Institutional On‑Ramp to XRP: Quantifying 803.78M Locked in Spot ETFs, Evernorth’s XRPN, and Price Scenarios

Summary

Executive summary

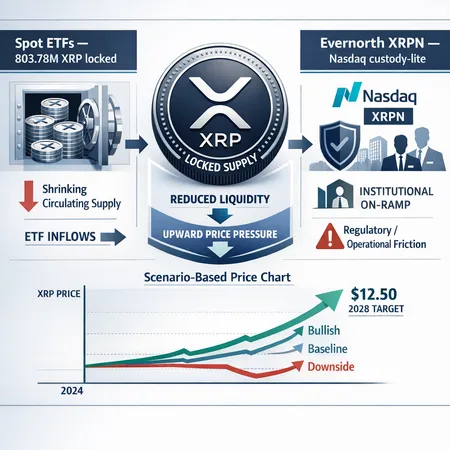

Institutional access to XRP is changing along two vectors: spot ETFs that lock token supply, and broker‑friendly equity wrappers such as Evernorth’s proposed XRPN which aim to circumvent custody roadblocks. On‑chain reporting shows 803.78 million XRP already held inside spot ETF structures — a figure worth quantifying against circulating supply and order‑book liquidity. Meanwhile, sell‑side forecasts (including Standard Chartered’s $12.50 2028 target) are contingent on much broader institutional adoption than today's flows imply.

This piece breaks down ETF locking mechanics, translates 803.78M XRP into a free‑float context, evaluates Evernorth’s XRPN as a custody‑lite on‑ramp (with practical frictions), and lays out three scenario models to help allocators judge whether institutional access is likely to materially reprice XRP.

How spot ETFs lock XRP: mechanics and the 803.78M figure

Spot ETFs that hold crypto operate like commodity ETFs: the fund custody holds the underlying tokens and issues shares to market participants. Creation/redemption is typically done in-kind with authorized participants (APs), and the ETF’s wallets are custodial — the tokens are effectively removed from daily spot market circulation while held on the fund’s ledger.

On‑chain analytics cited by u.today indicate 803.78M XRP is now held by ETF structures (u.today report). That on‑chain tally is important because it’s a concrete, verifiable reduction in the pool of immediately tradable tokens.

What 803.78M XRP means in the context of supply and float

XRP’s maximum issuance sits near 100 billion tokens; market trackers typically estimate circulating supply in the low‑50 billions today (exchange on‑chain reconciliations and escrow releases change the exact number modestly). Using a conservative circulating estimate of ~52 billion XRP, 803.78M represents roughly 1.5% of circulating supply. If you measure against a slightly larger float (say 53.5B), the share falls to about 1.5% → 1.6%; measured against total supply it is ~0.8%.

Why percentage of float matters: institutional demand concentrated into ETFs removes marginal sell‑side liquidity and shallow order‑book depth in the short term. A 1.5% reduction in float does not, by itself, force a 10x price move — but it is non‑negligible, and its price effect magnifies if inflows continue, if more tokens are sequestered, or if lending/liquidity providers cannot quickly fill the gap.

Liquidity effects: order books, lending markets and price discovery

Locked ETF supply reduces the tokens available for market makers, margin desks, and lending pools. The immediate effects are:

- Order‑book thinning: large bids or sells move price more when top‑of‑book depth is lower.

- Higher slippage for block trades: allocators executing multi‑million dollar trades face worse execution quality or higher transaction costs.

- Lower available collateral for lending/repo: fewer tokens in lending pools can elevate borrowing costs (if demand for shorts or leverage persists).

These mechanics mean ETFs act as a structural demand sink. But the magnitude of price impact depends on the scale and persistence of inflows and the speed at which market makers, exchanges and OTC desks supply alternate inventory.

Evernorth’s XRPN: a custody‑lite institutional vehicle

Evernorth has proposed an equity vehicle (ticker: XRPN) to list on Nasdaq that would represent institutional exposure to XRP without requiring clients to manage private keys. Coverage of the proposal and the vehicle’s rationale is summarized in Blockonomi’s reporting (blockonomi).

Why XRPN matters to allocators

For many allocators, the custody problem is the primary blocker: regulatory, operational, and insurance hurdles make direct crypto custody costly. An NASDAQ‑listed XRPN would let a buy‑side allocator obtain XRP exposure through established broker‑dealer channels, simplifying compliance, custody oversight, and inclusion in model portfolios.

Put simply: XRPN is a distribution and access layer. It can open tax‑favored accounts, custody via broker custodians, and simplify KYC procedures compared to native spot holdings — that same ease helped accelerate ETF adoption in Bitcoin and Ethereum markets.

Potential regulatory and operational frictions for XRPN

However, XRPN is not frictionless:

- SEC/FINRA scrutiny: an equity wrapper tracking XRP must meet U.S. securities regulations and ongoing disclosure requirements; if regulators view the underlying differently across jurisdictions, distribution may be limited.

- Tracking error and NAV transparency: institutional allocators require clear intraday NAV mechanics and tight tracking; any NAV slippage will disincentivize larger allocations.

- Custodian counterparty risk: the custodian must provide auditable proofs and insurance; questions over custody providers or complex segregation arrangements can slow flows.

- Market microstructure mismatch: if XRPN creation/redemption mechanics aren’t tight, large flows could create arbitrage windows that discourage primary APs from making markets.

All of these can blunt XRPN’s near‑term growth, even as the product reduces the psychological and operational barriers to institutional XRP allocations.

Modeling price impact: three scenarios

Below are three simplified, transparent scenarios to illustrate how locked supply (803.78M) plus XRPN distribution might influence price. These use a basic supply‑shock framework and explicit inflow assumptions; they are not forecasts but tools for stress testing allocation thinking.

Assumptions common to models

- Circulating supply baseline: 52 billion XRP (conservative mid‑range). 803.78M = ~1.5% lock.

- Price impact from a static supply shock is approximated by a simple inverse‑float elasticity: if free float shrinks x%, and demand is constant, price change ≈ 1/(1−x) − 1 (a first‑order view).

- Institutional ETF inflows are represented as yearly notional USD inflows converted into XRP at prevailing market prices; sustained inflows further reduce available float as they are sequestered by custodial funds.

- This model does not include macro factors, network adoption changes, or major regulatory events — those can dominate outcomes.

Scenario A — Conservative: one‑time lock, minimal incremental demand

- Inputs: 803.78M locked, no further ETF inflows beyond current holdings. Market makers and lending desks refill liquidity over 1–3 months.

- Float reduction: ~1.5% permanent removal.

- Implied price effect (static): ~1.5% uplift (very small). Short‑term volatility may spike due to order‑book adjustment, but price returns toward prior levels as liquidity providers respond.

Takeaway: a single sub‑2% reduction in float is visible but not transformative by itself.

Scenario B — Base case: continued ETF inflows + XRPN adoption

- Inputs (annualized): ETFs + XRPN together absorb the token equivalent of 3–6% of float per year for 2 years (this is illustrative: it could be $2–10B in cumulative inflows depending on XRP price). The existing 803.78M is year‑one base.

- Float reduction after 2 years: ~5–8% cumulatively sequestered.

- Implied static price effect from float shrinkage: 5% lock → ~5.3% uplift; 8% lock → ~8.7% uplift. With market psychology and reduced liquidity, amplifying multipliers (2–4x) on these base uplifts are possible in rallies, implying 10–35% price moves in directional momentum phases.

Takeaway: sustained institutional absorption combined with easier access via XRPN can produce meaningful positive re‑rating, but this requires persistent flows and credible distribution.

Scenario C — Bull case: broad institutional allocation wave (sell‑side target pathway)

- Inputs: large institutional allocation wave over multiple years, equivalent to locking 20–30% of free float into ETFs/XRPN/other custody channels (this would require tens of billions in inflows, depending on price). Standard Chartered’s $12.50 target implies market assumptions of material demand growth and constrained supply dynamics compared with today.

- Float reduction: 20–30% locked; static price effect using the inverse‑float approximation implies a price uplift of 25–43% from the supply contraction alone — but this ignores demand growth, network fundamentals and positive feedback loops.

- In practice, if demand scales and market participants treat XRP as an institutional reserve or strategic allocation, feedback loops (FOMO, reduced shorting, higher leverage) can multiply price moves much beyond the static supply‑shock calculation — resulting in multi‑x price outcomes necessary to reach high sell‑side targets.

Takeaway: hitting multi‑dollar forecasts such as Standard Chartered’s $12.50 implies not just the current 803.78M lock, but sustained, large inflows and a structural re‑rating of XRP as an institutional asset.

Important caveats on modeling

- The simple inverse‑float model underestimates price impact when demand is growing (not constant). Real markets have dynamic liquidity provision, hedging strategies, and derivative markets that can attenuate or amplify moves.

- Large moves often self‑reinforce via media, repo costs, and counterparty behavior — which is hard to capture in static models.

- Regulatory shocks (e.g., custody rulings, ETF trading halts, taxation changes) can abruptly change the pathway.

Putting the pieces together: will institutional access reprice XRP materially?

Short answer: it can, but only if institutional demand scales substantially beyond the current locked quantum and if distribution channels like XRPN achieve broad uptake. The current 803.78M locked is an important plumbing signal — it demonstrates institutional vehicles can and do hold XRP — but in isolation it is a modest fraction of float (~1.5%).

Why institutional access matters beyond the raw number

- Distribution velocity: XRPN (and similar products) change the rate at which capital can flow into XRP. A faster on‑ramp increases the risk of sharper repricing.

- Investor base change: broker‑dealer access attracts pensions, insurers and wealth managers that traditionally allocate in large chunks and hold longer-term, reducing turnover.

- Structural scarcity vs. transitory demand: long‑term lockups (ETFs with limited redemptions, large treasury holdings) create more durable scarcity than short‑term trading buys.

Constraints that temper a straight line to $12.50

- The current locked amount is relatively small versus the float; meaningful repricing requires sustained large inflows.

- XRPN must clear regulatory, custody and market‑making hurdles to be widely usable.

- Market makers, OTC desks and exchanges will compete to provide liquidity; their ability to replenish float moderates extreme price moves.

Practical implications for institutional allocators and wealth managers

- If you need access today: ETFs and OTC desks provide routes, but expect transaction‑cost dispersion and slippage for large blocks. Platforms like Bitlet.app and traditional custody solutions will coexist as allocators decide between direct custody and wrapper exposure.

- If you need to model risk: stress‑test portfolios for scenarios in which ETF inflows compound and locked supply grows from 1–2% to 10–20% over 12–36 months — those are the regimes where repricing becomes dramatic.

- Operational checklist: confirm NAV mechanics, custodian insurance, AP creation/redemption rules for XRPN‑like products, and trading desk capacity to execute block flows without excessive slippage.

Bottom line

803.78M XRP locked in spot ETFs is a credible early signal of institutional interest and represents a measurable reduction in immediately tradable supply (~1.5% of float). Evernorth’s XRPN could be a catalytic distribution channel by removing custody frictions, but it faces regulatory and operational hurdles that could slow adoption.

Material repricing toward sell‑side targets like Standard Chartered’s $12.50 requires a multi‑year, large‑scale reallocation from institutional pools — far larger than the current locked amount alone. For allocators, the right framing is this: ETFs and XRPN increase the probability and speed of a re‑rating, but they do not guarantee it. Price outcomes will depend on sustained inflows, market‑making behavior, and regulatory clarity.

For those building allocation frameworks, treat ETF locking and XRPN adoption as scenario drivers — not deterministic outcomes — and size positions so you can withstand path‑dependent volatility while benefiting from potential structural scarcity.

Sources

- On‑chain ETF lock reporting: 803.78M XRP now locked in ETFs — u.today

- Evernorth XRPN Nasdaq proposal coverage: Evernorth targets Q1 2026 Nasdaq listing — Blockonomi

- Sell‑side price scenario discussion: Standard Chartered bullish outlook on XRP — Coinpaper

For further reading on market structure and institutional products, see analysis pieces on XRP and coverage of how tokenized ETFs shaped earlier cycles.