Institutional Flows

Recent large spot-BTC ETF outflows have pressured prices and driven heavy unrealized losses in self-custody wallets. This article explains the mechanics, why slipping below $70k matters for market structure, and actionable hedges and liquidity rules for allocators and traders.

A run-through of macro, on‑chain and derivatives signals that could drive BTC toward the $50K zone, with a balanced checklist for traders on triggers, stops and re‑entry areas.

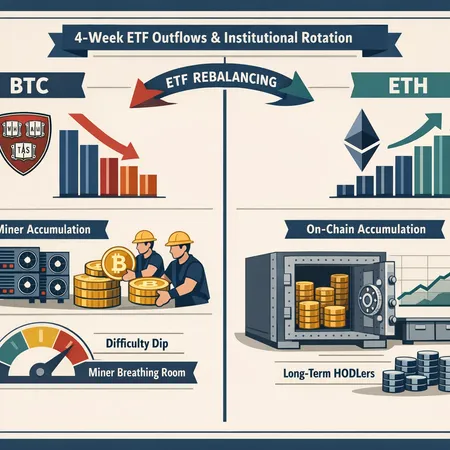

Universities and funds appear to be rebalancing away from BTC while miners and long‑term holders accumulate on‑chain. That divergence changes the effective supply curve — and should influence how allocators weight BTC vs ETH.

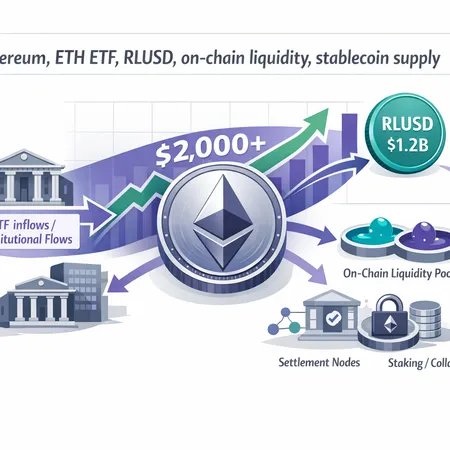

Renewed ETH spot‑ETF inflows helped ETH reclaim $2,000, while Ripple’s RLUSD expansion to ~$1.2B on Ethereum is shifting settlement and collateral dynamics. Together these forces are increasing on‑chain liquidity and altering medium‑term price scenarios for ETH.

Arthur Hayes argues that weak 2025 for crypto was a dollar-credit story, not a rejection of crypto narratives. This article unpacks his thesis, the channels that turn U.S. dollar liquidity into crypto returns, and actionable portfolio frameworks for allocators.

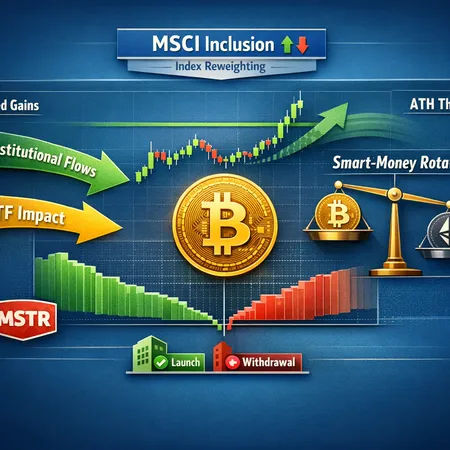

A wave of institutional flows, MSCI index tweaks and smart-money rotation are reshaping 2026’s price discovery for BTC and ETH. This article unpacks the mechanics, risks, and signals portfolio managers should watch.

Renewed US spot-BTC ETF inflows, dovish macro expectations and cleaner market plumbing have tilted the odds toward Bitcoin testing six figures in early 2026. Traders should weigh entry scales, hedges and concentration risks from large institutional holders like MSTR.

The Dec. 22–24 Deribit year‑end options expiry, a bullish 0.38 put‑call ratio and $27bn of notional open interest will collide with nearly $497m in weekly spot ETF outflows and rising margin longs to create concentrated year‑end volatility. This piece parses the expiry skew, liquidity clusters around $90K, institutional cues and practical hedges for traders and treasury managers.

A U.S. spot XRP ETF plunged after launch even as private buyers, regulated listings and on‑chain supply moves point to growing institutional demand. This piece reconciles the apparent contradiction and outlines what allocators should watch next.

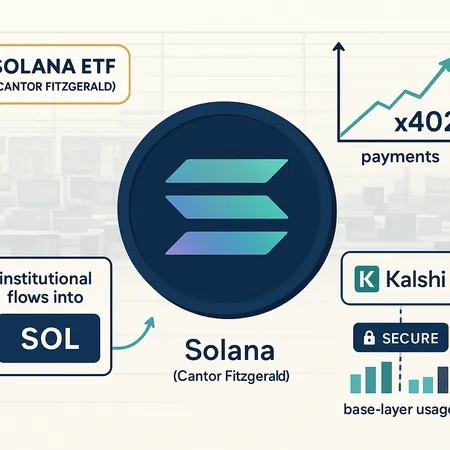

Recent institutional moves — Cantor Fitzgerald's Solana ETF stake, x402's payment-volume spike, and Kalshi’s tokenized contracts on Solana — suggest growing interest from regulated players. This piece evaluates whether these are durable signs of institutional adoption and higher base‑layer throughput usage for SOL.