Spot ETFs

Cardano’s current valuation gap, staking utility, and improving market structure create a plausible pathway for ADA to attract institutional flows as spot ETFs broaden altcoin exposure. This article examines the mechanics behind that thesis, realistic upside, timeline, and a practical checklist for investors.

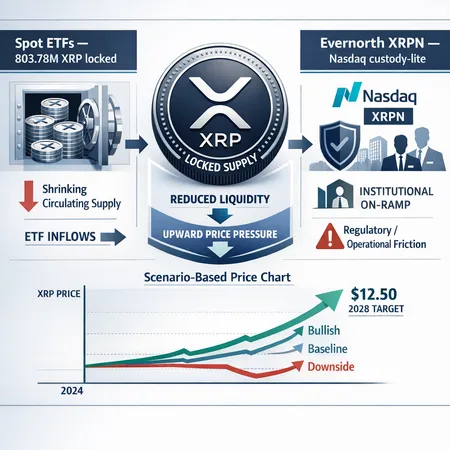

Spot ETFs have already locked a material tranche of XRP supply and Evernorth’s planned XRPN could lower custody friction — together these channels change the calculus for institutional allocators. This article quantifies the 803.78M XRP locked in ETFs, examines XRPN’s custody-lite mechanics and frictions, and models scenario-driven price implications up to sell‑side targets like Standard Chartered’s $12.50 forecast.

A data-driven look at how spot BTC ETF flows, corporate treasuries and exchange deposits pushed Bitcoin through $94.5–96k and what that means for a move toward $100k. Includes flow numbers, short-liquidation dynamics, futures positioning and macro risks for portfolio managers.

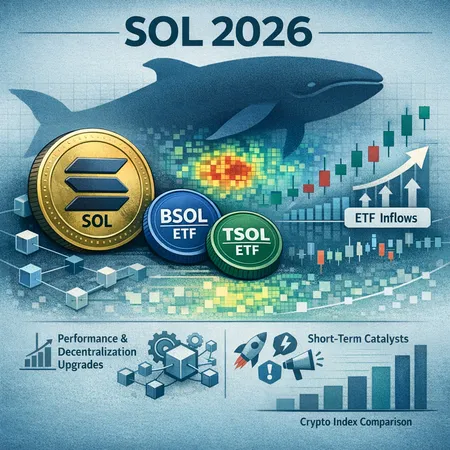

Solana enters 2026 with renewed institutional interest via spot ETFs, visible whale behavior, and planned protocol work that could change the risk-reward for short-term traders and allocators. This piece unpacks ETF assets and inflows, on-chain whale concentration, technical catalysts, and how index performance should reshape positioning for Q1 2026.

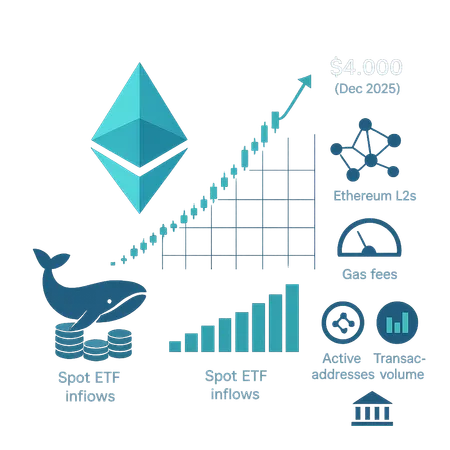

A confluence of whale accumulation, spot ETF inflows and a softer macro backdrop propelled ETH toward $4,000 in December 2025. This piece breaks down the on‑chain evidence, falling L2 fees, technical targets and practical allocation strategies for the next 6–12 months.

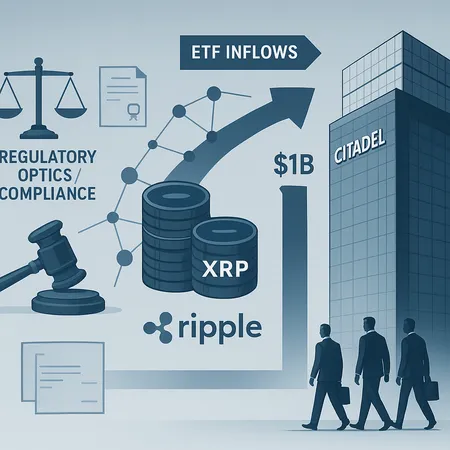

A wave of institutional capital — from Citadel’s investment to surging XRP spot ETF inflows — is reshaping XRP’s market structure and raising complex regulatory questions. This article breaks down the mechanics, liquidity effects, and compliance red flags institutional investors should weigh.

Spot Solana ETFs in the U.S. have seen an impressive $200 million inflow, signaling strong investor confidence and new opportunities. Discover how this boom impacts your investment strategy and how platforms like Bitlet.app can help you get involved with flexible crypto payment options.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility