Tokenomics

A recent linked-wallet dump of PUMP tokens exposed how concentrated tokenomics and coordinated wallets create asymmetric exit risk. This article explains how to spot linked-wallet behavior, practical safeguards for traders and projects, and market lessons as capital rotates toward Bitcoin.

ZeroLend’s wind-down exposes how fragile small, multi-chain lending protocols can be when TVL, token incentives and cross-chain complexity are misaligned. This article breaks down the failure modes and gives a practical stress-test checklist for projects, DAOs and LPs.

A data-driven breakdown of the recent weekend memecoin surge and why PEPE, PI and DOGE outperformed. Learn how whale accumulation, tokenomics and CPI-driven rotation created momentum — and how active traders should size positions and hedge risk.

Grayscale’s move to convert its AAVE trust into a 1940 Act-style spot ETF raises complex questions about custody, liquidity, and governance. The SEC review will shape not only AAVE tokenomics but the roadmap for future altcoin spot ETFs.

LayerZero's Zero promises a purpose-built L1 for institutional settlement backed by Citadel, DTCC and ICE — sparking a notable ZRO rally. This article evaluates the technical pitch, partner implications, token-market response and the open questions ahead of a fall 2026 launch.

Several altcoins have outperformed during recent BTC-led sell-offs. This article examines MYX Finance, XMR and SHIB to determine whether their strength is idiosyncratic or an early sign of market rotation.

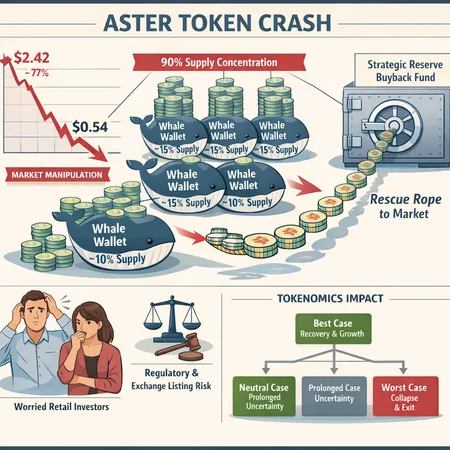

ASTER’s collapse from $2.42 to $0.54 exposed extreme supply concentration and prompted a Strategic Reserve Buyback Fund. This analysis breaks down the evidence, buyback mechanics, regulatory risks, and practical scenarios for retail holders.

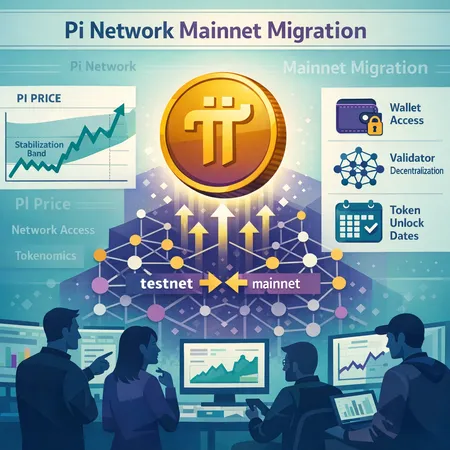

A deep-dive case study of Pi Network’s recent mainnet migration, the drivers behind the PI price rebound and early stabilization signs, and practical guidance for projects communicating migrations to avoid sell-the-news dynamics.

A recent 60%+ surge in GHOST highlights renewed interest in privacy tooling on Solana. This explainer breaks down the catalyst, how Solana supports privacy dApps, tokenomics and liquidity risks, on-chain checks for sustainability, and implications for SOL price outlook.

This article tests the provocative thesis that XRP could displace Bitcoin as the dominant liquid crypto during a global liquidity crunch, weighing Jake Claver’s ‘XRP Domino Theory’ against current market signals and risks.