Valuation

Recent ETF outflows and renewed debate about cryptographic risk (the so‑called 'quantum discount') raise a practical question for allocators: is the market already embedding a long‑term premium for quantum threats? This article dissects ETF flows, Willy Woo’s thesis on lost‑coins assumptions, miner/hodler behavior and offers a framework for position sizing if a quantum risk premium is material.

Tether’s decision to shrink a planned multi‑billion fundraising round highlights investor concerns about private valuations and stablecoin counterparty risk. The move has implications for USDT’s market confidence and strategic choices across the stablecoin sector.

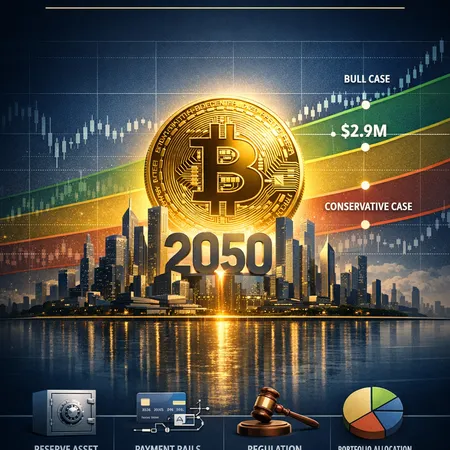

VanEck’s headline projection that one BTC could be worth $2.9M by 2050 rests on settlement and reserve assumptions that deserve close scrutiny. This piece breaks their model into components, stress-tests the core inputs, offers alternative scenarios, and gives practical allocation and custody guidance for institutional allocators.

A focused investigation into whether XRP’s market price is defensible given its proposed role as a global liquidity layer, large unrealized institutional losses at Evernorth, and Ripple’s escrow defense. Practical risk checks and monitoring steps for portfolio managers are included.

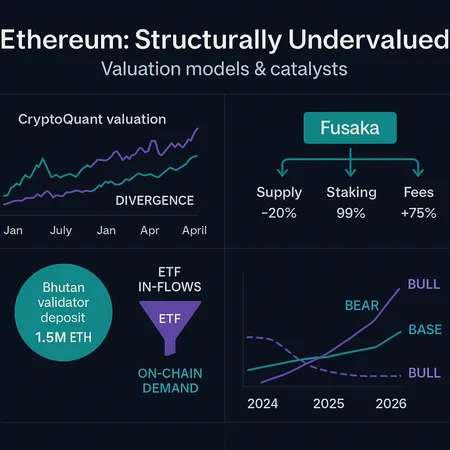

Multiple valuation models and on‑chain indicators suggest Ethereum is trading below intrinsic value. Upcoming protocol changes like Fusaka plus growing institutional staking and ETF flows could compress supply and trigger a re-rating.

Bullish Exchange recently achieved a $13.16 billion valuation, signaling strong confidence in the crypto market. This milestone has important implications for retail investors, including increased market stability and new opportunities such as crypto installment services offered by platforms like Bitlet.app.

Bullish Exchange recently achieved a massive $13.16 billion valuation, signaling strong confidence in the crypto market's future. This valuation impacts market dynamics and offers retail investors new opportunities, especially with platforms like Bitlet.app providing flexible buying options.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility