Why Ethereum Looks Structurally Undervalued — Fusaka, Staking, and ETF Flows Could Force a Re‑Rating

Summary

Executive summary

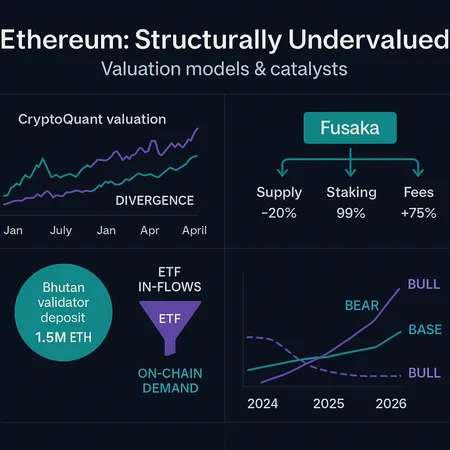

Across several valuation frameworks aggregated by CryptoQuant, Ethereum shows signs of being structurally undervalued relative to historical norms and alternative asset benchmarks. Those models — which compare market cap to on‑chain activity, realized value, and supply‑adjusted ratios — put ETH below where rational long‑term pricing might sit today. With the Fusaka upgrade approaching and evidence of larger public staking commitments (Bhutan’s recent deposit provides a timely example), institutional flows and potential ETF interest could materially change supply dynamics and force a market re‑rating. For investors and on‑chain analysts, the question is less if Fusaka matters and more how the combination of supply compression and demand reallocation plays out in price paths.

What the valuation models are saying (and why it matters)

Recent coverage summarizing CryptoQuant’s cross‑model work highlights that Ethereum appears cheap on multiple fronts — not just a single ratio outlier. Those valuation methods include realized capitalization comparisons, activity‑adjusted valuations (think NVT variants), and models that incorporate staking and fee burn dynamics. When a cohort of models consistently points in the same direction, it increases the signal‑to‑noise ratio for a structural mispricing: either the market is efficiently discounting a long‑term negative change, or demand/supply drivers are about to shift.

This matters because Ethereum’s market structure is unique: it is both a chain of broad utility (DeFi, NFTs, smart contracts) and an increasingly scarce asset due to staking and EIP‑1559 style fee burns. When on‑chain activity, institutional demand, and protocol upgrades move together, valuation models that previously read cheap can rapidly become self‑fulfilling as capital reallocates.

Fusaka upgrade: supply, staking, and fee mechanics

The Fusaka upgrade (coverage and preview here) isn't just another hard fork; it bundles changes that tweak how fees are dealt with, validator economics, and the incentives to stake versus hold liquid ETH. While specifics and final parameterization will determine magnitude, the broad themes are clear: anything that increases validator security, reduces voluntary withdrawals friction, or improves fee predictability can push more ETH into long‑duration staked positions. That reduces the liquid float available to traders and market makers.

Equally important are marginal changes to fee dynamics. Even incremental improvements to fee burn effectiveness or predictability heighten the asymmetry between holding and using ETH as collateral or gas. Higher protocol capture of transaction value (or clearer long‑term fee sinks) enhances the scarcity narrative embedded in many valuation models — the same models CryptoQuant used to flag undervaluation. For readers modeling supply, treat Fusaka as a credible catalyst that accelerates the lockup rate of ETH and thus amplifies any demand shock.

Evidence of growing public and institutional staking demand

Large, visible validator deposits serve as both demand and signaling events. The reported nearly $970k stake from Bhutan shows that sovereign or quasi‑sovereign actors are willing to commit meaningful capital to Ethereum’s validator set, and that public entities can and will lock capital into staking for yield and participation. This is mirrored by a broader trend of institutions and custodians building staking products that convert passive treasury capital into staked positions.

From a supply viewpoint, this matters in two ways. First, deposited ETH is out of liquid circulation; it cannot be traded or used as margin while locked. Second, institutional participants often have longer time horizons and lower marginal liquidity needs, meaning capital becomes less responsive to short‑term price moves. When you combine incremental institutional staking with retail staking, the pool of tradable ETH tightens — an input many valuation models use implicitly or explicitly.

ETF inflows and market structure: the demand side of the equation

ETF interest and custodial products reshape how capital accesses ETH. ETF‑led flows can be persistent and mechanically buy on inflow days, creating price support independent of spot traders' behavior. Coverage of recent ETF‑driven dynamics and a short technical pullback illustrates that while flows can be choppy, the underlying bid is structural when large pools of capital choose passive exposure.

Crucially, ETFs and custodial staking can act in concert. Some ETFs may directly or indirectly steward ETH into staking strategies, or at least channel capital into custodial ecosystems that offer staking overlays. That converts ‘flow’ demand into locked demand in a way traditional spot liquidity does not. The combined effect is that the same dollar of institutional participation removes more liquid ETH than before — an amplifying multiplier for valuation models that account for supply‑adjusted metrics.

Putting it together: why undervalued becomes actionable

Valuation models tell you where value should be; protocol changes and demand flows tell you how price could get there. When models converge (CryptoQuant’s signal), upgrades add credible supply compression (Fusaka), and capital flows look likely to increase (ETF interest + public staking), the market is set up for a re‑rating. That re‑rating can be gradual as buy pressure outpaces newly available supply, or rapid if a catalyst concentrates flows in a short window.

Practically, analysts should reweight models that incorporate supply lockups, burn trajectories, and institutional demand curves. Traditional trailing multiples or short‑term technicals will understate fair value if they ignore the increase in non‑tradable ETH.

Practical price‑path scenarios (illustrative)

Below are three condensed scenarios for ETH’s price path over a 6–18 month horizon. Numbers are illustrative to show mechanics; treat them as frameworks rather than precise forecasts.

Conservative (20% probability): Fusaka passes but has only marginal staking uptake; ETF approvals are delayed. Liquid supply tightens slightly, but macro liquidity and risk‑off sentiment keep upside muted. Result: ETH grinds higher toward fair value implied by activity models, outperforming Bitcoin modestly but staying range‑bound.

Base (60% probability): Fusaka increases staking incentives and fee predictability; institutional staking grows (including more sovereign and custodian deposits). ETF flows begin to materialize or are anticipated, creating steady buy pressure. Liquid supply tightens enough that demand slightly outpaces supply — ETH re‑rates to the mid‑range implied by CryptoQuant models over 6–12 months.

Bullish (20% probability): Fusaka acts as a tipping point — staking participation accelerates, multiple large institutional and sovereign wallets lock ETH (visible on‑chain), and ETF flows compound. The market experiences a fast re‑rating as scarcity concerns collide with FOMO. Result: ETH reaches valuation levels justified by more aggressive supply‑adjusted models within a compressed timeline.

For long‑term investors, the base scenario is the most actionable: build positions in tranches, monitor on‑chain staking ratios, and watch custodial inflow announcements that signal structural demand.

Key metrics to monitor (on‑chain and off‑chain)

- Staked share of total supply and weekly net flows into staking contracts.

- Exchange net flows (withdrawals from exchanges reduce available sell pressure).

- Fee burn rate and base fee behavior post‑Fusaka (effective fee sink activity).

- Institutional custody and ETF flow announcements; track cumulative ETF AUM where available.

- Realized‑cap based valuation and NVT variants — watch divergence vs. market cap.

These metrics let analysts detect whether the market is moving from a model‑driven signal to a price response.

Risks and counterarguments

- Upgrade risk: Parameter changes or delayed implementation could blunt Fusaka’s expected effect. Markets price certainty — delays matter.

- Macro liquidity: A broad risk‑off period can overwhelm on‑chain structural positives; flows are necessary to realize re‑rating.

- Substitution effects: Competing L1s gaining traction in specific verticals could dampen Ethereum’s activity-based valuations.

Counter to the undervaluation thesis would be sustained outflows from custodial staking or regulatory moves that restrict institutional access; both would increase available supply and pressure multiples downward.

Conclusion

CryptoQuant’s multi‑model signal that ETH is undervalued deserves attention because it aligns with concrete supply and demand narratives: Fusaka can accelerate staking and fee dynamics that tighten liquid supply, while visible public stakes and ETF‑style flows change how capital arrives. For long‑term investors and on‑chain analysts, the pragmatic play is to monitor staking ratios, custodial inflows, and fee sink behavior while building positions in tranches — the timing and magnitude of a re‑rating will depend on how quickly supply is removed and how persistent institutional demand proves to be. For detailed tracking, integrate these on‑chain indicators alongside macro and ETF flow data and remember that platforms such as Bitlet.app make it easier to think about custody and staking when modeling institutional behaviors.

Sources

- Summary of CryptoQuant valuation findings: Ethereum’s real value under debate again

- Fusaka upgrade preview and catalysts: Ethereum’s Fusaka upgrade, Grayscale, Chainlink — Crypto week ahead

- Example public staking deposit: Bhutan stakes $970k in Ethereum validator program

- ETF‑led flows and technical context: ETH price pullback from $3,100 rally tests key support levels

For broader context on activity dynamics, see research referenced above and ongoing on‑chain reporting from CryptoQuant and custodial flow trackers.

For perspective on cross‑market behavior, remember that for many traders, Bitcoin remains the primary bellwether, while protocol‑level demand narratives often play out most clearly on DeFi stacks.