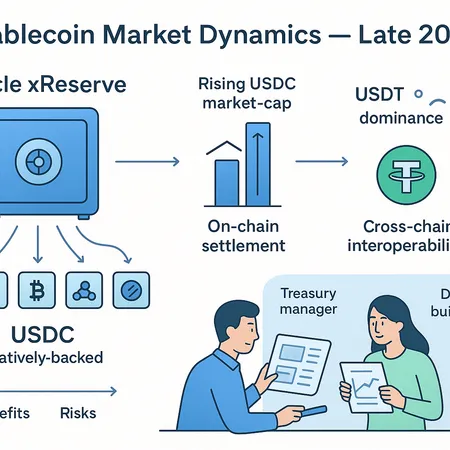

Stablecoin Market Dynamics in Late 2025: Circle xReserve vs. Rising USDT Dominance

Summary

Why stablecoin rails matter in late 2025

Stablecoins are no longer an interchangeable plumbing choice — they are strategic rails that affect settlement speed, composability, and operational risk. In late 2025 the market is seeing two concurrent trends: Circle’s xReserve is expanding to enable natively issued USDC‑backed tokens across multiple chains, while Tether’s USDT has increased its relative dominance to historically meaningful levels. These shifts matter for treasury managers, token issuers and DeFi builders because they change where liquidity lives, how atomic — and final — on‑chain settlement can be, and which rails minimize reliance on bridges and wrapped assets.

Circle xReserve: architecture and what “native” USDC means

Circle’s xReserve is a design intended to let other blockchains host USDC as a natively issued asset while keeping the dollar backing and auditability centralized under Circle’s reserve framework. Instead of relying on wrapped representations that depend on cross‑chain bridges or custodial wrapping, xReserve supports chains issuing tokens that are technically USDC‑backed from inception. The practical effect is fewer intermediaries between a transfer and its settlement finality; the token minted on a destination chain is not a representation but a native liability recognized by Circle’s reserve model. This reduces the classic bridge vector where a token must be burned on chain A and minted on chain B via a custodian or protocol, which historically has added counterparty and technical risk.

How xReserve reduces bridge reliance and improves interoperability

The key implication for DeFi composability is that when USDC exists natively on multiple chains, protocols can design flows without assuming a wrapped‑asset reconciliation step. That simplifies liquidity routing and makes on‑chain settlement more deterministic: a trade that settles to native USDC on Chain B does not require downstream unwraps or custodial reconciliations. For builders, this means fewer emergency procedures around stuck cross‑chain deposits. For a primer and technical overview of Circle’s move, see the reporting on xReserve’s expanded access and the mechanics Circle described in their rollout documentation and news coverage.

USDC market cap growth and practical settlement benefits

USDC’s market cap growth has been steady as institutions, tokenized asset issuers and stablecoin‑native DeFi products gravitate toward a reserve‑backed token with clear attestations. Larger USDC supply on multiple rails directly improves on‑chain settlement UX: settlement speeds shorten because liquidity need not be sourced from a single chain’s pool of wrapped tokens, and accounting becomes simpler when the same stablecoin semantics hold across networks. For token issuers and exchanges, native USDC rails reduce reconciliation overhead and make custody models more predictable, which is attractive for tokenized real‑world assets and short‑term treasury hedging.

At the system level, cross‑chain native issuance encourages designs where stablecoins can be treated as a common settlement layer inside DeFi stacks, improving composability for lending protocols, AMMs and tokenized asset marketplaces. That said, native issuance is not a panacea — operational and regulatory subtleties around reserve disclosures and chain integration require teams to maintain reconciliation tooling and clear KPIs for liquidity depth and settlement success rates.

Tether’s rising dominance: what USDT > 6% implies

While USDC gains native rails, Tether’s relative dominance has climbed; recent analysis notes USDT’s market share surpassing 6% in November 2025. Higher USDT share signals two simultaneous realities: deep liquidity and entrenched market‑making, and persistent counterparty and transparency debates. From a pure liquidity perspective, USDT often leads in cross‑exchange depth and tight spreads, which makes it attractive for execution desks and atomic swaps. That liquidity can materially improve UX when a user needs instant fills or when a protocol relies on broad, cross‑exchange arbitrage to keep peg tight.

However, a larger USDT footprint also concentrates on‑chain liquidity in a token with different audit and reserve disclosure characteristics than USDC. That changes the risk calculus for treasuries: deeper liquidity may lower slippage and execution risk, but it can increase exposure to idiosyncratic counterparty or regulatory shocks specific to a single issuer. For DeFi builders, the implication is pragmatic: routing and aggregation layers should treat USDT and USDC as complementary, not identical, rails — optimizing for liquidity when necessary while keeping settlement determinism for final accounting.

Comparing outcomes: settlement determinism vs. liquidity depth

When choosing rails, teams face a tradeoff. USDC on native xReserve rails tends to favor settlement determinism — clearer provenance, simpler cross‑chain logic, and fewer bridging edge cases. USDT tends to offer liquidity depth and execution efficiency on many trading venues. In practice, the right choice often isn’t exclusive. Treasury teams that prioritize predictability for payroll, vendor payouts, or tokenized asset redemption may prefer USDC rails for final settlement, but keep USDT as an execution rail for large swaps where market depth matters.

For readers wanting primary coverage of the two forces at work, reporting on Circle’s xReserve expansion provides context for native issuance, while analysis of Tether’s market share movement highlights liquidity dynamics and market structure shifts. See Circle’s xReserve rollout coverage and analysis of Tether’s dominance for additional detail.Circle xReserve expansion and Tether dominance analysis.

Recommended treasury strategies for multi‑rail stablecoin management

Operational resilience in 2025 favors multi‑rail treasury architectures that combine the strengths of both tokens. Recommended practices:

- Maintain reserve buckets split across USDC (native rails where available) and USDT to balance settlement finality and execution depth.

- Implement live liquidity monitoring: track depth, spreads, and on‑chain transfer success metrics so automated routing can prefer the optimal rail per use case.

- Use smart order routing (SOR) that considers on‑chain settlement windows — for example, prefer native USDC for payouts requiring guaranteed finality, and route swaps through USDT pools when minimal slippage is the priority.

- Design fallbacks: automated retry and alternative‑rail logic reduces operational incidents when a chain bridge or feed underperforms.

- Keep legal and compliance teams in the loop: different reserve models and disclosure regimes can affect counterparty exposure limits and KYC/AML considerations.

These actions reduce single‑point exposures while letting projects exploit the best attributes of each stablecoin.

UX and DeFi integration patterns: reduce friction, preserve determinism

For DeFi builders, UX matters as much as on‑chain accounting. Users expect instant confirmations and predictable balances; they rarely want to understand whether liquidity was sourced via a wrapper or native mint. Recommended UX patterns:

- Abstract rails away from end users: present a single stablecoin balance even if the protocol uses multi‑rail settlement behind the scenes.

- Show provenance when useful: allow power users to inspect whether a balance is native USDC, native USDT, or a wrapped representation, but keep defaults simple.

- Offer seamless swap fallbacks: if the preferred rail lacks liquidity, enable instant UX fallbacks to an alternate rail with transparent fee and slippage disclosures.

- Optimize contract flows for native rails: prefer settlement paths that avoid cross‑chain custody steps where possible to minimize failure modes and gas inefficiency.

These patterns improve conversion and reduce support burden while preserving the traceability and finality benefits of native issuance. Bitlet.app and other platform integrators are already experimenting with abstractions that let projects route liquidity intelligently while keeping UX friction low.

Practical checklist for decision‑making

- Define the primary goal: final settlement (accounting certainty) vs. execution efficiency (lowest slippage).

- Map where your users and counterparties operate: if most flows are on a chain with native USDC, prefer that rail for payouts.

- Implement observability: on‑chain transfer success rates, reserve attestation checks, and market depth trackers.

- Build SOR rules that incorporate legal limits — for example, avoid exceeding treasury exposure caps to a single issuer even when liquidity looks favorable.

- Test failure scenarios: simulate chain congestion, oracle freezes and sudden liquidity withdrawals to ensure fallbacks work.

Conclusion: pragmatic pluralism wins

Late‑2025 stablecoin dynamics favor a pragmatic pluralism. Circle’s xReserve materially improves the usability of USDC by reducing bridge dependence and enabling clearer cross‑chain settlement semantics, while USDT’s growing share keeps it indispensable for liquidity‑sensitive workflows. For treasury managers, DeFi builders and token issuers the practical approach is not an ideological choice but an engineering one: combine native USDC rails where finality matters, keep USDT available for depth, and design orchestration layers that minimize user friction while enforcing operational and compliance guardrails.

For teams making the switch, start small: integrate native xReserve rails on your primary chains, monitor settlement metrics, and expand multi‑rail logic as you validate reliability. The market is evolving fast; staying observant, instrumented and pragmatic will let projects capture the benefits of both models without exposing themselves to unnecessary risk.

For further reading on the two forces shaping this market, see coverage of Circle’s xReserve expansion and the analysis of Tether’s recent dominance change.