supply — a mix that creates a textbook breakout setup but also clear failure scenarios. This post breaks down the on‑chain signals, ETF mechanics, technical levels to watch, and practical trading/position‑sizing rules for 2026.

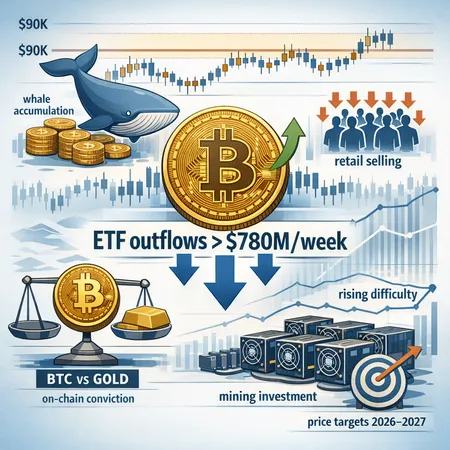

At the close of 2025, on-chain signals show large Bitcoin holders accumulating in the $80k–$90k band even as weekly spot ETF outflows topped $780m. This piece synthesizes whale metrics, ETF flow dynamics, macro narratives and miner behavior to frame plausible price trajectories for 2026–2027.

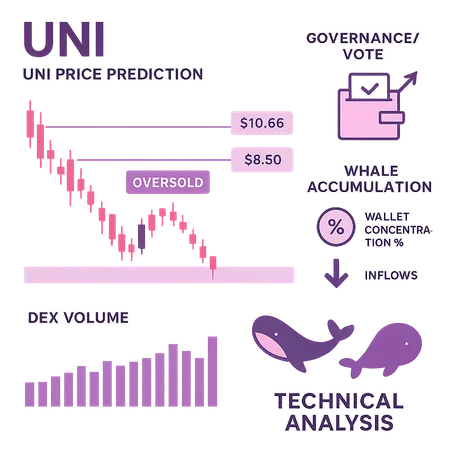

A focused, evidence‑based UNI trade thesis: oversold technicals, whale accumulation and improving DEX volume together open an $8.50–$10.66 recovery window — here’s the setup, on‑chain context, and a practical risk plan for intermediate traders.

ChainLink has experienced a notable price surge recently, driven largely by whale accumulation and strategic movement from the Chainlink Reserve. Understanding these factors sheds light on the price dynamics and future potential of LINK tokens.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility